Ethereum derivatives markets are entering December with the nervous energy typical of election night and surprise hard forks. This mood is formed by inflated open interest, lopsided options trading, and peak distress levels that signal a month in which traders need caffeine and courage in equal measure.

Ethereum open interest falls as options trading heats up

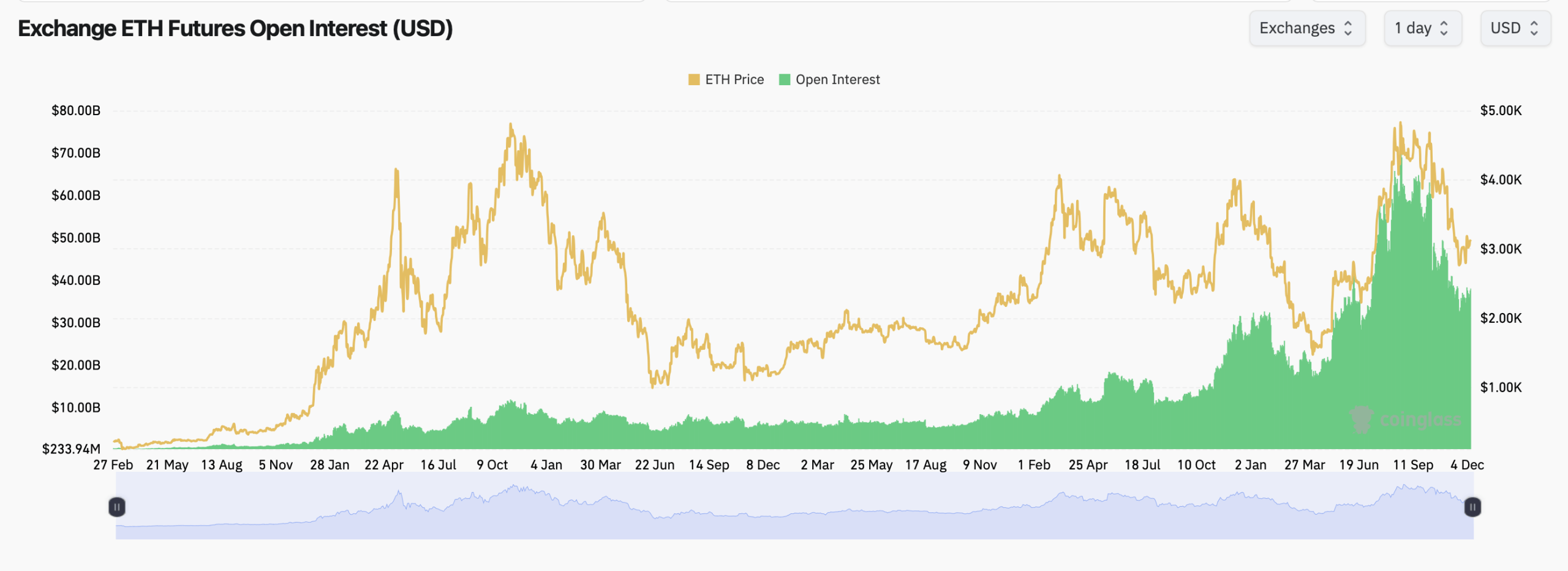

According to statistics from Coinglass.com, Ethereum is trading around $3,291, with futures open interest across all exchanges at approximately 12.24 million ETH (equivalent to approximately $38.07 billion). That number alone is significant, but what’s more interesting is how uneven the flow is.

CME, which manages a huge open interest of 2.02 million ETH and currently accounts for about 16.5% of global futures exposure, saw a slight decline in the last hour, but posted a slight rally late in the session. Binance, which holds an even larger amount of 2.57 million ETH and accounts for just under 21% of total open interest, is following a similar pattern, indicating that there are many outflows and traders are reducing risk at the last minute.

Meanwhile, Bybit and Kucoin are two of the only exchanges flashing green for short-term capital inflows, suggesting that smaller exchanges may be picking up directional bettors while the larger ones are cautious. Changes in 24 hours tell the truth. Almost all exchanges saw a decline in open interest, confirming that traders are avoiding risk rather than seeking an advantage heading into December.

Broader futures data reinforces this trend fueling tensions. Total Ethereum futures open interest remains historically elevated, still reaching tens of billions of dollars, even after falling from its previous peak. When open interest remains high while prices remain flat, the market tends to behave like a coiled spring. The final movement is rarely gentle. December has a reputation for historically proving that point.

