Ethereum (ETH) Price The first week of June 2025 began with a relatively calm price action, holding around $2,500 despite growing expectations in the broader crypto market. Both hourly and daily Ethereum Price Chart It is increasingly likely that a breakout or breakdown will be revealed this week, revealing key technical structures.

Ethereum Price Prediction: Are Ethereum prices losing momentum?

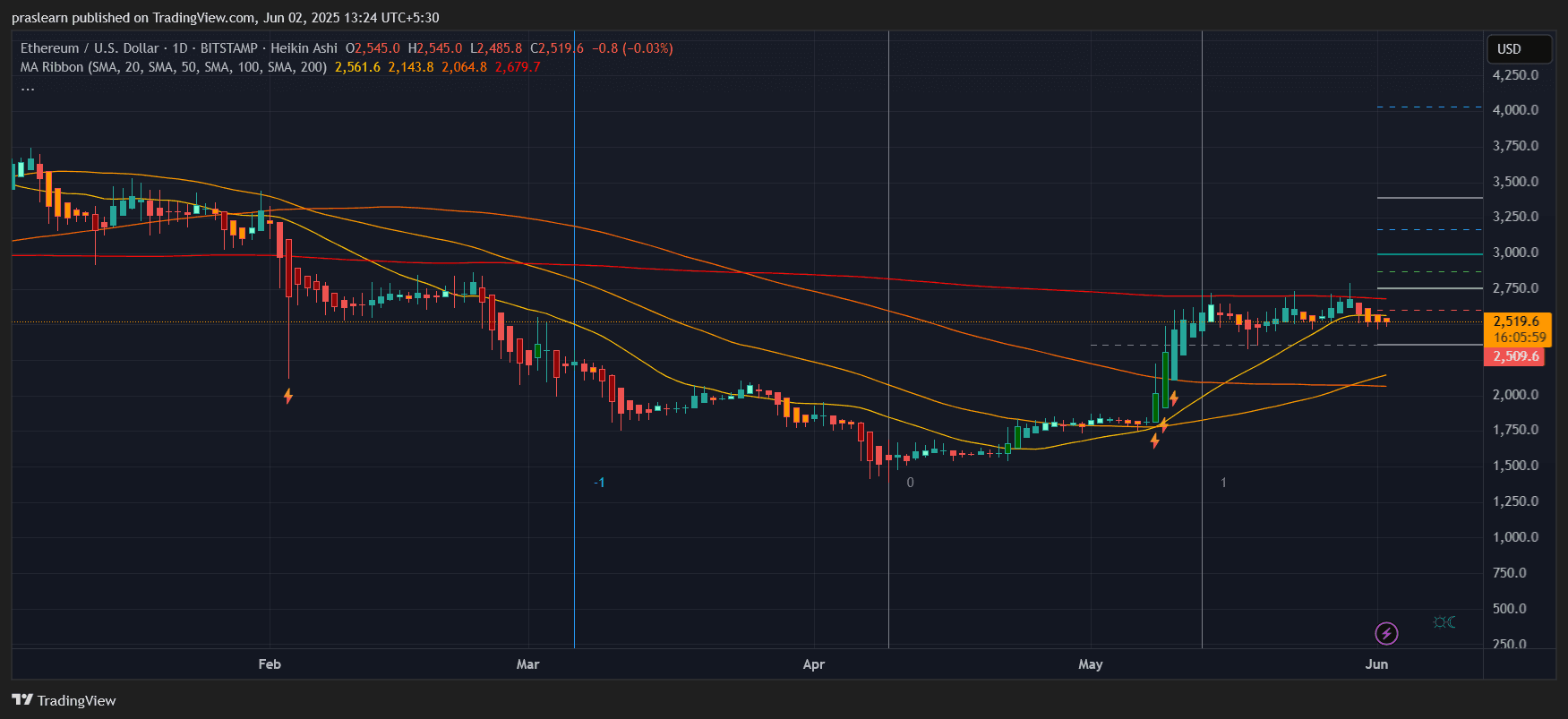

eth/usd daily charts – TradingView

In Daily ChartsEthereum prices are now consolidated just below the 200-day Simple Moving Average (SMA) nearby $2,680. This moving average acts as a large dynamic resistance. ETH prices recently attempted a breakout of over $2,700, but were unable to hold it and returned to a tough integrated channel.

The last three daily candles show indecisiveness with a smaller body and a longer core, suggesting equal pressure from both the bull and the bear. Ethereum prices are traded Approximately $2,519Converged close, just above the 20 and 50 days SMA. $2,145 and $2,065respectively. This confluence of support is increasing the price of ETH, but the resistance of the 200 SMA needs to be destroyed for a sustained gathering.

What does the hourly chart reveal?

