Ethereum (ETH) is likely to end December in the red, marking the fourth straight month of declines. This scenario could put pressure on large investors who have been accumulating ETH throughout the year.

If ETH continues to fall, these holders will have to choose between exiting at breakeven or accepting losses.

How are Ethereum whales caught between breakeven and losses in December?

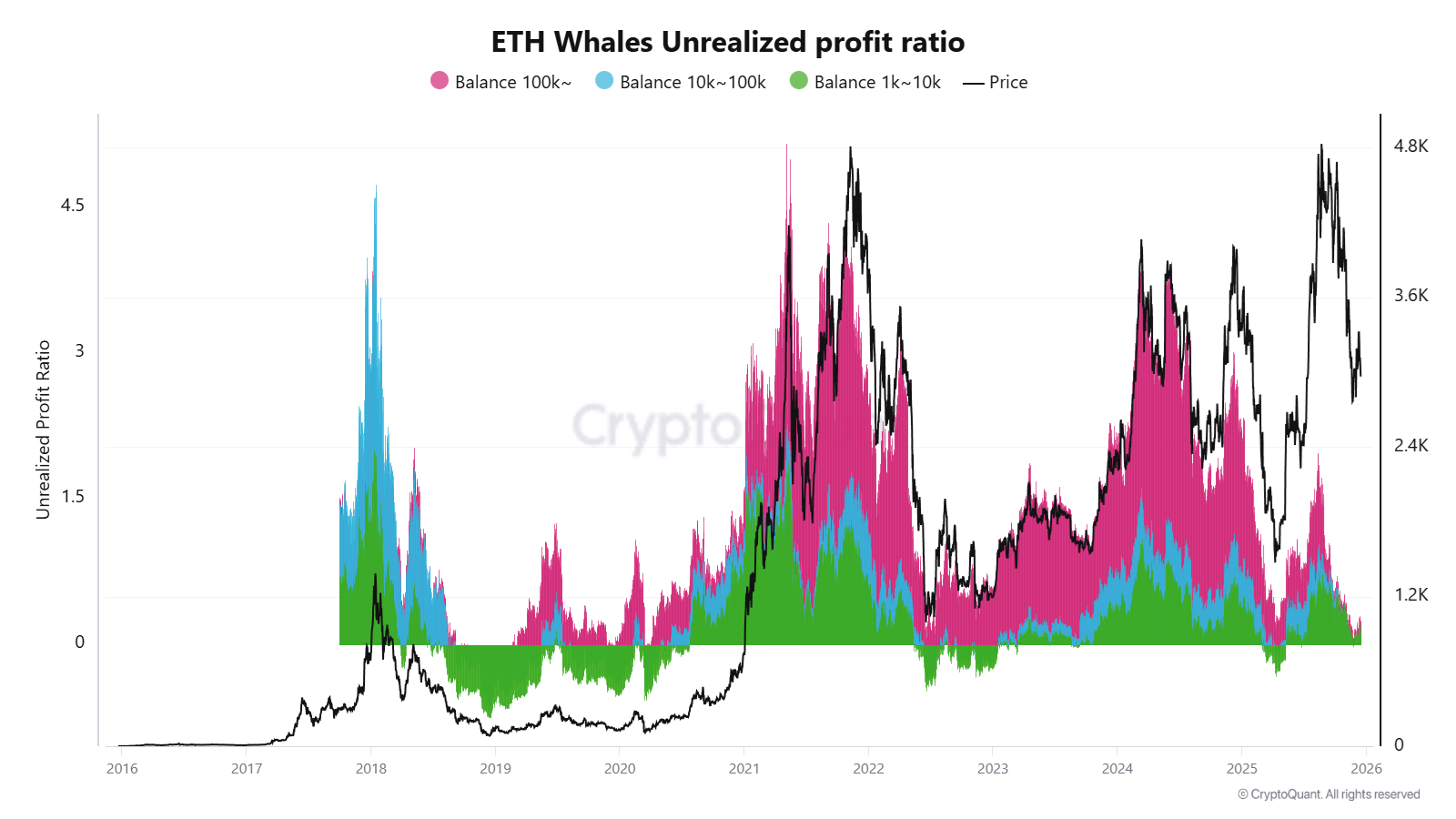

Data from ETH Whale Unrealized Profit Ratio, which tracks addresses holding between 1,000 ETH and more than 100,000 ETH, shows a steady decline over the past four months.

The ratio is close to zero. This indicates that large ETH investors have an average cost close to the current market price, leaving little to no unrealized gains.

