Ethereum (ETH) is currently below the key $2,000 mark and is struggling to find momentum after pressure around $1,900 and days after integration. The broader crypto market is under heavy bear control, with ETH losing more than 57% of its value, making it increasingly difficult for the Bulls to set their recovery.

Currently, Ethereum is below multi-year support levels, so this zone could reverse into strong resistance, further complicating potential rebounds. The market is in a very unstable stage, with traders carefully looking at strength and signs of further downside risk.

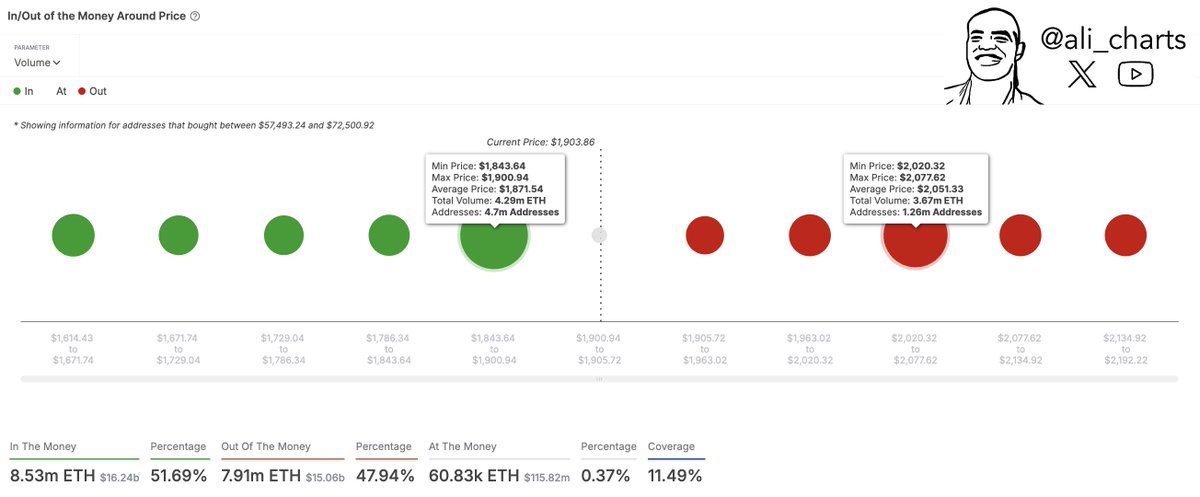

On-chain data highlights two key price levels in Ethereum’s immediate trajectory. Now, $1,870 is serving as a key support. Meanwhile, $2,050 is currently the most challenging resistance and serves as the main barrier ETH must recover to confirm a trend reversal.

For now, Ethereum remains vulnerable and promotes uncertainty price action. If the Bulls fail to defend their current support, ETH could drop even further, but successful reclamation of resistance could spark new trust in the market. The next few days are important in determining the short-term direction of ETH.

Ethereum is facing a critical test as bulls struggle to get back $2,000

Ethereum is at a critical turning point, approaching its lowest level since October 2023 as the Bears maintain control. After selling weeks of pressure and uncertainty, the Bulls must regain the $2,000 mark as soon as possible to prevent further negatives and restore market confidence.

The broader macroeconomic landscape remains uncertain, with the fears of trade wars and global financial instability being heavily weighted in both the crypto and the US stock market. These factors set potential deeper correction stages and give investors the advantage. However, some analysts believe that the market will be able to recover in the coming months, especially if Ethereum is able to regain its major resistance levels.

Top analyst Ari Martinez recently shared on-chain metrics and identified $1,870 as Ethereum’s strongest support level. This means that if ETH breaks under this zone, a further reduction may be imminent. In an advantage, $2,050 is now Ethereum’s most challenging resistance and serves as an important barrier the Bulls must overcome.

When Ethereum successfully retrieves $2,050, it shows a strong trend reversal and sets the stage for a potentially powerful recovery rally. ETH will be important as investors are closely monitoring price actions, as ETH will need to retain its position or even hold further downsides.

ETH Bulls Should Hold Over $1,900

Ethereum Currently $1,920 dealcontinues Consolidation Days below the Important $2,000 Level. in spite of Attempts to push it higherBulls I had a hard time regaining the lost groundleave ETH In a vulnerable position.

To see a recovery, the ETH must be damaged by more than $2,000 and exceed the 4-hour 200 Moving Average (MA) and Exponential Moving Average (EMA) to exceed around $2,400. Successful regeneration of these levels will demonstrate an updated purchasing momentum and could set the stage for a powerful gathering towards a higher zone of resistance.

However, if Ethereum is unable to regain these levels, sales pressure could be increased and ETH could drive ETH towards a demand zone of around $1,750. A breakdown below this level can put more pressure on the bull and lead to more downsides and extended bearish feelings.

As the market situation is still vulnerable, the short-term direction of ETH remains uncertain. The Bulls must intervene immediately to protect critical levels. Or Ethereum must lose more ground and make quick recovery much more difficult. The next few days will be very important as ETH traders watch breakouts or further downside movements in response to wider market trends.

Dall-E special images, TradingView chart