Ether’s weekend drop in early February revived familiar questions. Is the Ethereum network lagging behind newer competitors or struggling to justify its valuation?

as $ETH It plummeted 17%, in line with most cryptocurrencies, but skeptics wondered if this was a warning signal that the protocol’s dominance may be eroding.

However, within the Ethereum ecosystem, there is no similar sense of alarm about the stock price decline. Developers and long-term players primarily framed this move as a market-driven correction rather than a judgment on Ethereum’s health.

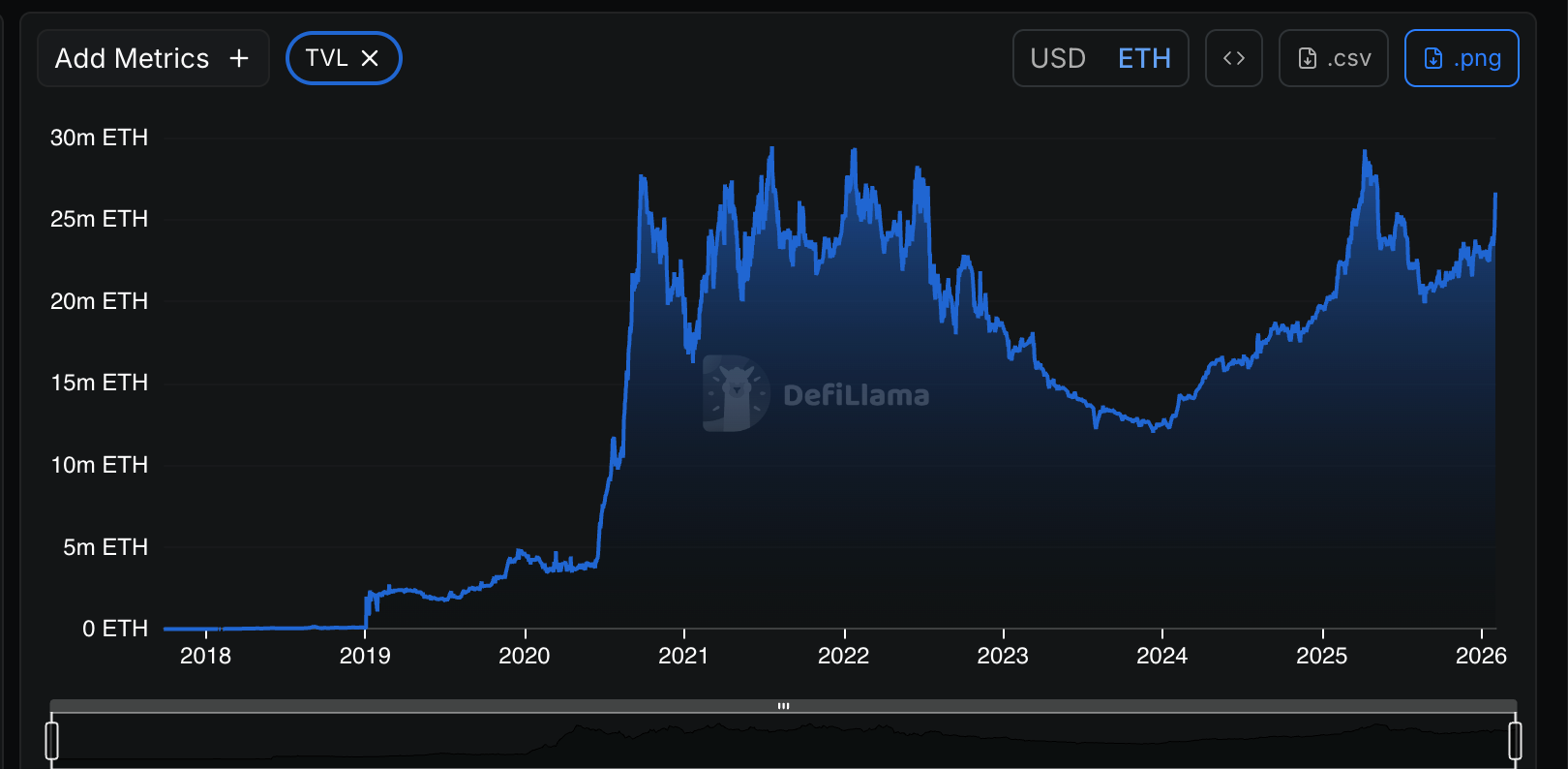

By several measures, network activity remains near peak levels. “Ethereum TVL is actually $ETH” said Messari analyst Sam Raskin, suggesting that capital is not leaving the ecosystem in a meaningful way despite the decline in the dollar price of the token.

($ETH TVL-built $ETH/Defilama)

Other indicators also point in the same direction. entry queue for $ETH Staking (the waiting time faced by validators to ensure the network is secure) spans approximately 70 days, indicating that demand to put money into Ethereum remains strong, especially among large institutions, despite short-term volatility.

That resilience is also evident across decentralized finance, where activity remains even as prices decline. Traders and users still engage with on-chain applications in search of yield. This shows that usage has not evaporated along with sentiment.

“We are still growing and gaining more users and revenue, but the token price is lagging,” Mike Shiragadze, CEO of ether.fi, one of the largest restaking networks, told CoinDesk via Telegram. “We are only focused on the long term.”

Some market participants argue that the price movements themselves are being overinterpreted. Marcin Kazmierczak, CEO of blockchain data firm Redstone, said Ether’s decline looks more like market “noise” than a signal of weakening fundamentals, especially as retail trading activity declines. More importantly, he said, there is a level of institutional confidence around on-chain finance that has never been seen before.

“The lack of retail excitement is actually refreshing. The next cycle will be driven by actual adoption rather than memes, allowing builders to focus on long-term value creation,” Kazmierczak added.

The disconnect between price trends and progress on the ground is a well-known pattern in Ethereum’s history. Periods of market disruption often coincide with the network’s most important development milestones, as builders continue to ship regardless of short-term sentiment.

“As we’ve seen with the merge, the market is pretty bad at factoring in the fundamental technical realities of the chain,” said Marius van der Weyden, a core developer at the Ethereum Foundation, noting that big technical changes are often reflected in prices only long after they’ve been completed.

Some analysts believe that the discrepancy between price data and on-chain data reflects broader market trends rather than Ethereum’s specific weaknesses. Raskin said the network “looks as healthy as ever” and claimed: $ETH’s recent decline has more to do with Bitcoin trends and broader market sentiment than with deteriorating Ethereum fundamentals.

Read more: The quiet strength of DeFi: As market declines test traders, the value locked into the platform remains