Ethereum had a market capitalization of $524 billion and a 24-hour trading volume of $3.02 billion on Saturday morning, between $4,341 and $4,357. Intraday prices ranged between $4,279 and $4,408.

Ethereum

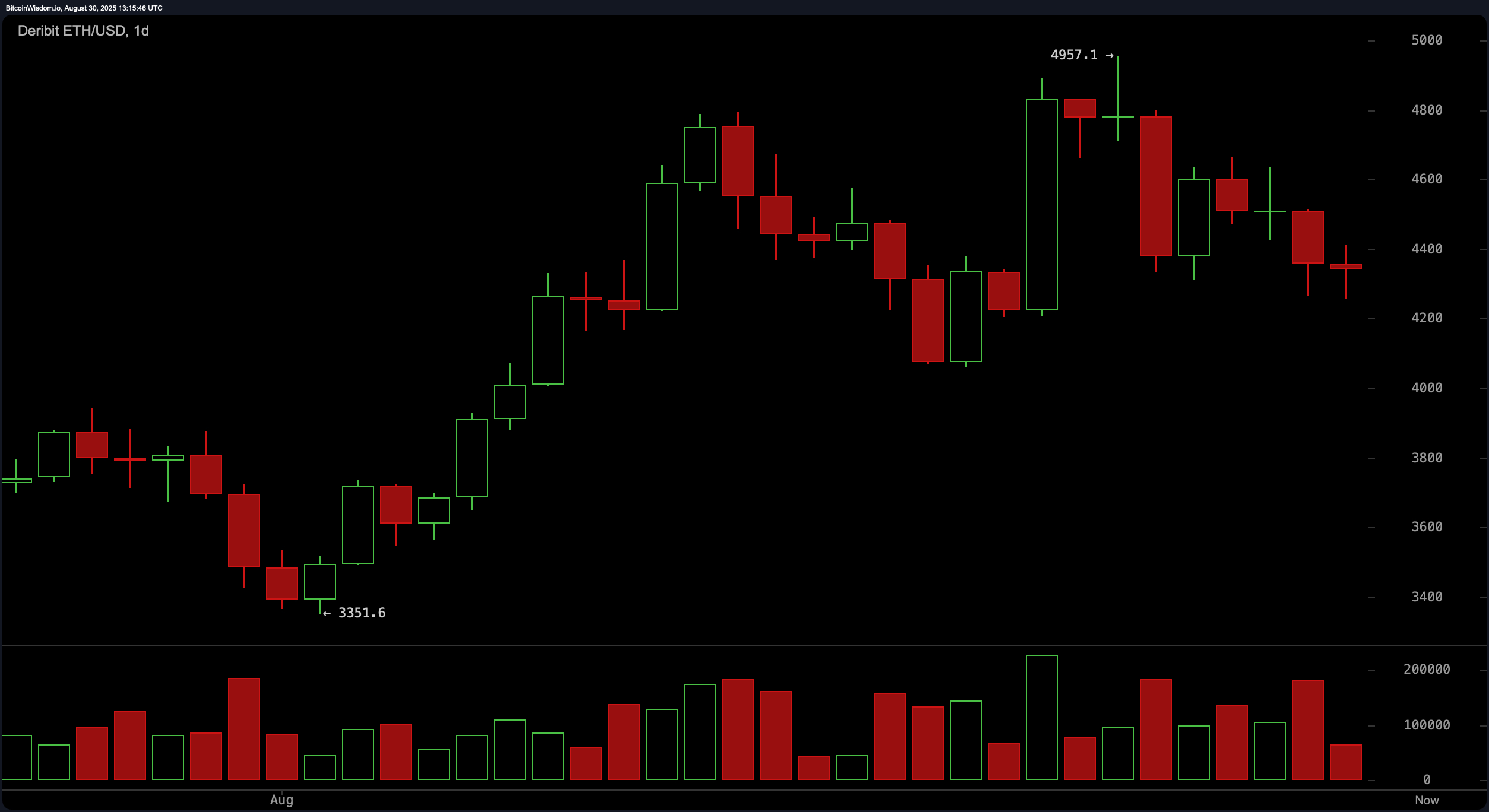

On the daily charts, ether continues to track poor trends after peaking at $4,957.1. Price action confirms a consistent formation of lower peaks and lower lows with rising volumes of red candles. The current support bands, around $4,200 to $4,300, are proof of the important thing just below today’s average price. The bounces confirmed here, especially those marked with bullish hammers and green siege candles, could provide opportunities for mid-term entry. A more aggressive signal is a critical push of over $4,500, with previous support recouping resistance. Conversely, breaching $4,200 could lead to a setback to $4,000 or $3,850.

ETH/USD 1-day chart for August 30th, 2025.