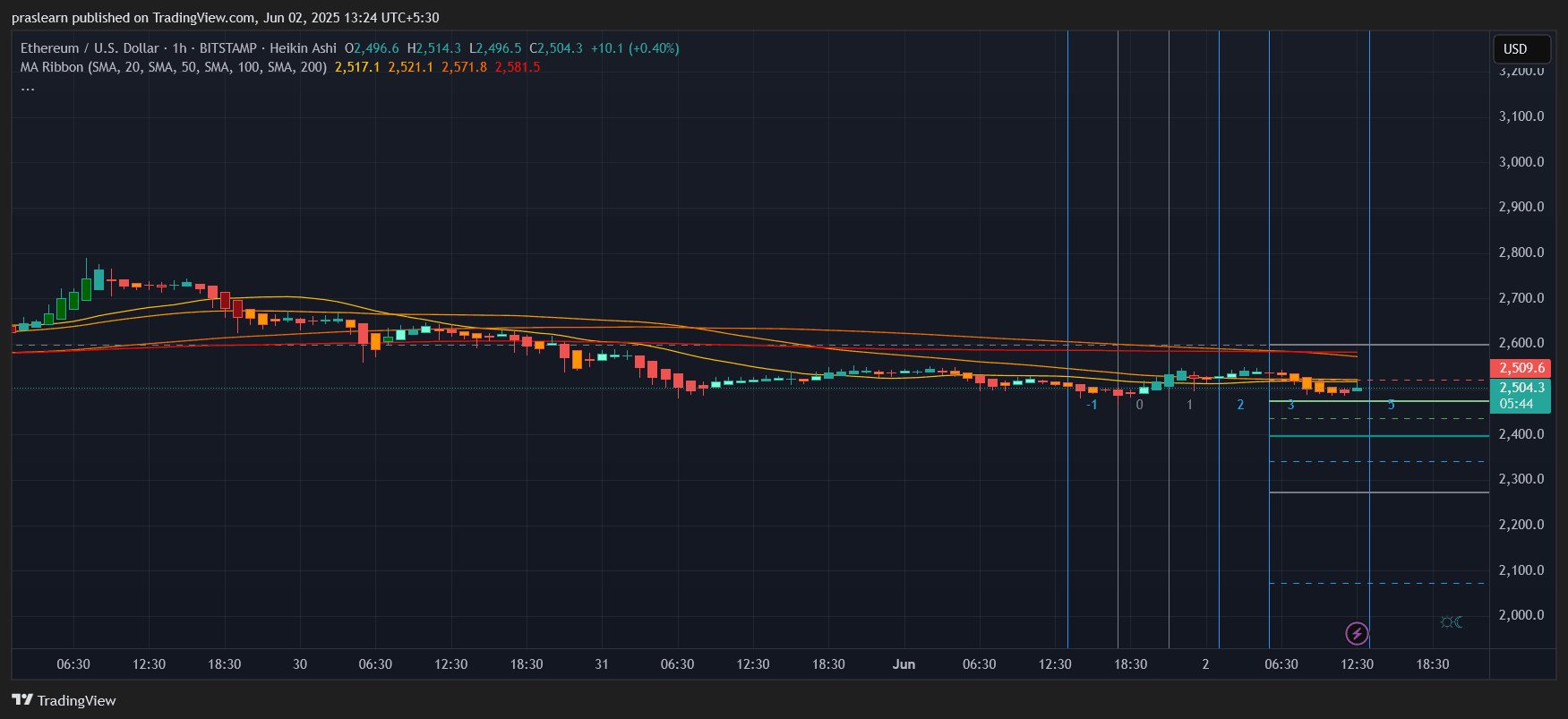

ETH/USD 1 hour chart – TradingView

Hourly Chart Draw more carefully. Ethereum Price trades under all major SMAs (20, 50, 100, and 200). These are stacked badly. There is the most direct resistance $2,521 (SMA 20) and $2,571 (SMA 50). The latest hourly candle prices are abundant $2,504suggesting a slight bullish attempt, but has failed to convincingly break the ETH price above $2,520.

This shows a potential liquidity sweep below the current lows to test for short-term bearishness and deeper support. Prices are currently being captured in a narrow range $2,485 and $2,520.

Where will Ethereum prices go next?

Use Fibonacci Retracement from the recent swing donkey in May ($1,620 in April) to nearly $2,750.

- 38.2% FIB Retracement = $2,357

- 50% retracement = $2,185

- 61.8% retracement = $2,012

Ethereum prices so far have respected the 38.2% retracement zone, slightly above $2,350. If your ETH closes daily candles under $2,500, expect a test of $2,350- $2,185 Support band this week. Failing to hold $2,185 opens the door to $2,000 in psychological support.

The advantage is that Ethereum prices will be regaining $2,571 (50-hour SMA) and then you should try Critical Resistance Zones of $2,680-$2,750. A strong break above $2,750 causes bullish continuation to $3,000 and $3,250, as shown in the expansion of the top Fibonacci.

Ethereum price forecast: Are bears controlled so far?

The short-term structure indicates that the bear is slightly controlled. The aperture between the lower high and consistent bass, which does not break beyond the Ethereum hourly SMA, refers to bearish triangle patterning. The volume is dry and allows for sharp movements within 48-72 hours. The direction is determined by whether there is a $2,500 hold or break.

From a calculated perspective:

- If ETH prices close $2,485 per hourhoping that the measured movement will drop to $2,350

(Target=Support Zone=$2,485-($2,520-$2,485)=$2,450-$2,485=$2,450) - If the ETH price is above $2,571my next goals are $2,680 and $2,750.

Weekly Outlook: What Should Traders Look at?

This week, Ethereum prices could remain in range until a clear breakout or breakdown occurs. Traders need to look closely:

- $2,500 Support Zone

- $2,570 short-term resistance

- $2,750 for the decisive breakout zone

If Bitcoin remains stable and Ethereum prices break $2,750, expect a new bullish momentum at $3,000. However, if you can’t hold $2,500, you could reduce your ETH to under $2,185.