Ethereum breaks important levels but struggles at $1,800. Can growth in network activity and increased long positions lead to a move to $2,000?

When the crypto market recovery pauses, Bitcoin will fall below $93,000, while Ethereum continues to fall below $1,800. Currently, Ethereum is trading at $1,769, showing an intraday pullback of nearly 1.5%.

Ethereum continues to face resistance, but optimistic traders expect a bounce after a retest. Can this recovery push prices beyond $2,000? Let’s look into it.

Ethereum price analysis

On the four-hour price chart, Ethereum’s trends show bullish breakouts from the supply zone over the years, surpassing the Fibonacci level of 38.20%, close to $1,675.

After this breakout, Ethereum passed the 50% Fibonacci level and the 200 EMA line, close to $1,755. However, the uptrend was unable to maintain momentum above $1,834, resulting in short-term consolidation and minor pullbacks.

This current pullback could be a potential retest of the 200 EMA line and 50% Fibonacci level. In particular, this recovery has a positive impact on the 50 and 100 EMA lines, implying a possible bullish crossover.

Additionally, bullish recovery expands the uptrends in MACD and signal lines, showing strong bullish momentum. As a result, technical indicators support the possibility of a reversal after a reversal of Ethereum prices.

Based on Fibonacci levels, a reversal after a success of over 61.80% Fibonacci retracement ($1,834) could potentially open the door for Ethereum to reach $2,000. Such upward momentum increases the chances of a golden crossover between 50-200 EMA lines. This is a strong bullish signal.

Conversely, if Ethereum cannot hold above the 50% Fibonacci level, the price will be further boosted and tested the resistance zone that has been turned to $1,675 support.

Analysts show that major ecosystems in Ethereum are on the rise

In Ethereum’s recent bullish recovery, a new analysis by Cryptoquant analyst Carmelo Alemán highlights a major boost to network activity. He points out that active Ethereum addresses are rising sharply from 306,211 to 336,336 in just 48 hours.

This represents a surge of nearly 10% between April 20th and April 22nd. Analysts also point to the overall growth of Ethereum Active Addresses along with a broader market recovery.

Carmelo projects potential expansion into the broader Ethereum ecosystem. This could serve as a launchpad for multiple projects built on Ethereum. As ecosystems increase, demand for ETH is expected to rise, and prices could rise.

Ethereum: Active address

Bullish traders make big bets on the Ethereum Breakout Rally

As price action analysis suggests potential rebounds, bullish sentiment in the Ethereum derivatives market continues to grow. According to Coinglass data, the long position in the derivatives market is approaching 55%.

Based on Coinglass’ long-term ratio chart, the long position accounts for 54.98%, driving the ratio to 1.02. This indicates a marked increase over the past three hours from 46.3%.

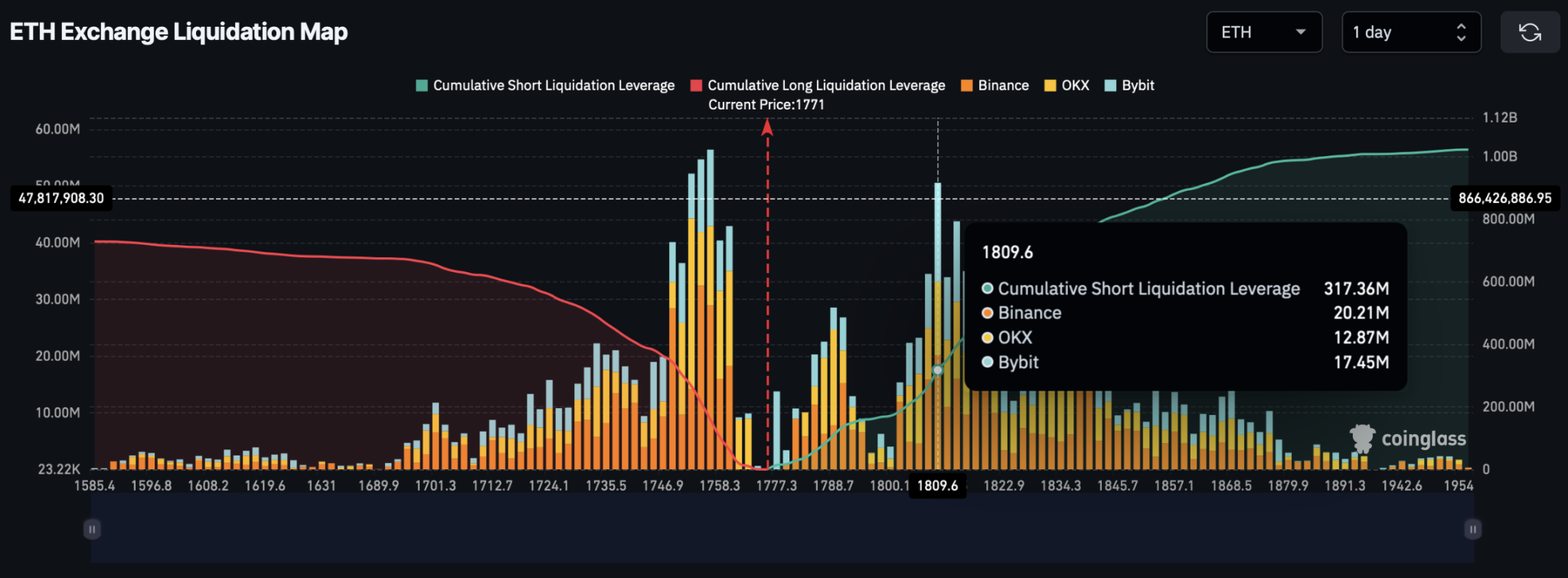

With new optimism for breakout rallies, derivative traders are putting a big bet on Ethereum. According to the Ethereum Exchange liquidation map, breakouts over $1,800 can lead to significant short liquidation.

This data shows the potential for a cumulative short fluid of $317.36 million, close to the $1,809.60 level.