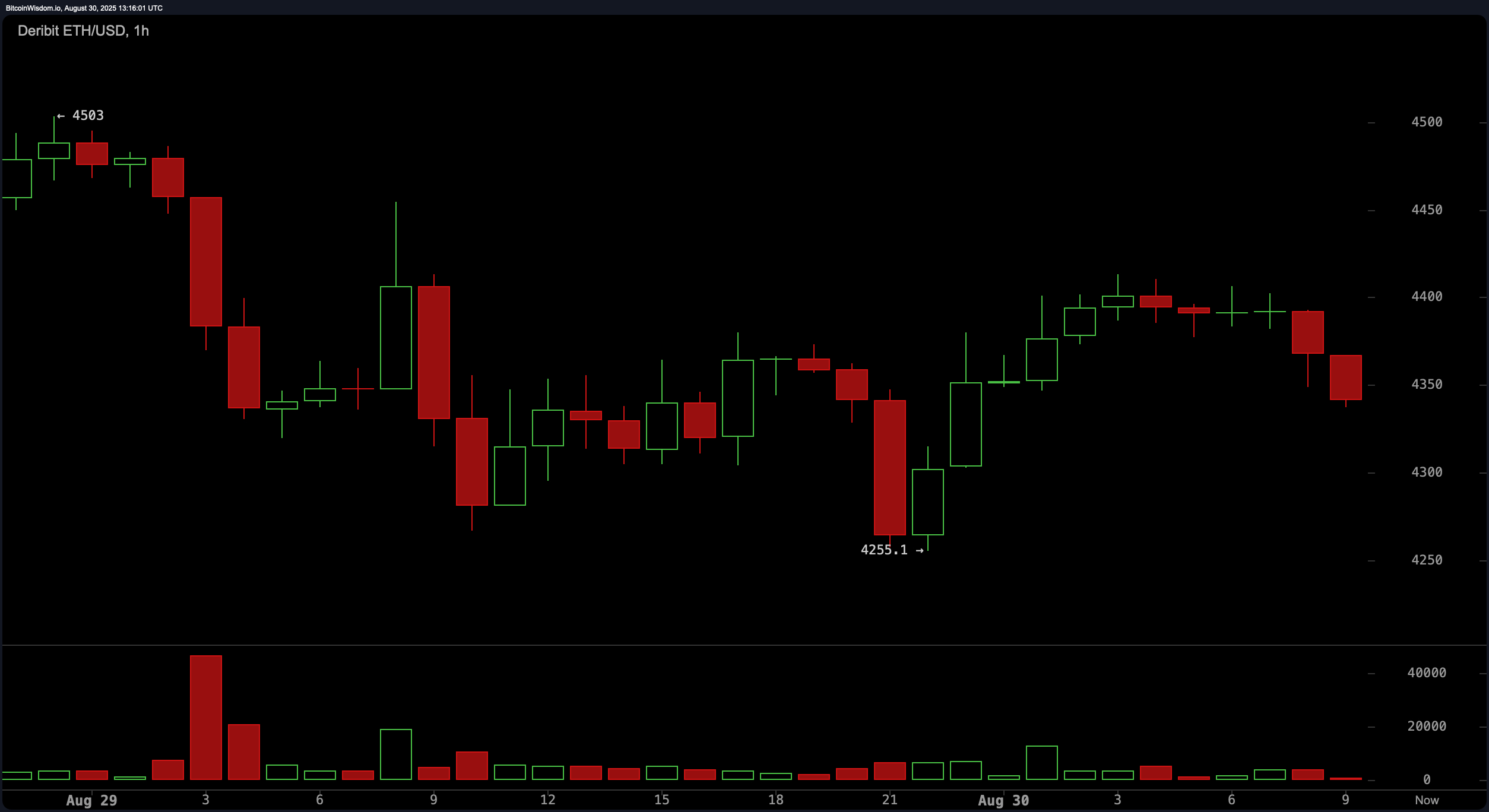

The four-hour Ethereum chart reflects a more immediate downtrend, ranging from $4,957 to nearly $4,255 in recent lows. The red candle volume spikes support the story of a sustained sale, with relative strength index (RSI) appearing to hover near the territory where it was sold. This opens a narrow window for short-term bullish divergence, especially when double bottoms with prices around $4,250-4,300 are integrated. Traders who focus on traders may consider breaks above $4,400-$4,420 as early signals, but upward momentum should be treated with caution. Given the resistance of $4,480-4,500, a tight stop loss strategy remains important.

ETH/USD 4-hour chart for August 30th, 2025.

The 1-hour ether chart highlights the pattern of miniconsolization after each downward movement, hinting at trader hesitation and market indecisiveness. Ethereum rebounded to $4,400 in a short time, but was sold quickly, informing the bull’s lack of strength. The reversal could form at nearly $4,255, subject to holding a level of $4,300 and exceeding $4,380 in volume support surges. If prices shrink in large quantities below $4,250, bearish continuation is more likely and short or flat positioning is more cautious. Immediate resistance remains concentrated in the corridors between $4,400 and $4,450.

ETH/USD 1-hour chart for August 30th, 2025.

The oscillator offers a mixing outlook with a relative strength index (RSI), stochastic oscillator, commodity channel index (CCI), mean orientation index (ADX), and a great oscillator holding all neutral positions. However, the momentum indicator and moving average convergence divergence (MACD) both exhibit bearish momentum, with the latter showing a level of 151.0. These divergences demonstrate the importance of waiting for confirmation before positioning, especially in a market where there is no uniform oscillator sentiment.

The moving average reflects the transition period. Short-term averages such as exponential moving averages (EMA) and simple moving averages (SMA) suggest that simple moving averages (SMA) for 10 and 20 periods continue to weaken. However, medium to long term trends show strength, with bullish signals across moving averages of 30, 50, 100, and 200th periods. This difference between short-term and long-term signals may indicate that Ethereum is trying to stabilize, but confirmation is still pending. For now, traders will benefit from tracking volume shifts and structural integration in lower time frames.

Bull Verdict:

If Ether maintains support between $4,200 and $4,300 and breaks beyond the $4,380-$4,420 zone on volume checks, the short-term recovery rally can be extended to $4,500 and potentially $4,600-$4,700. Medium-term and long-term moving average alignment in bulls support a cautious optimistic outlook, especially when sales pressures decline and oscillators move from neutral territory.

Bear Verdict:

If Ethereum crucially breaks its support level of $4,200 with an increase in selling volume, it looks like it will have a downside target of $4,000 and $3,850. With key momentum indicators such as short-term moving average and moving average convergence divergence (MACD) and bearishness in momentum indicator signals, the seller will retain the dominance unless structural reversals appear.