Unrealized profit margin of ETH whale. Source: CryptoQuant.

From a positive perspective, the purchasing behavior of this group has a significant impact on market trends. It strengthens our belief that the current price is an opportunity. Continued accumulation at these levels suggests a potential bottom zone for ETH accumulation.

CryptoQuant analyst CW8900 commented: “They are not taking profits this cycle and are increasing their holdings even further. This means the current price range represents an opportunity to buy ETH at the lowest possible price.”

But a bearish view raises important questions. What happens if the market continues its four-month downward trend? In that case, whale investors will face real losses. Two factors suggest that this scenario remains plausible.

There are two factors that will cause the ETH whale to take action in December.

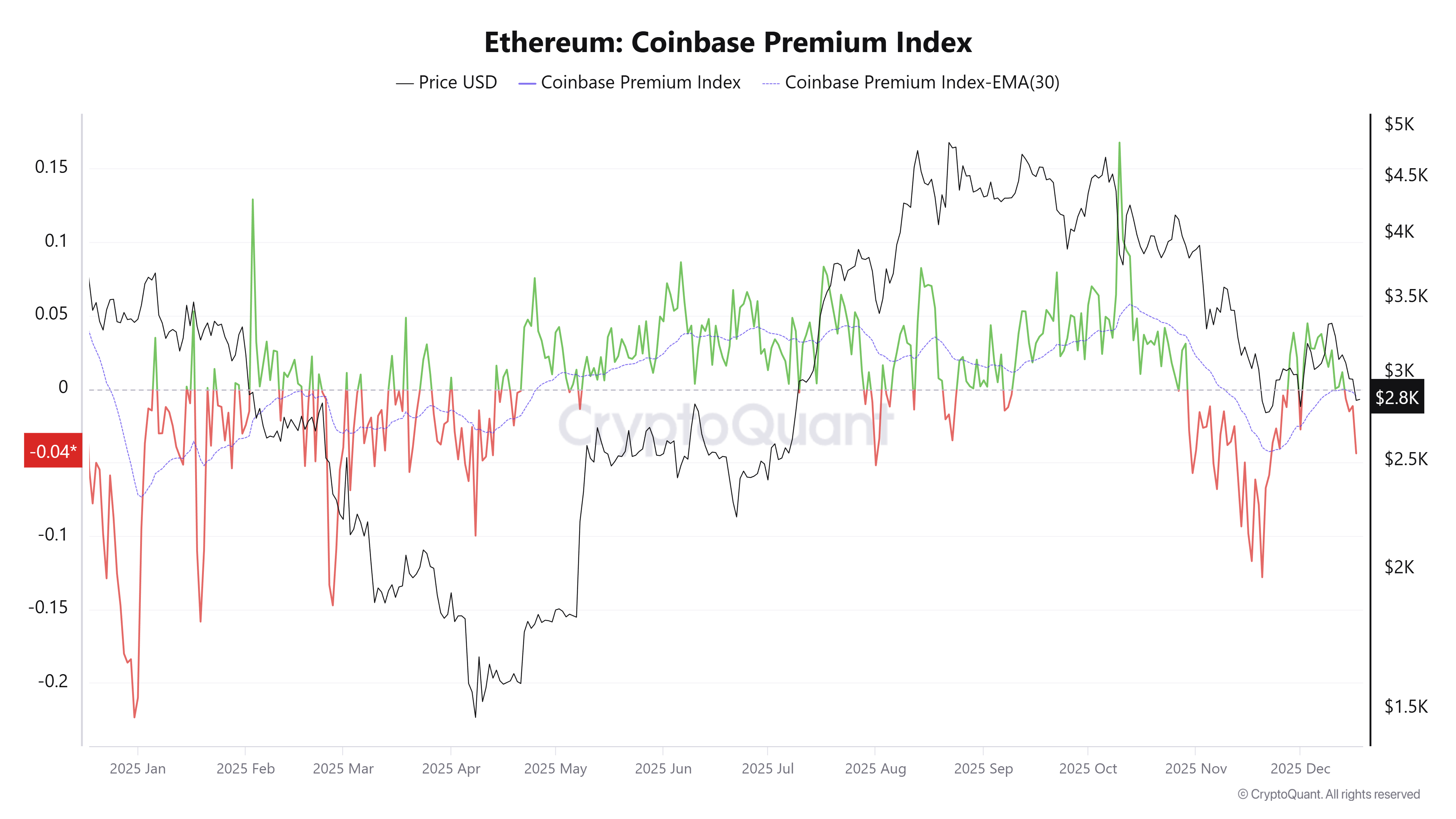

First, the Ethereum Coinbase Premium Index turned negative in the third week of December.

