Ethereum (ETH) has recently skyrocketed, reaching three months high. This price movement brings the $3,000 mark within reach, but the challenges lie ahead.

Long-term holders (LTHS) continue to reserve profits. This will prevent ETH from reaching the $3,000 threshold in the near future.

Ethereum Investors Prepare for Surges

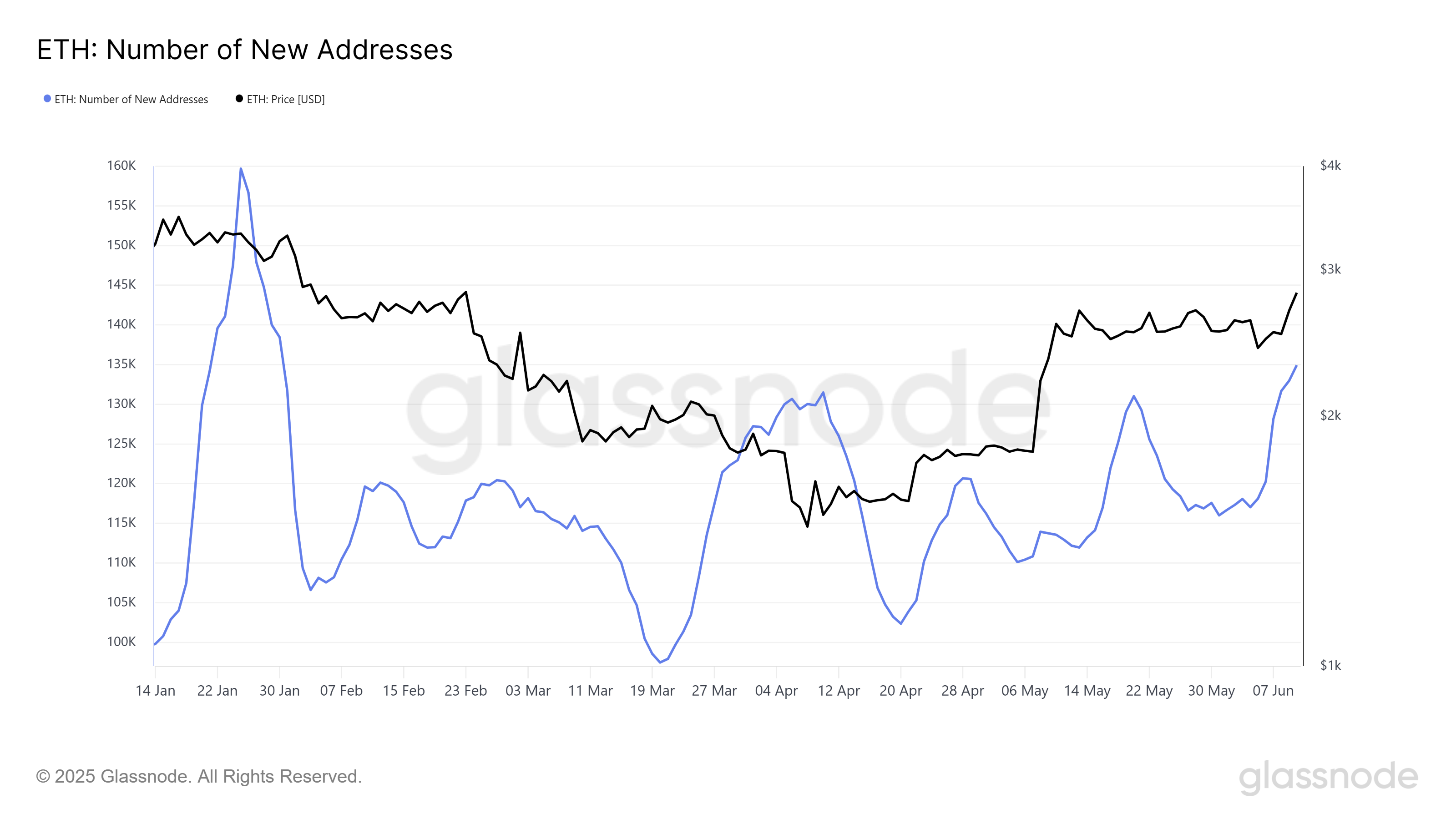

The new address has reached a height of four months, indicating that Ethereum is gaining attention among investors. The increase in new addresses is a positive sign of Altcoin’s adoption, indicating that more investors are showing interest in Ethereum.

However, many of these new addresses can be driven by FOMO (fear of missing), making them more susceptible to volatile influences. These investors will help raise Ethereum prices, but they could sell quickly if the market changes.

Despite the risks of FOMO-led actions, the increase in new addresses clearly indicates that Ethereum is still attracting new participants. A new influx of investors will help boost ETH prices.

