Ethereum was unable to reach the $5,000 mark earlier this month and is currently struggling to surpass $4,500.

Altcoin King is facing higher pressures as recent market conditions weaken support levels. As sales activity rises, Ethereum could become vulnerable to further declines in the short term.

Ethereum owners sell it

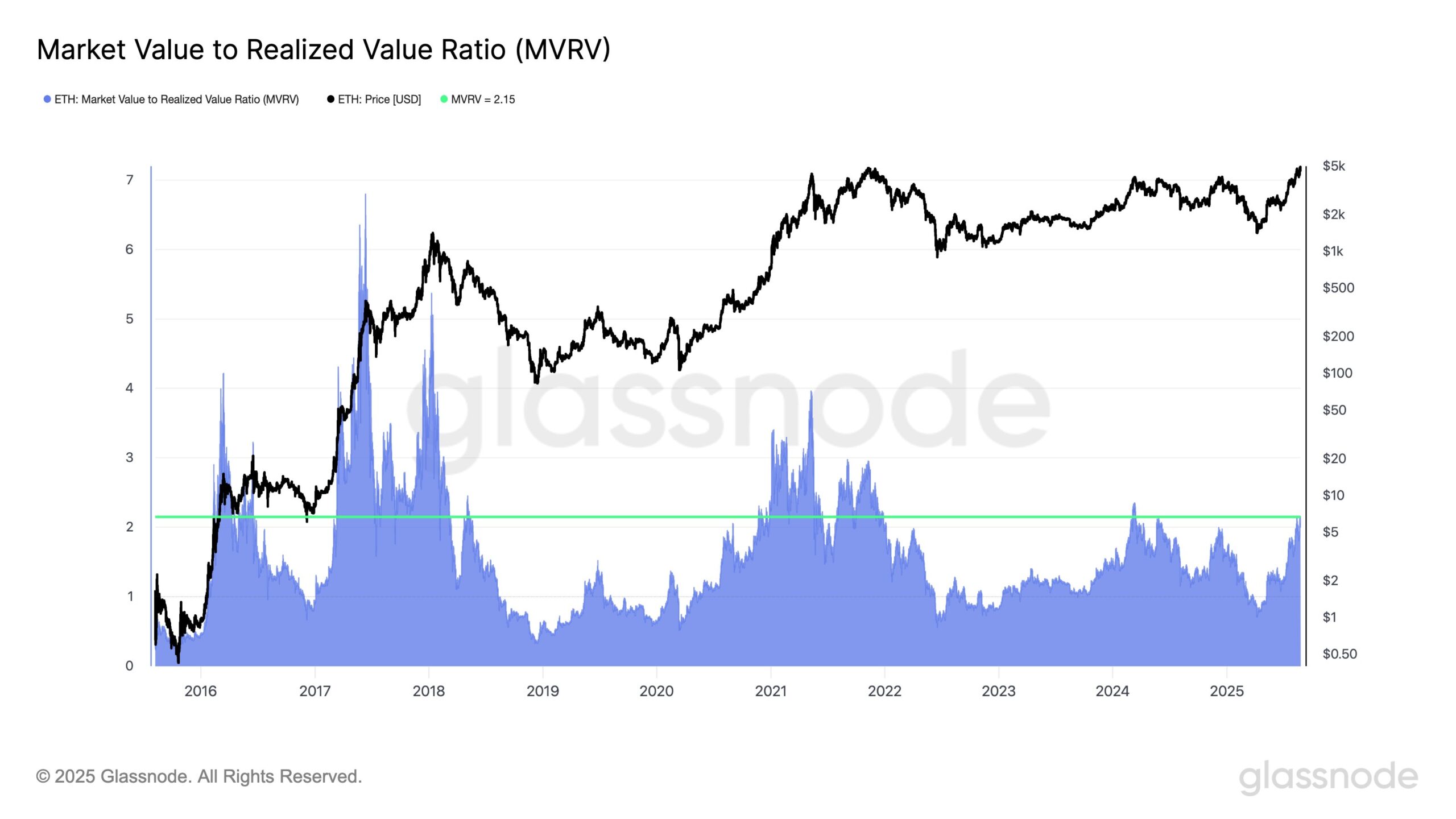

Ethereum’s MVRV ratio has risen to 2.15, indicating that on average investors currently hold 2.15 times the initial capital in unrealized profits. This level has historically coincided with periods of increased profits. A similar pattern was observed in March 2024 and December 2020, both of which increased volatility.

