Ethereum prices traded nearly $3,705 on July 23, and are stable after a strong rally from the $2,200 level earlier this month. The current structure shows integrations below the major descending trendlines with ETH prices close to $3,780-$3,820. This setup suggests that Ethereum is approaching the inflection point of volatility.

What will be the price of Ethereum?

ETH Price Dynamics (Source: TradingView)

Ethereum forms a highly compressive symmetric triangle on the 4-hour chart, gradually pushing a fixed horizontal resistance against it. Currently, price action is sandwiched between $3,665 and $3,790, with buyers defending the upward trend since July 5th.

Recent moves over $3,500 have overturned the multi-week bear flag and reversed multiple high timeframe EMAs. Since then, the gatherings have matured to consolidation as ETH prices prepare for the next move. The balance volume (OBV) still rises, printing about 1.24 billion in 4 hours, confirming a consistent spot accumulation through the structure.

Parabolic SAR dots continue to follow below prices and show that the short-term uptrend is still intact, but weakened.

Why are Ethereum prices falling today?

ETH Price Dynamics (Source: TradingView)

The reason for Ethereum prices fall today is linked to an intraday denial from $3,790, a zone that has repeatedly restricted prices in July. On the 30-minute chart, ETH shows signs of fatigue, with two unsuccessful attempts to regain $3,780. The VWAP worked as a resistance at $3,774, but the RSI fell below 47, suggesting a weakening of purchase pressure.

In the same time frame, the MACD is flattened, the momentum decreases, +DI decreases with DMI and ADX is sideways.

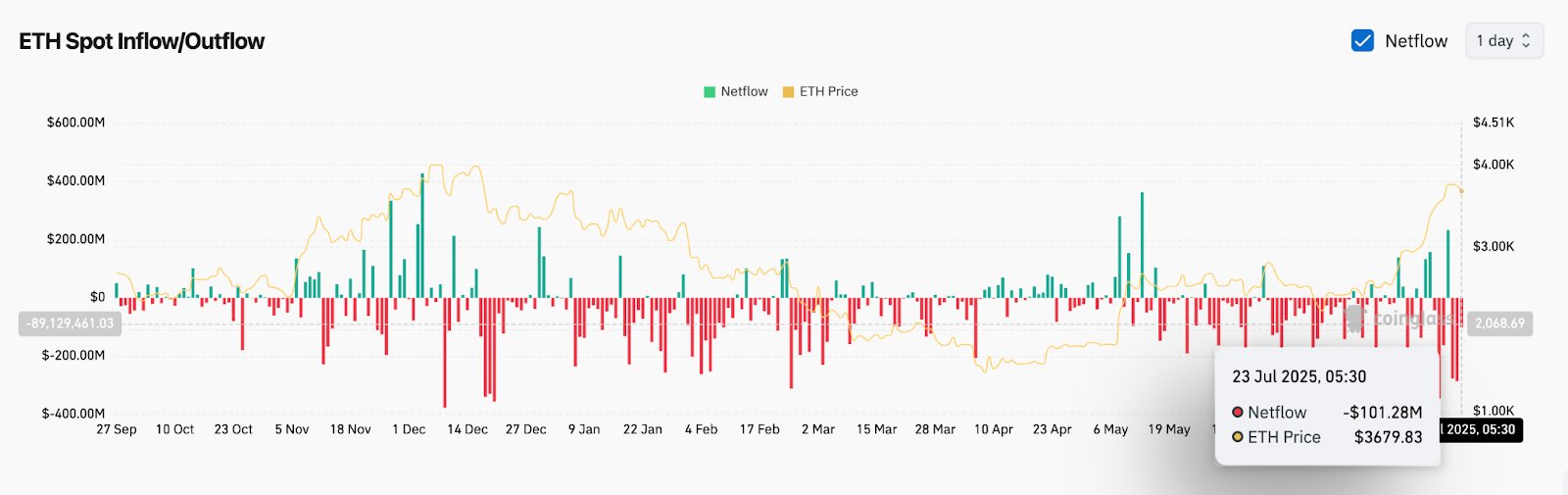

However, capital flows remain net. Ethereum’s 24-hour spot Netflow is +$8.79 million, suggesting the underlying investor conviction despite short-term resistance. The wider bull structure will remain effective unless the ETH is below $3,645 (the base of the triangle).

Bollinger Band and Emma squeeze the setup

ETH Price Dynamics (Source: TradingView)

The 4-hour chart Bollinger band is tightening rapidly, priced at $3,705 and compressed near the mid-band. This indicates a decline in volatility and increased likelihood of spread over the next 12-24 hours. If the ETH price can exceed the upper band ($3,790), you can see the next impulsive leg towards the $4,000-$4,140 zone.

ETH Spot Inflow/Outflow (Source: Coinglass)

The 20/50 EMA cluster is between $3,625 and $3,705 and is currently serving as support. The $3,484 100 EMA and the $3,250 200 EMA form a wider uptrend base. The bullish matching of these moving averages continues to support upward pressure.

ETH Price Dynamics (Source: TradingView)

The Supertrend remains bullish on the four-hour chart, printing support for nearly $3,605, while the VWAP is just above $3,718. This forms a minor supply band that needs to be cleared for continuity.

Ethereum price forecast: Short-term outlook (24 hours)

ETH Price Dynamics (Source: TradingView)

Ethereum is trapped in the pre-breakout aperture when compression rises. Once ETH confirms that it exceeds $3,790, the next move will be extended to $4,000, and if the target is promoted it will be $4,120-4,180. However, a refusal here leads to a pullback heading towards $3,625, and if trendline support fails, the downside is also $3,480.

As long as today’s Ethereum prices exceed support for 20/50 EMA clusters and supertrends, the short-term structure is bullish. The decisive closure outside the triangle pattern defines the breakout direction.

Ethereum price forecast table: July 24, 2025

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.