Although Ethereum is below the $1,600 mark, on-chain and technical signals suggest that the market may be in a critical accumulation phase.

According to an April 17 analysis by Cryptoquant Contributor AbramChart, Ethereum (ETH) is trading near realized price levels. Currently, the realised price, which is around $1,585, serves as a reliable signal for accumulation of deep value.

All major bulls in ETH history began when prices fell below this level. Ethereum is approaching the lower band of the realized pricing model, suggesting long-term holder priming for market cooling and re-entry.

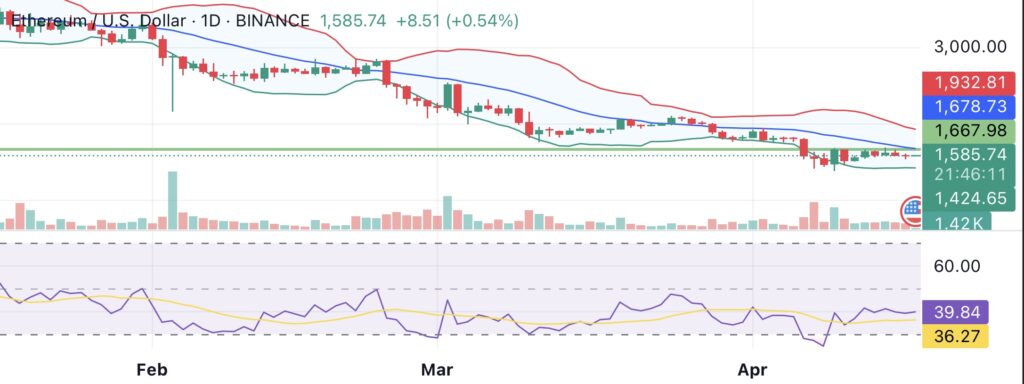

Still, the technical indicators remain mixed. ETH has slipped under the 20-day moving average, far below 200 days, indicating a strong downtrend. The relative strength index is under the age of 40, reflecting weak momentum, but not fully sold yet. The daily bollinger band remains compressed, reflecting a decline in volatility, but there may be a critical movement in either direction.

ETH price analysis. Credit: crypto.news

As the downtrend continued, ETH was able to find support in the $1,450-1,550 zone, which has historically served as the bottom. Immediate resistance is around $1,670, and an area of $1,930 can cause stronger overhead pressure.

On the basics, as noted in a Binance Research article on April 16, Layer 1 Ethereum value capture has been considerably weakened since the Dencun upgrade. Scalability has increased nearly 16 times with the introduction of Blobs, but L1 fee revenue has decreased.

As users moved to cheaper tier 2, ETH’s role as “ultrasonic money” decreased, undermining its appeal compared to faster, lower-cost rivals such as Solana (SOL) and BNB chain (BNB).

Santiment’s April 16 analysis revealed that Ethereum prices fell to their five-year low, averagering just $0.168 per transaction. This indicates a reduction in use and congestion, but from the opposite perspective it could suggest a potential rebound.

https://twitter.com/santimentfeed/status/1912571781782585596?s=46&t = nznxks3debx8jihnzhmzw

Historically, low prices under $1 often precede price rebounds. As Santiment points out, “the more the retail community is kicked out of assets (especially still thriving developers), the more likely it is to have little resistance to ultimate surprise.”

Many of the pullbacks may be linked to wider macro uncertainty. Santiment observed that traders are very sensitive to tariffs and economic news, and that greater clarity often delays ETH activities until greater clarity returns to global photography.