On-chain data confirms that profits are already rising. Investors use these levels to lock in profits, leading to increased sales pressure. The correlation between current MVRV ratios and past cycles highlights the possibility of short-term corrections.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum MVRV. Source: GlassNode

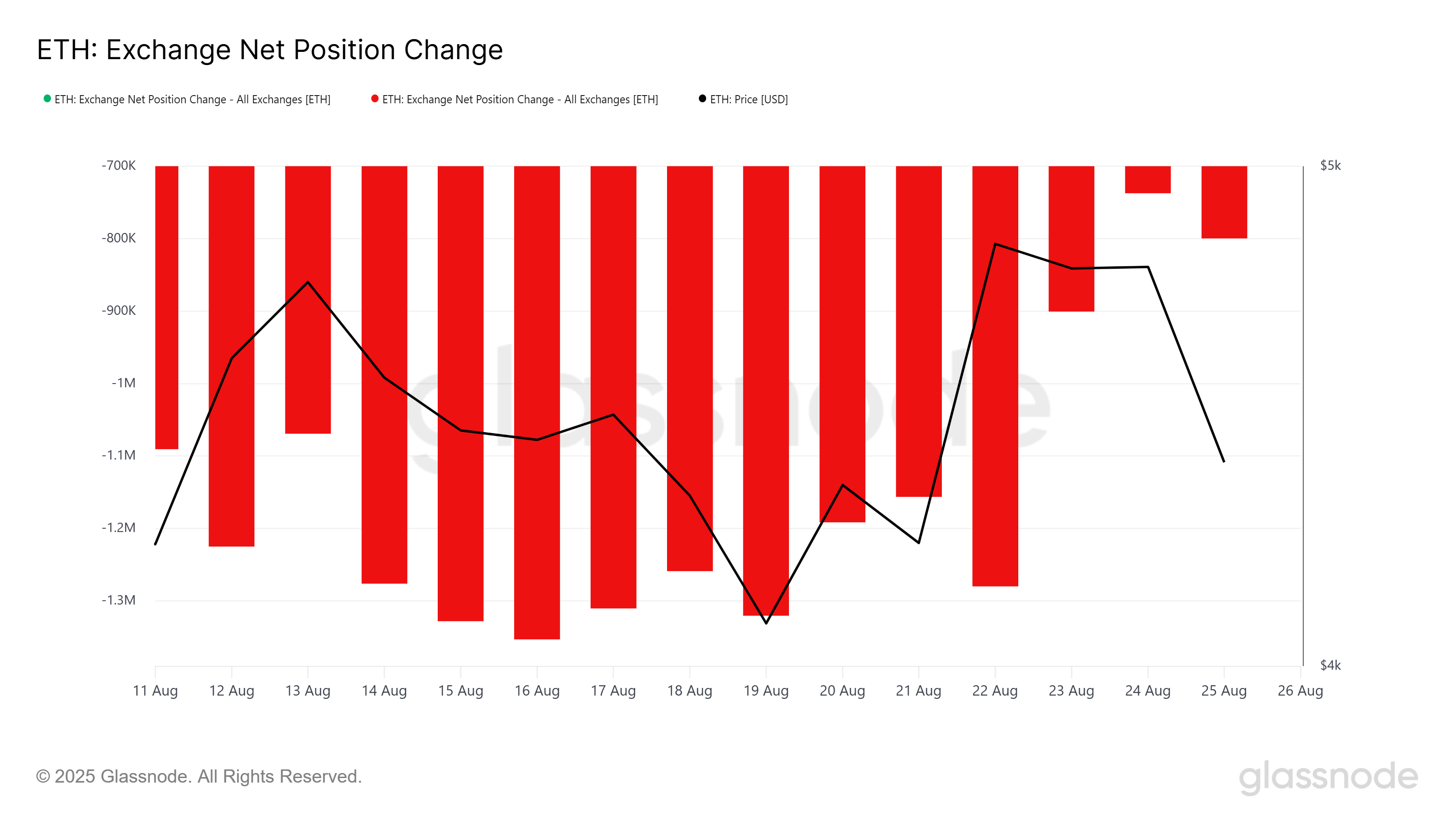

Exchange Net Position Change highlights sales activities further. Investors have moved from accumulation to distribution, with 521,000 ETH worth worth more than $2.3 billion last week. The scale of this inflow indicates a wide profit across the market. Such actions usually increase the likelihood of extending corrections.

Timing coincides with the MVRV signal and reinforces a historical pattern of rapid decline following high and unrealistic benefits. The fear of saturation in bullish momentum appears to promote capital rotation. The combination of heavy inflows and profit-raising increases will weaken.

