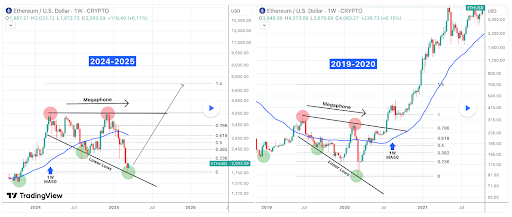

Crypto Analyst Trading Shot It revealed that Ethereum prices have formed the bottom of a megaphone that has not been seen since 2020. Analysts revealed what happened last when they formed this bottom.

Ethereum prices form the bottom of the megaphone

in TradingView PostTradingshot said that Ethereum prices formed the bottom of the megaphone, as in March 2020. ETH is now In the first week of rebound after recording three consecutive red weeks that failed to surpass the MA50 of the week. Analysts further stated that ETH has been taking on the low-value trendline, which is technically the bottom of the one-year megaphone since March 11, 2024.

Tradingshot argued that the market is not a man who knows such a long-term megaphone integration period. He stated it Ethereum prices It eventually broke upwards at the end of the formation of this megaphone between June 2019 and March 2020.

He noted that the March 2020 period is very similar to the current bearish Ethereum price action since late December. Analysts then highlighted how Fibonacci’s retracement levels are perfectly aligned. Based on this development, he predicted that Ethereum prices could at least be tested. 1.5 Fibonacci expansion For $6,000 before this cycle was top of the year.

Crypto analyst Crypto Patel has raised the possibility of a high valuation of Ethereum prices as much as $8,000. He suggested that this parabolic movement could occur during phase E of the bull run in ETH. He showed that ETH could face serious resistance at around $4,050 against this price level.

ETH’s bullish basics

Despite its poor performance, Ethereum prices have a bullish basis, which can cause an upside-down reversal, bringing it to a new high. Crypto analyst Alternative Bull revealed: Exchange ETH reserves It’s been significantly reduced. He said this would lead to limited supply. In line with this, analysts confirmed that Altcoin is still in the early stages of the Bull Run.

Crypto-analyst Ali Martinez It also revealed that whales are actively accumulating ETH. This is bullish for Ethereum prices. In an X’s post, he said 360,000 ETH has been withdrawn from the crypto exchange in the last 48 hours, with developments that could cause supply shocks being withdrawn.

It is also worth mentioning that Ethereum prices can be seen immediately through ETH ETFs. Asset managers like Bitwise include submitting files to the US SEC to staking their funds. If approved, this can remove more ETH from distribution as some institutional investors chose to wager ETH and receive yields.

At the time of writing, Ethereum prices are trading at around $1,969, down almost 2% over the past 24 hours. data From CoinMarketCap.

Unsplash featured images, charts on tradingView.com