On-chain data shows that large Ethereum investors have recently added to their holdings.

Ethereum Large Holders Netflow has been positive lately

In a new post on X, market intelligence platform IntotheBlock spoke about trends in large-scale owners of Ethereum, Netflow. This metric measures the net amount of cryptocurrency coming and going into a wallet controlled by a large owner.

The analytics company defines three categories: retailers, investors and whale investors. Retail members hold less than 0.1% of supply, investors members hold between 0.1% and 1%, and whales members hold more than 1%.

At current exchange rates, 0.1% of the ETH supply, a cutoff between retailers and investors, is worth more than $214 million, a very substantial amount. This means that the address you can qualify for is already very large.

Therefore, the large owners, the actual cohort interested in the current discussion, have included both of these groups. Therefore, large holder Netflow tracks transactions related to investors and whales.

A positive value for this metric means that a large-scale investor on the network is receiving net deposits in their wallets. Meanwhile, being under the zero mark suggests that these major owners are taking part in the net sales.

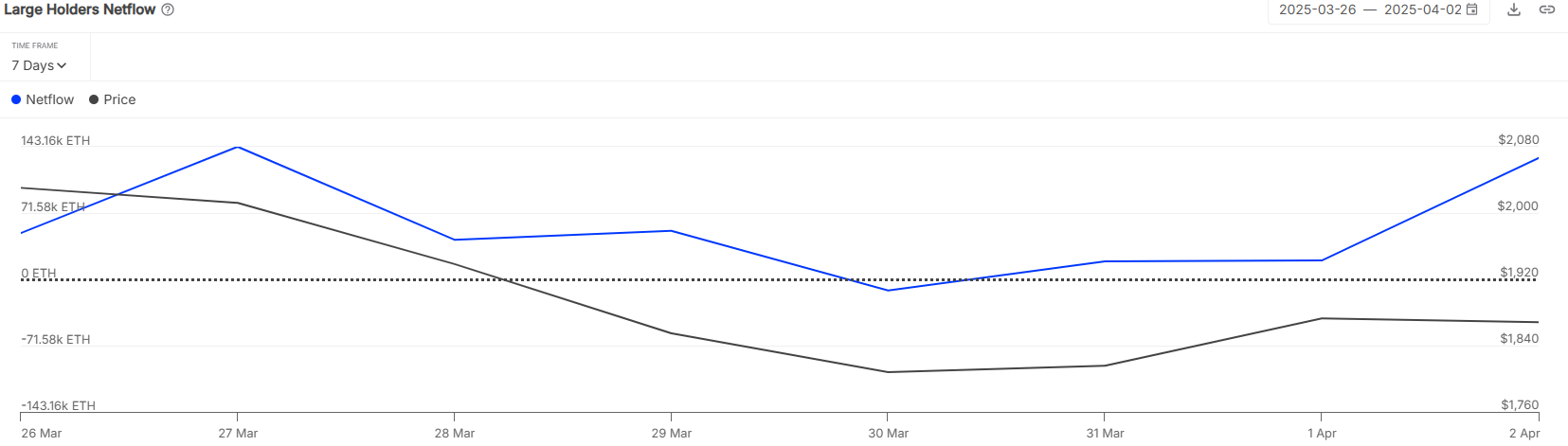

Well, here’s the chart shared by Intotheblock, showing the trends of last week’s Ethereum Large Holders Netflow.

The value of the metric appears to have been positive in recent days | Source: IntoTheBlock on X

As seen above, Ethereum’s large holder netflow remains almost entirely in the positive region for the duration of the graph. This means that investors and whales are accumulating. In the second of the month alone, these major entities were loaded at 130,000 ETH (approximately $230 million).

With a large net influx of holders occurring while cryptocurrencies are falling, this cohort may believe that recent prices provide profitable entries into assets. Currently, it remains to be seen whether this accumulation will help ETH reach its bottom.

In some other news, as the analytics company points out in another X-post, Ethereum fees have fallen to the lowest levels since the quarter.

The changes that occurred in key ETH metrics during the first quarter of 2025 | Source: IntoTheBlock on X

Following a sharp decline of 59.6%, Ethereum’s total transaction fees fell to $208 million. According to IntotheBlock, this trend is “mainly driven by increased gas limits and transactions moving towards L2.”

ETH Price

Ethereum saw a recovery of over $1,900 early in the week, but it appears the bullish momentum has already run out as Coin returns to $1,770.

Looks like the price of the coin has plunged recently | Source: ETHUSDT on TradingView

Dall-E featured images, charts on IntotheBlock.com and tradingView.com

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.