- Ethereum price is expected to retest the $3,100 area as potential support after a major breakout.

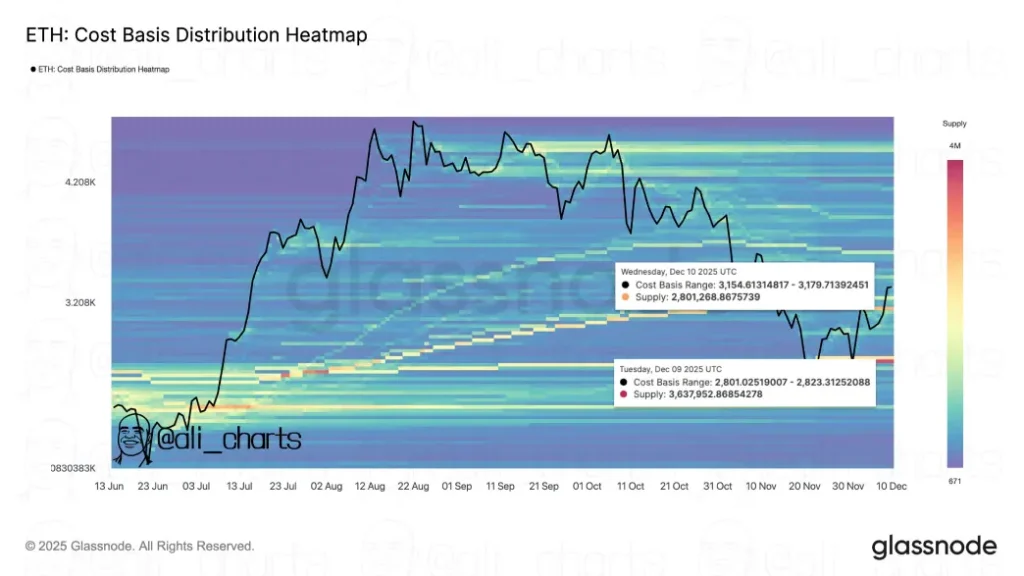

- According to recent on-chain data, $3,150 and $2,800 exist as immediate support.

- U.S. unemployment claims surged to 236,000, triggering a risk-off movement across cryptocurrencies.

On Thursday, December 11th, Ethereum price plummeted by more than 3.5%, reaching a trading value of $3,215. These losses coincide with a broader market pullback following disappointing U.S. unemployment data and the Fed’s recent decision to cut interest rates, triggering selling news. While macroeconomic turmoil is putting pressure on digital assets, on-chain data highlights that active buyers of ETH are preparing for a takeover.

Rising U.S. unemployment claims triggers crypto rebound

Cryptocurrency markets witnessed a bearish pullback on Thursday as weekly unemployment claims in the US rose to 236,000, an increase of 44,000 from the previous data. Although labor market conditions remain quite tight, this figure exceeded consensus expectations.

As a result, Ethereum’s price plummeted by 3.5% and is currently trading at $3,227, with a market cap of $390.2. Despite macroeconomic uncertainty, the latest on-chain data shows strong buyer confidence to drive higher price appreciation.

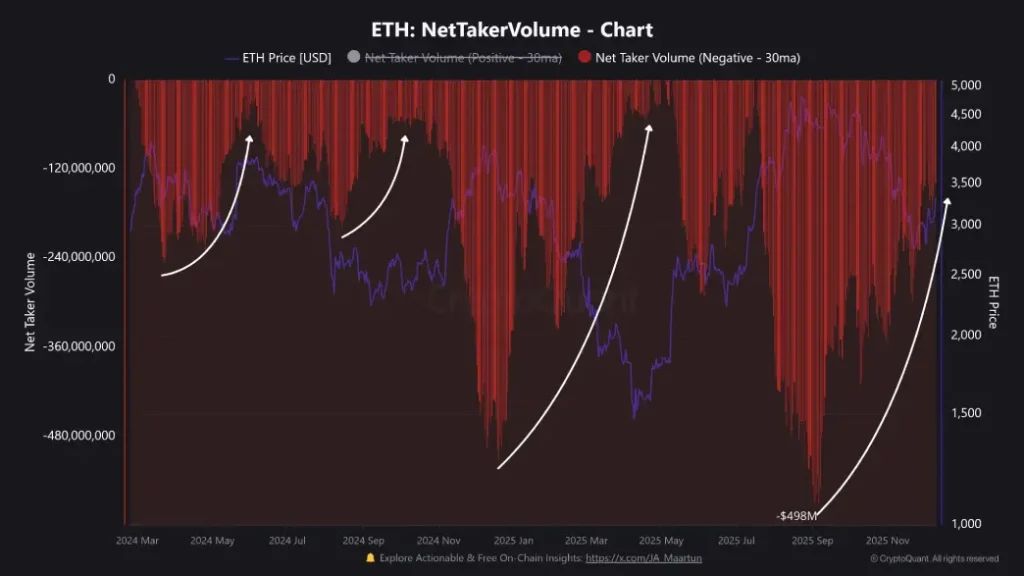

Perpetual futures data revealed that net taker volume hit $138 million in the past 24 hours. This coincided with a sharp decline in the price of Ethereum, a significant recovery from the negative $500 million peak of liquidation pressure in late October.

Nettaker volume is the difference between actively executed buy and sell orders on a perpetual contract. Positive values mean buyers are paying a premium price to fill now, while negative values reflect prevailing selling pressure from market orders.

The gradual decline in negative taker flows indicates that aggressive buying interest is returning, even though spot prices are near lows. Market participants are taking this change as an early signal that the downside may lose momentum.

Separate on-chain analysis found two large accumulation zones in Ethereum. Approximately 2.8 million ETH tokens are owned by addresses that were purchased around $3,150, likely a demand cluster. The deeper cluster is around $2,800, where around 3.6 million ETH represents a larger support zone, and the sell-off should begin in earnest.

Traders are watching to see whether improved taker aggressiveness could push prices above nearby resistance, or whether rising unemployment claims will lead to a new wave of risk-off positioning across digital assets.

Ethereum price awaits retest of major support at $3,100

On December 9th, Ethereum price experienced a significant spike in intraday gains, decisively breaking out from the resistance trend line of the descending channel pattern. Since early October, the chart settings have shown a steady correction trend, resonating within two downtrend lines.

Therefore, the recent breakout signals a change in market dynamics and boosts buyers with adequate support for further recovery. Today’s market decline has caused ETH price to retest the broken trend line as potential support.

The coin price is also receiving support from the 20-day exponential moving average, underscoring the previous bullish sentiment. If Concrete shows sustainability above the $3,300 mark, the breakout could trigger a 12.75% rally to $3,666 resistance and then a jump towards $4,245.

ETH/USDT -1 chart

On the other hand, if the retest phase is driven within the channel structure, the bullish theory will be invalidated.