The Ethereum (ETH) market has increased its recent fortune by more than 5% in the last 24 hours. Despite this price rise, the prominent Altcoin remains on a downtrend, as shown by its 11.17% loss last week. However, the notable analytics platform GlassNode has discovered key pricing levels that can provide short-term support.

Investors will boost the accumulation of 300,000 ETH in this price region – what does that mean?

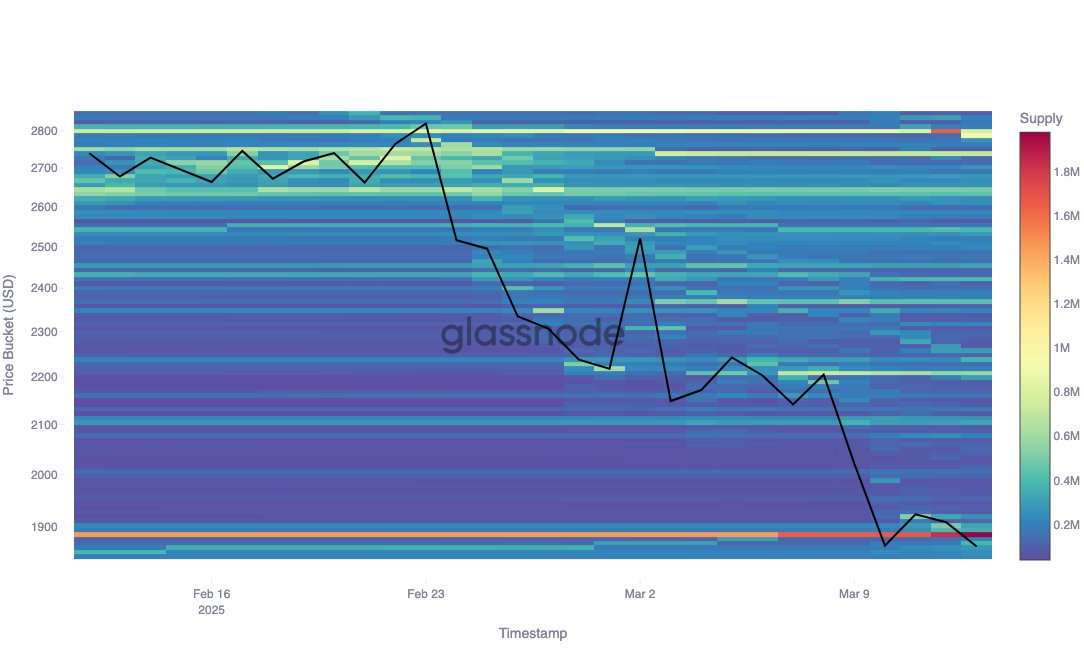

In a post on March 14th, GlassNode provided an interesting analysis of the ETH market highlighting a strong potential level of support. Based on cost-based distribution (CBD) metrics, these analysts believe that if ETH is further price drops, they are likely to reach the main support zone at a price level of $1,886.

In the crypto market, CBD represents a key on-chain metric that tracks the price level the token was last sold or purchased. Once a significant number of coins are acquired within a certain price range, the zone often acts as a support or resistance level.

According to GlassNode, Ethereum’s CBD data shows that the $1,886 investor supply has increased from 1.6 million ETH to 1.9 million ETH. The development assumes that a significant portion of investors consider $1,886 a key price range and is likely to create a viable support zone to increase ownership in the region and prevent further declines.

Glassnode points out that this assumption, consistent with insights from custom yield metric designs, captures price-based yield events that exploit the weighted sales volume and use of nonlinear economic pain experienced by investors. However, it is worth noting that the $1,886 price level can only provide short-term support, suggesting the possibility of price capitulation in the presence of overwhelming sales pressure.

Ethereum price overview

At the time of writing, Ethereum is trading at $1,924, following a 5% increase on the last day, as mentioned previously. Meanwhile, daily trading volume in the market fell 29.29%, worth $129.1 billion. Interestingly, the relative strength index metric suggests that Ethereum could quickly enter the area where it was sold and experience a price reversal.

However, ETH Bull faces multiple zones of resistance, $2,249, $2,539 and $2,829. Meanwhile, if the decisive price falls below $1,886, it could lead to low levels, such as $1,650 or $1,132.

ISTOCK featured images, TradingView chart