Changes to Ethereum Exchange net position. Source: GlassNode

ETH prices remain vulnerable

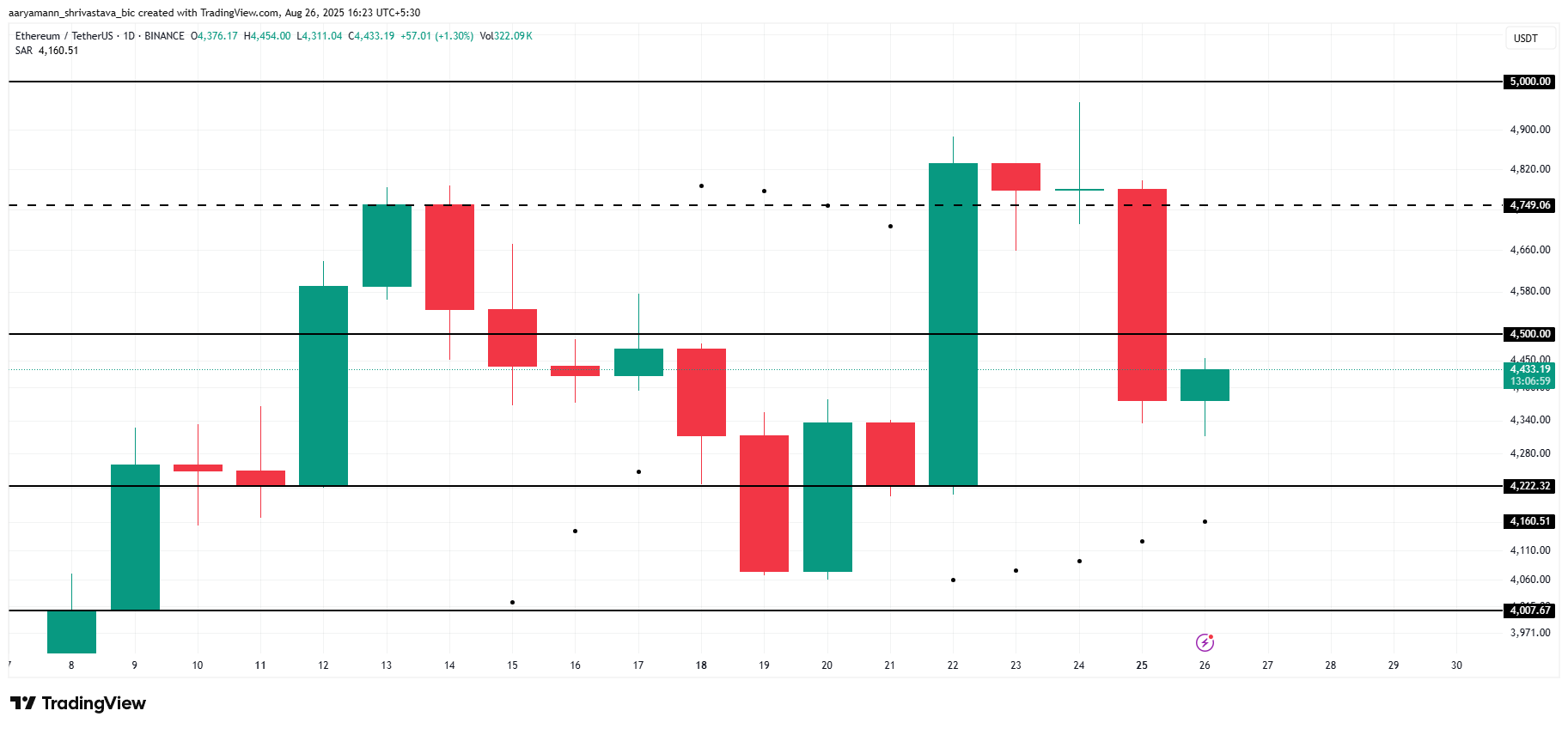

Ethereum traded at $4,433 at the time of writing, below $4,500 resistance. The assets failed to recover this level as support, indicating a weakness in maintaining highlands. There is a risk that purchases will not be renewed and Ethereum will slip into even lower ranges.

General terms suggest that Ethereum could break the $4,222 support. A reduction below this level could push the Altcoin King down below $4,007. Such a move confirms a broader sales trend and aligns with top chain indicators.

ETH price analysis. Source: TradingView

If sales pressure stops, Ethereum could bounce off $4,222 and try to regain $4,500. A successful recovery will expand to $4,749, reestablishing short-term strength. This move disables the bear signal.

Post Ethereum prices are facing a $4,000 drop, according to the $2 billion ETH sales that first appeared on Beincrypto.