Ethereum price falls near $1,948 amid overall decline in whale wallets $ETH Supply management share.

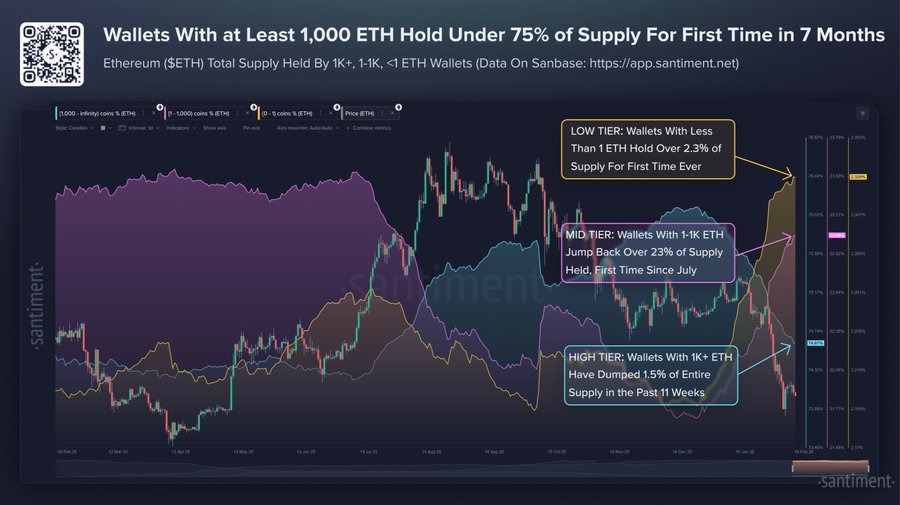

Santiment data shows that large $ETH Holders have fallen below 75% of supply ownership after being in the ascendancy for several months.

Over 220,000 $ETH Withdraw from exchanges and reduce short-term selling pressure on the overall cryptocurrency market.

Ethereum price is currently trading around $1,948, down 3.5% and down nearly 14% over the past week, indicating strong selling pressure. At the same time, big changes are happening behind the scenes.

Meanwhile, the big whale wallets are losing control of supply. $ETH Leaving the exchange. These changes are $ETH Prices remain under pressure.

Large Ethereum holders cut back $ETH supply management

Santiment said his wallet contained at least 1,000 coins. $ETH It currently controls less than 75% of Ethereum’s total supply, and this is the first time in seven months that this level has been this low.

However, since December, these large holders have sold or redistributed about 1.5% of their supply, suggesting profit-taking and reduced exposure amid market uncertainty.

On the other hand, it is a medium-sized wallet that can hold from 1 to 1,000. $ETH The market share has increased to over 23%, showing quiet accumulation.

Smaller wallets are also on the rise, holding less than one address. $ETH It currently holds a record of 2.3% of supply. Santiment believes this growth among small holders is likely related to staking activity.

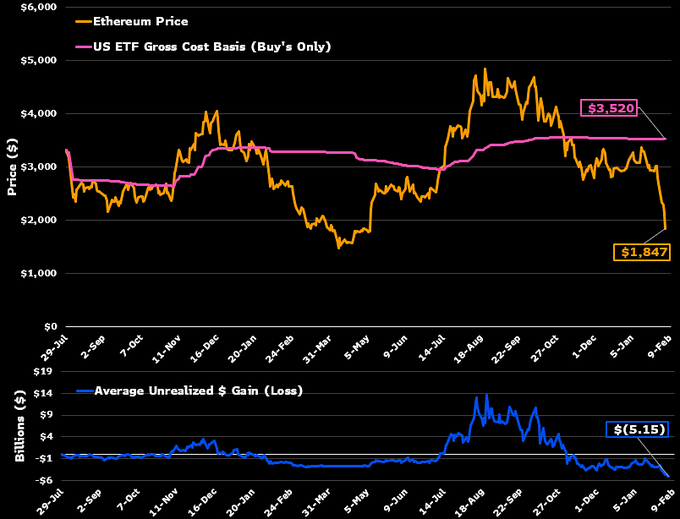

$ETH Currently below whale cost standards

Ethereum is currently trading below the average price at which large holders purchased Ethereum. $ETHThis means that many whales are currently being lost. This may be more readily visible among Ethereum ETF investors, who are in a tougher position than Bitcoin ETF holders.

and $ETH (It’s trading around $1,945, still well below the ETF’s estimated average entry price of about $3,500.) For many investors, this is a tough situation.

But despite these losses, ETF holders continue to accumulate more assets. $ETH.

In fact, the Ethereum Spot ETF has also seen new inflows, with $57 million on February 9th and $13.8 million on February 10th, indicating continued interest from institutional investors.

220K $ETH leaf exchange

Ethereum price has been depressed recently, but on-chain data shows strong signs of accumulation. According to CryptoQuant data, over 220,000 $ETH Funds have been withdrawn from exchanges in recent days, the biggest net outflow since October.

On February 5th, it was viewed by approximately 158,000 people on Binance alone. $ETH Withdrawals were at the highest level since August last year.

Large exchange withdrawals typically reduce selling pressure, as coins moved to private wallets are less likely to be sold immediately.

Ethereum price outlook

For now, $ETH is trading within a well-defined descending channel, confirming continued selling pressure. The price recently fell below an important support level at $2,000, but it is now resistance. $ETH is currently trading around $1,945, close to the key demand zone around $1,800.

For recovery, $ETH You must collect $2,440 first, then $2,800. If the price fails to sustain above the $1,750 support, further downside towards $1,600 is possible.

However, the RSI is showing oversold conditions around 28, suggesting a possible short-term rebound.