Ethereum prices crashed more than 52% from their December highest levels, with technology and chain metrics pointing to more downsides in the short term.

Ethereum (ETH) peaked at $4,105 in December and was trading at $1,970 on March 20th. This 52% crash is one of the worst blue chip coins on the market.

Ether crashed as concerns about its future remains. This week, Standard Charter Analysts downgraded estimates by 60% from $10,000 to $4,000, citing increasing competition from Layer-1 and Layer-2 networks that affected revenue growth.

Layer 2 networks on Ethereum, such as Coinbase’s Base, Kinkai and Optimism, attracted more users to the ecosystem due to their lower fees. for example, Defi Llama data shows The Dex Ethereum protocol has processed more than $9.8 billion in the last seven days.

Arbitrum processed $2.87 billion and Base was $2.8 billion. In the past, this volume was processed on Ethereum’s mainnet network.

Ethereum is also seeing an intensifying competition with Layer-1 networks such as Solana (SOL) and BNB chains. BNB Smart Chain’s Dex protocol has processed over $13 billion in DEX volumes over the past seven days.

Also, Ethereum is not expected to become a major beneficiary of emerging technologies such as Real World Asset Tokenization due to its high fees and slow speeds. Instead, developers can choose to use other scalable and inexpensive networks, such as Mantra (OM) or BNB chains.

You might like it too: Cardano Wallet Race adds support for Bitcoin

Ethereum has weak chain metrics

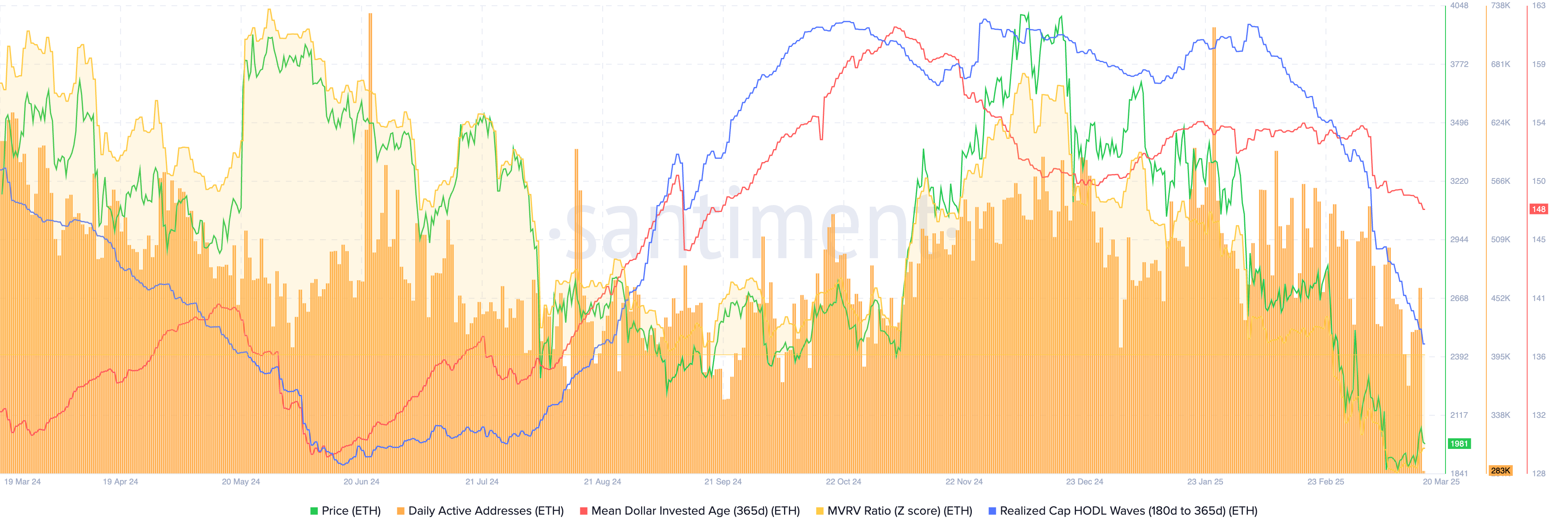

More data shows that the number of active addresses in Ethereum has decreased over the past few months. Santiment’s chart below shows Ethereum had 461,000 active addresses on Wednesday, down from 717,000 earlier this year.

Another notable data point is the realised cap for the Ethereum wave, displayed in blue. Since August last year, it has hit a low point, a sign that long-term holders have begun selling.

Average 365 days of dollars invested age or MDIA. This calculated how long each coin stayed at the address, and reduced all the money used for the purchase to a low September.

Ethereum Daily Active Address, MDIA, and Realization Cap | Source: Santiment

Ethereum price technology analysis

ETH Price Chart | Source: crypto.news

Daily charts show that ETH prices have been on a strong downward trend over the past few months. This drop started after forming a triple top pattern for $4,000, with a neckline of $2,120.

The ether then formed a cross-pattern of death as the 50-day and 200-day moving averages crossed each other. This cross often leads to more negative side momentum. Also, popular oscillators such as relative strength index and percentage price oscillators have been removed.

So, the coin could continue to fall as sellers target psychological points for $1,500. This is about 25% below the current level.

You might like it too: Moonpay has secured a $200 million credit line from Galaxy