New address for Ethereum. Source: GlassNode

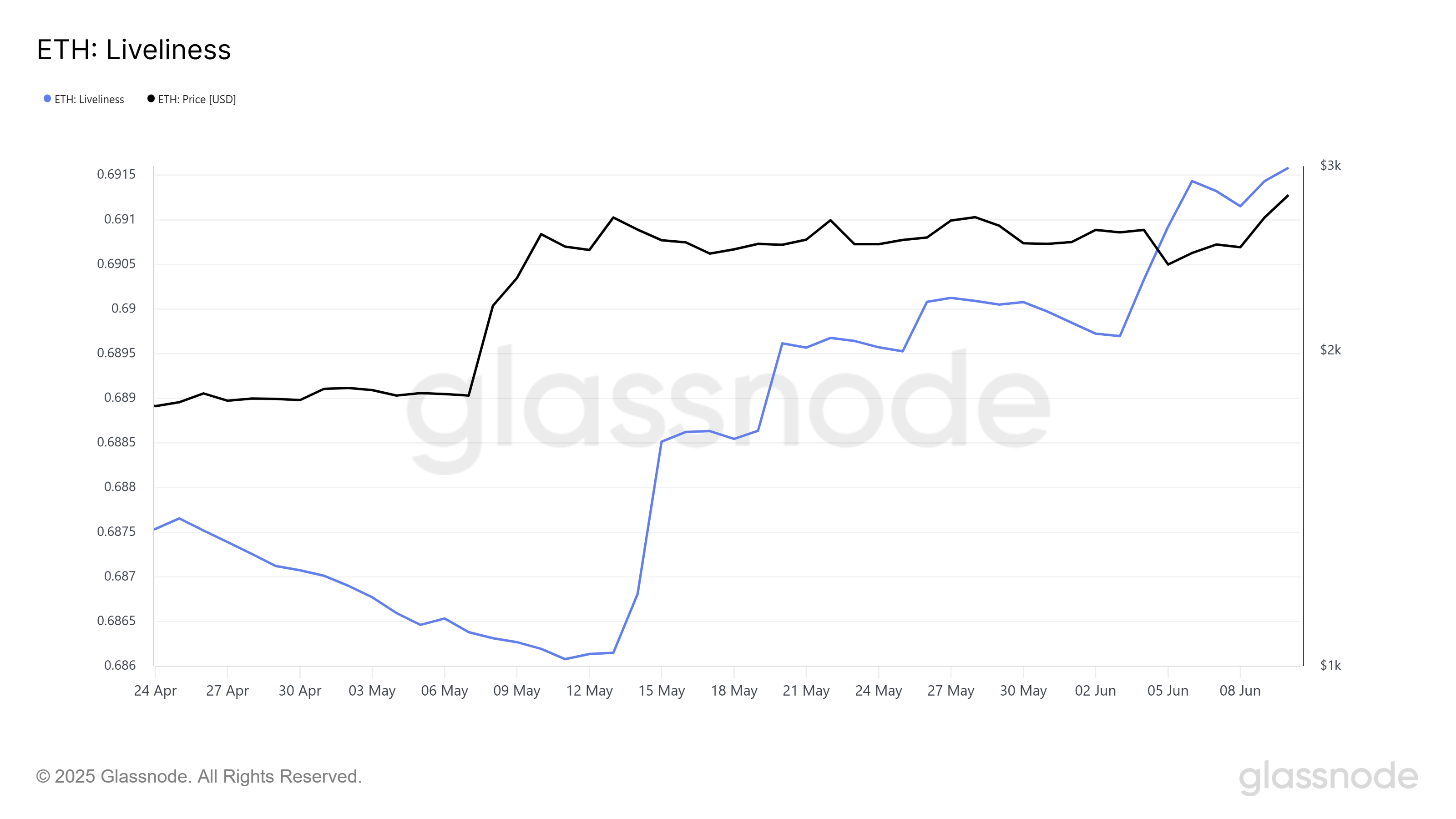

This week, lively indicators continue to rise, indicating that long-term holders (LTH) are increasingly liquidating their holdings. Vibration measures how often coins move from the wallet, and this metric rise indicates sales pressure.

As LTHS withdraws the market, their sales could have a negative impact on Ethereum prices. As these investors typically retain through volatility, a sales decision could indicate a lack of confidence in ETH’s short-term outlook. This sales trend could hamper Ethereum’s efforts to break the $3,000 mark, just as it helped ETH consolidate in May.

Lths plays a key role in supporting Ethereum prices, and their exits can make it difficult for Altcoin to maintain a strong uptrend. If this trend continues, Ethereum may struggle to reach $3,000.

The vibrancy of Ethereum. Source: GlassNode

ETH Prices need to find a way

Ethereum’s price is now $2,769, up 14.6% after escaping a month’s consolidation of less than $2,681 this week. ETH is currently facing resistance at $2,814.

The price of Altcoin is about 8% off the $3,000 mark, which last reached in February this year. If sales are stopped and the broader market clue remains bullish, Ethereum’s price could be pushed to $3,000.

Ethereum price analysis. Source: TradingView

However, if ongoing LTH sales continue to outweigh bullish cues, Ethereum could return to support levels at $2,681. Losing this support could potentially reduce further, potentially sending your ETH to $2,476. If this occurs, bullish papers will be invalidated and Ethereum can enter another phase of integration.