Ethereum has fallen below its main support level of $2,200, bolstering a bearish mood and triggering a warning of a potential decline to $1,250.

Famous analyst Ali Martinez emphasizes that Ethereum’s breakdown from parallel channels shows a potential decline to $1,250 if downward momentum continues.

After Ethereum fell to $1,840, analysts identified key support zones at $1,640 and $1,250. If sales pressures don’t wander, ETH could plummet further towards a $1,250 target, a level consistent with historical support and Fibonacci’s retracement levels.

#ethereum $eth targets $1,250 after escaping this parallel channel! pic.twitter.com/xs3n9p8unr

– Ali (@Ali_Charts) March 14, 2025

Can you see the view?

According to GlassNode, Ethereum’s cost-based distribution (CBD) has increased from 1.6 million to 1.9 million ETH at the $1,886 level. Increased supply in certain price ranges suggests potential accumulation by investors.

In addition to mixed signals, custom yield metrics that integrate CBD with realized loss data highlight the increased yield pressure in the market. These metrics suggest that ETH can find temporary support in about $1,886 before determining its next move.

Related: ETH plunged to 13.40%, then whipped: $330 million in liquidation – Price analysis

Purchase opportunities for long-term holders

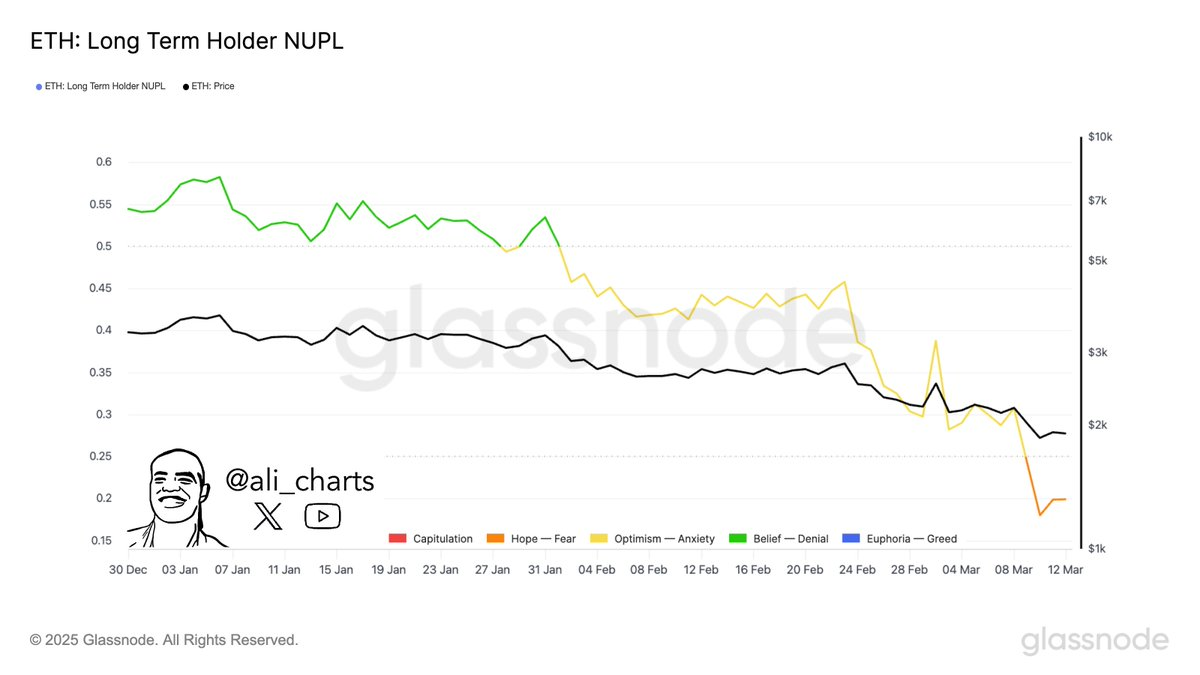

Ali Martinez also points to Ethereum’s long-term holder net unrealized profit/loss (NUPL) metrics. This is currently in the fear zone. This reflects long-term investors abandon their holdings as ETH falls below $2,000.

Source: x

Historically, such terror-driven sales have created major accumulation opportunities. As investors’ feelings change, Ethereum could experience strong rebounds, reflecting past recovery patterns. The question is, will sufficient buyers intervene to stop the bleeding?

Technical indicators confirm bearish trends

ETH/USD Daily Price Chart, Source: TradingView

As of press time, the price is currently at $1,930.19, a recovery of 3.08% over the past 24 hours, but overall down 11.82% over the past week.

The relative strength index (RSI) is 35.68, indicating that ETH is approaching its selling state. This suggests potential purchase rights at a lower level, but short-term gains remain limited without the recovery of lost support zones.

Related: Ethereum (Eth) Exchange Exodus: 600,000 ETH withdrawal – A rapid rise in potential prices for supply squeeze signals

Ethereum’s MACD (moving average convergence divergence) remains in the negative domain. The MACD line is at -209.5 under the signal line at -195.4, confirming the ongoing bearish momentum. Positive changes in these indicators are necessary for reversal. Until then, traders will need to monitor responses at these key support levels ($1,640 and $1,250).

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.