Ethereum (ETH) price has rebounded sharply from the crash lows around $3,430 and has risen to about $4,130 at the time of writing, an increase of about 20%. Although this looks like a strong recovery, price charts and on-chain data suggest this move may not be easy.

Ethereum could continue to rise, but there could be a short period of decline before the next high is formed.

Whales pick up ETH, but cautious groups maintain market polarization

Ethereum’s current rally appears to be driven by large wallets rather than small holders. Since October 11, Whale Wallet holdings have increased from 128 million ETH to 136 million ETH, according to Santiment data.

This equates to approximately 80,000 ETH, or approximately $330 million at current Ethereum (ETH) prices. The slow but steady increase in whale holdings indicates quiet accumulation after the crash and suggests confidence among long-term investors.

Ethereum whales slowly adding: Santiment

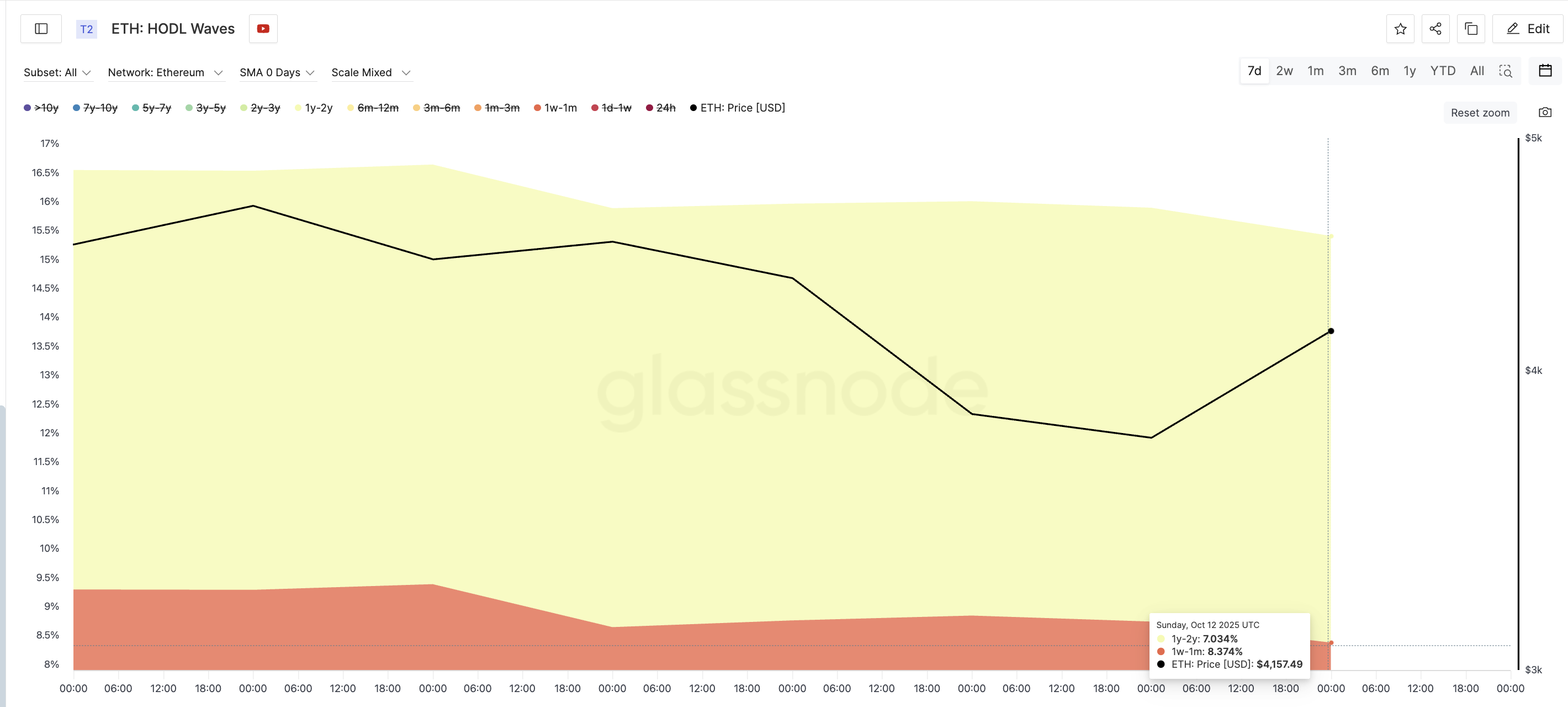

However, some keyholder groups do not express similar beliefs. According to Glassnode’s HODL Waves, which categorizes coins by holding period, two major cohorts have reduced their exposure. The one-week to one-month cohort, which typically consists of short-term traders who react quickly to volatility, reduced its share from 8.84% to 8.37%.

Want more token insights like this? Sign up for editor Harsh Notariya’s daily crypto newsletter here.

On the other hand, in the 1-2 year cohort, there are many medium- to long-term holders who contribute to price stability in times of uncertainty, but after the crash, the percentage declined from 7.16% to 7.03%.

Ethereum holders remain cautious: Glassnode

These are typically the cohorts that create short-term momentum and sustain long-term recovery. Their current caution explains why Ethereum’s rebound, while promising, still looks uneven. Until these traders and holders re-enter the market, the recovery is likely to remain largely whale-driven. If this happens, Ethereum’s price trend will become even more volatile near the resistance zone.

Cup pattern suggests a rise in Ethereum price, but a fall could come next

On the 4-hour chart, Ethereum has formed a cup pattern, often seen as a bullish reversal signal. Looking at this structure, the formation appears to be stable on both sides, with prices trending upwards from around $3,640 towards the $4,130-$4,390 range. The long bottom core of the October 11 crash is excluded from the pattern as it was a rapid anomaly that did not affect the broader structure.

Volume trends support this formation. A heavy red candle appeared on the left side during the fall. Volume then flattened out at the base as the market stabilized. And finally, the buys returned and the green bar started rising on the right side.

Based on this setup, Ethereum price could rise to around $4,390, completing the cup and aligning both rims at the same level. Once that level is reached, the decline in ETH price is likely to continue as a handle begins to form.

Ethereum Price Analysis: TradingView

During the handle phase, ETH could drop to $4,070, or perhaps even $3,950, without invalidating the structure. However, a close below $3,950 will break the pattern and indicate weakness. If the handle forms nicely and momentum is maintained, a breakout above $4,390 could trigger the next leg up. In that case, short-term targets would be $4,550 and $4,750.

Ethereum price could rise or fall to these levels before the next rally — here’s why The post appeared first on BeInCrypto.