A significant amount of Ethereum (ETH) has shifted to centralized exchanges by major players on the past day, indicating delays in the network’s Pectra upgrade face until investor sentiment has weakened.

Upgrades, the major development after registration, were pushed from March to May 7th.

More than $117 million ETH moves into exchanges, causing fearful sale

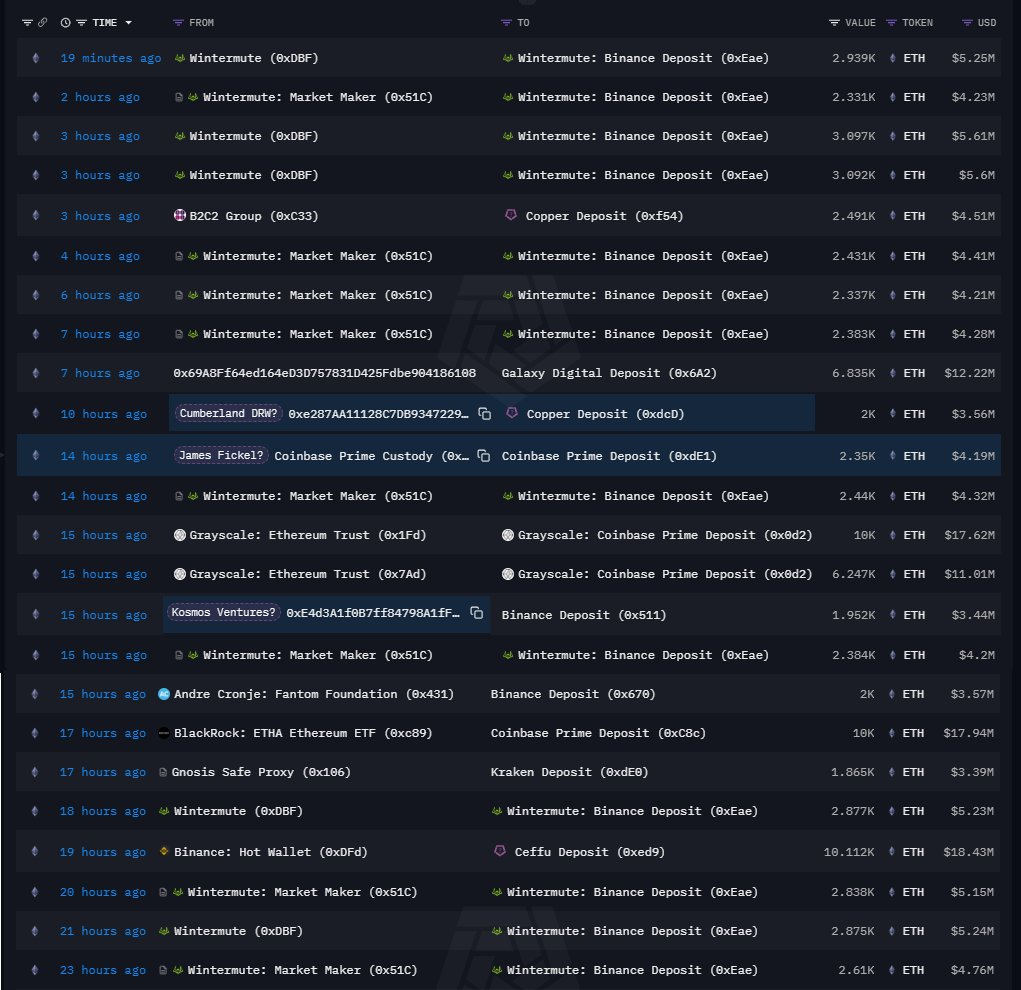

Large institutions and individual holders moved tens of thousands of ETH to the exchange within 24 hours. Data reported by X data nerds include transfers from.

According to X’s data nerd, the following transfers were recorded:

- Grayscale: 16,247 ETH (~$28.63 million)

- BlackRock: 10,000 ETH (~$17.94 million)

- WinterMute: 34,634 ETH (~$62.94 million)

- Other cronje (fantom): 2,000 eth (~$3.44 million)

- James Fickle: 2,350 ETH (~$4.19 million)

These transfers totaling over 65,000 ETH (over $117 million) are often seen as preparations for sale, without offsetting influx or bullish news, particularly in the air.

ETH Price Analysis for April

Ethereum is currently down 1.3% at $1,801.12 over the last 24 hours, CoinmarketCap data shows. ETH was violating key support around $1,800, reaching its daily low of $1,751.33 a day and trying to regain the $1,800 level.

The $1,928 $20-day Exponential Moving Average (EMA) currently serves as a critical resistance. With ETH falling 32% under this EMA and 24-hour trading volume down 32%, the short-term momentum appears bearish.

Technical indicators show bearish momentum

A Daily Chart’s relative strength index (RSI) read at nearly 37.61 suggests current bear control price action, while the gradient indicates potential short-term integration.

ETH Price Action is currently when you are near the bottom edge of the Bollinger Band and support with ETH Price Action approaches the bottom Bollinger Band. If approximately $1,734 in support is retained, the middle band ($1,928) can be retested.

A breakout ($2,112) above the upper band requires persistent bullish control. Conversely, failing to regain a 20-day EMA ($1,928) could keep prices silenced, potential moves can go beyond $2,000.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.