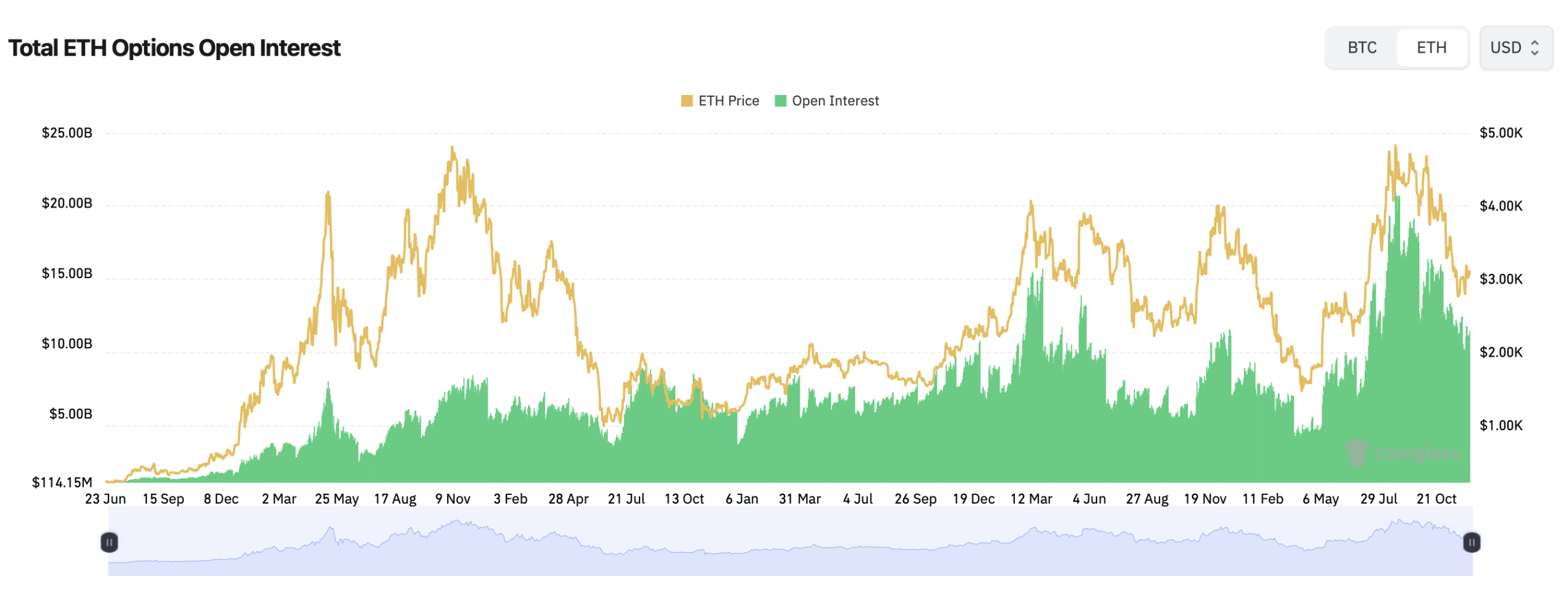

The Ethereum options market adds another layer of intrigue. As of Tuesday, open interest in calls still significantly exceeded puts, with calls accounting for about 62.6% of all open options and puts accounting for about 37.4%, according to Coinglass statistics. Simply put, this indicates that more traders are betting on or protecting against upside movements than downside movements. However, this volume tells a much creepier story.

Over the past day, calls accounted for just 58% of trades, while puts rose nearly 42%, showing traders were quietly hoarding downside protection. It’s not a transition to panic, but rather like the market slipping on its seatbelt before the ride even begins. Meanwhile, strike activity at Deribit, the undisputed powerhouse of Ether options, shows traders are flocking around some ambitious price targets heading into late December.

The contract associated with $6,000 holds the most open interest, closely followed by strikes at $4,000, $5,000, and even $7,000 highs. This means that even if the spot price is barely holding the $3,100 line, traders are still motivated to take positions for a strong move higher. This is certainly speculation, but it also reflects the state of the market, which has not given up on the surprise “Santa Rally” at the end of the month.

In terms of trading volume, the busiest contracts are concentrated around the December expiry around the $5,100 to $5,500 range, with Bybit and Deribit sharing the bulk of the trading. Tuesday’s record shows that these trades reflect a simple sentiment: No one knows where ETH will land, but many traders want to be exposed to big swings.

The maximum pain level (the price at which option sellers theoretically make the most profit) provides a clear picture for December. At Deribit, the max pain zone will hover around the low $3,000s heading into the upcoming December expiration, then rise to the mid-$3,000s, and eventually spike above $4,000 for the contract in early 2026. Binance follows a similar curve, but the near-term maximum pain level is slightly lower, centered around $3,000 to $3,100, and then rising towards expiration.

In plain language, the options market indicates that Ethereum is more likely to gravitate toward the $3,000 to $3,300 range in the near term, even as traders continue to buy exposure to wilder price paths.

read more: Eight AI chatbots offer wildly different Bitcoin price predictions — which one will hit on December 31, 2025?

When you combine all this with broader sentiment, analysts see a mixed month in December with a breakout of resistance potentially heading towards $3,400, $3,800, or even higher, but the roadmap becomes clearer. The market has dreams of upside, but is cautious in the short term. Futures and options data recorded this week both reflect that the market is bracing for a move, but has not yet committed to a full breakout. It’s in this setting that December is notorious for its false happenings, whiplash events, and occasional holiday miracles.

Ethereum’s derivatives structure ultimately paints December as the month in which traders should expect movement. While the futures market is still reasonably large and the options market is bullish, hedging is underway and maximum pain levels imply a pullback toward the low $3,000s before a definitive trend emerges. Traders aren’t panicking, but they’re definitely bracing for some fallout this month.

Frequently asked questions ❓

- What’s driving Ethereum derivatives volatility in December?High open interest, changing options activity, and concentrated maximum pain levels create conditions for rapid price movements.

- Why are Ethereum traders increasing their put activity?More puts are being purchased as traders hedge against the downside while maintaining upside exposure through calls.

- What does the current maximum pain level suggest for Ethereum price?The concentration of maximum pain around $3,000 to $3,300 suggests that ETH may gravitate toward that range before the main trend is confirmed.

- How does the Ethereum futures market compare to last month?Futures open interest remains historically high, indicating heavy positioning even as traders reduce leverage in the short term.