Ethereum Coinbase Premium Index. Source: CryptoQuant

This indicator measures the percentage difference between the ETH price on Coinbase Pro (USD pair) and Binance (USDT pair). A negative value indicates that Coinbase’s price is low, reflecting selling pressure from US investors.

After removing the noise using the 30-day EMA, the index remained negative for over a month. If selling pressure from Coinbase increases, ETH price could fall further in the coming days.

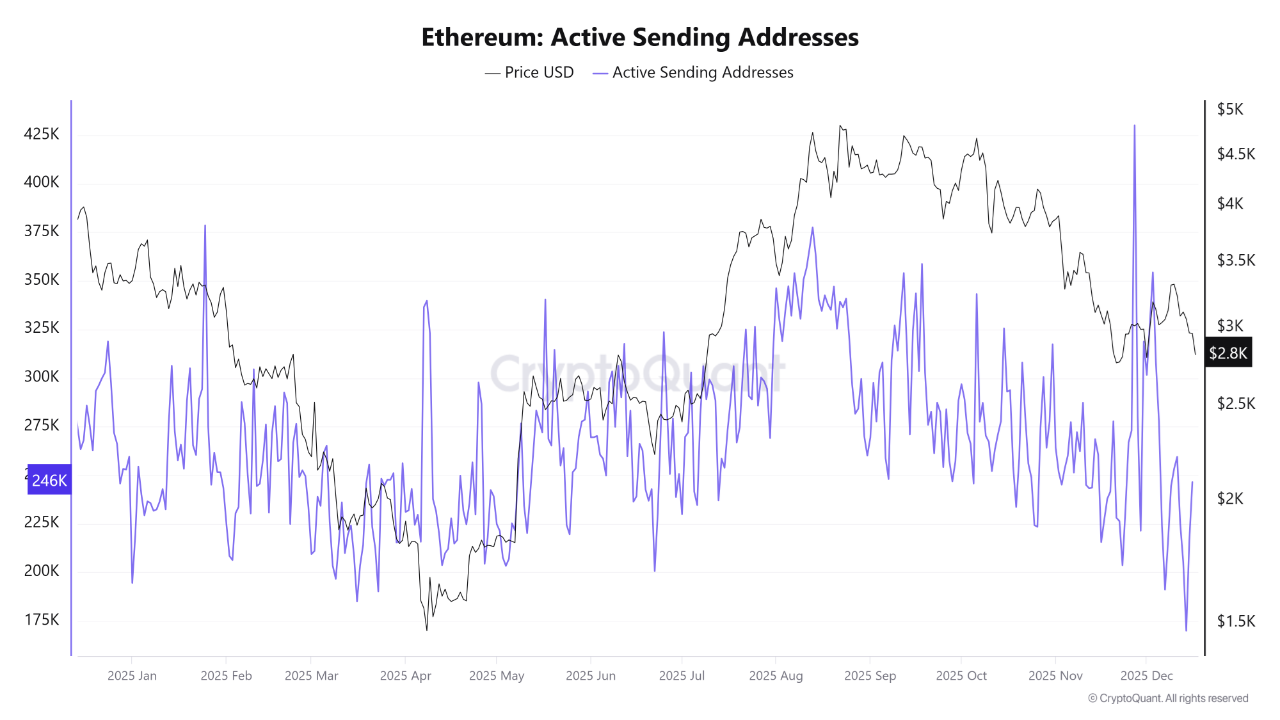

The second factor is a decline in interest in retail. ETH on-chain activity reached its lowest level of the year in December.

ETH active sending address. Source: CryptoQuant

The ETH active sending address chart shows a clear downward trend. Network activity has cooled down significantly. Without retail buying pressure, ETH has struggled to match the institutional demand driving the breakout.

CryptoOnchain commented, “Retail flows typically drive momentum during an initial pullback, so the lack of retail participation could cap short-term upside.”

Moreover, the realized price of ETH accumulation addresses serves as an important support line at around $3,000. ETH is currently trading around $2,800 and appears to be on the verge of breaking below this support level.

These factors place whales in a situation that requires action. Selling to recover capital or limit losses could increase downward pressure. Such a move could even lead to institutional panic selling.

Despite these risks, a recent report from Bitwise maintains an optimistic outlook for 2026. The report suggests that ETH price could reach all-time highs sooner than expected.

The post Ethereum Coinbase Premium Index Turns Negative, Raising Concerns of Whale Panic Selling appeared first on BeInCrypto.