Ethereum prices have risen steadily over the past week, rising nearly 10% as institutional players continue to pour capital into key Altcoin.

This growing momentum lies in broader optimism in the crypto market and the strengthening correlation with Bitcoin. Together, these trends suggest that Ethereum may be ready for a major breakout, but the familiar obstacles are still in the way.

ETH/BTC correlation increases

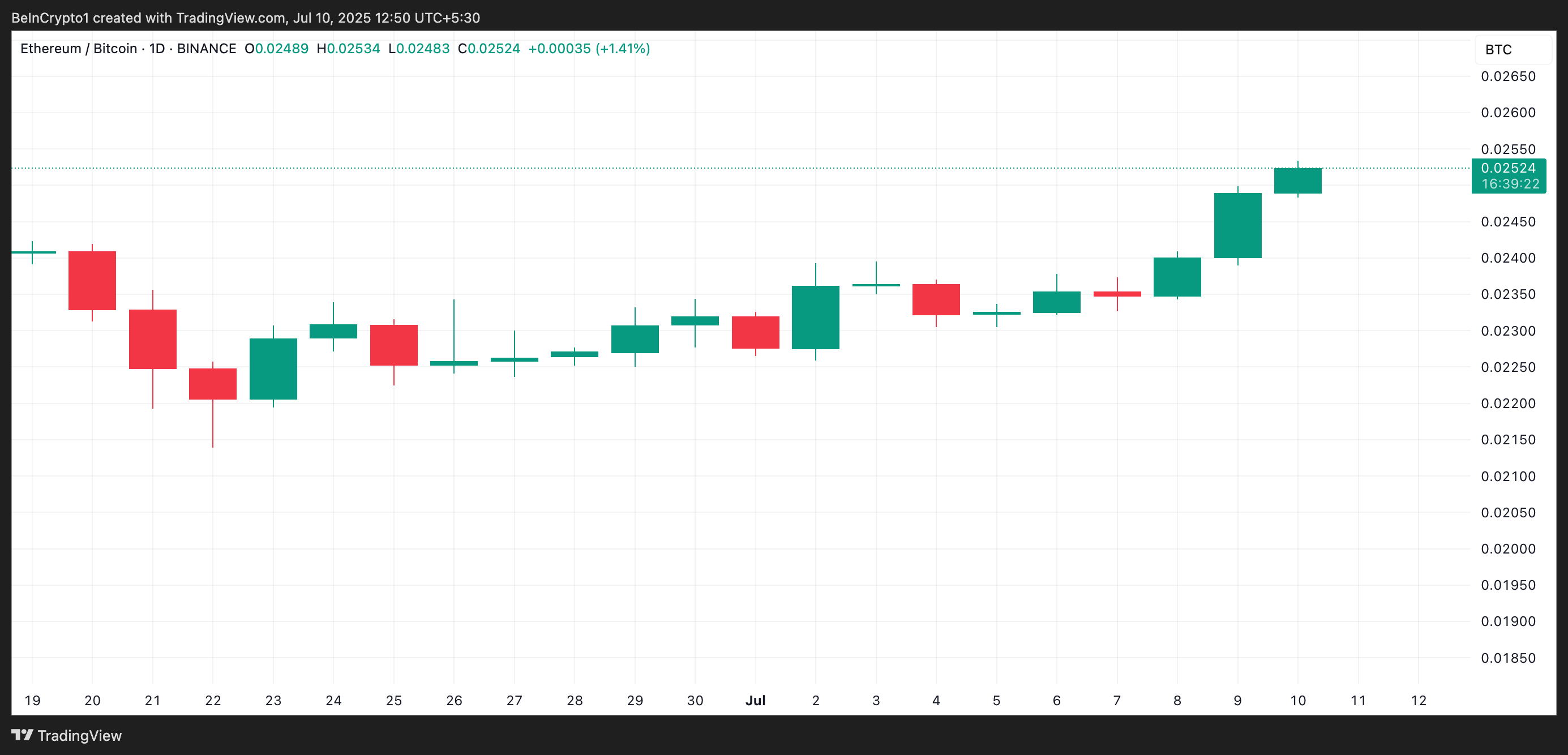

The correlation between Ethereum and Bitcoin has risen sharply since late June. The ETH/BTC correlation coefficient measures how ETH price movements track BTC price movements over a given period and is currently located at 0.02.

ETH/BTC correlation coefficient. Source: TradingView

A value close to 1 indicates that both assets move in the same direction, while a value near -1 means that they move in the opposite direction.

As BTC is approaching an all-time high, ETH prices could follow suit and rallies. This is because historically high correlations in the Bull Phase precede the joint assembly of both assets.

ETH targets $3,000 when the institution loads

Ethereum institutional investors seem to be trapped in positions as they use the correlation of mountaineering ETH/BTC. As both assets have been working together at a historically bullish stage, the group is likely to be more than $3,000.

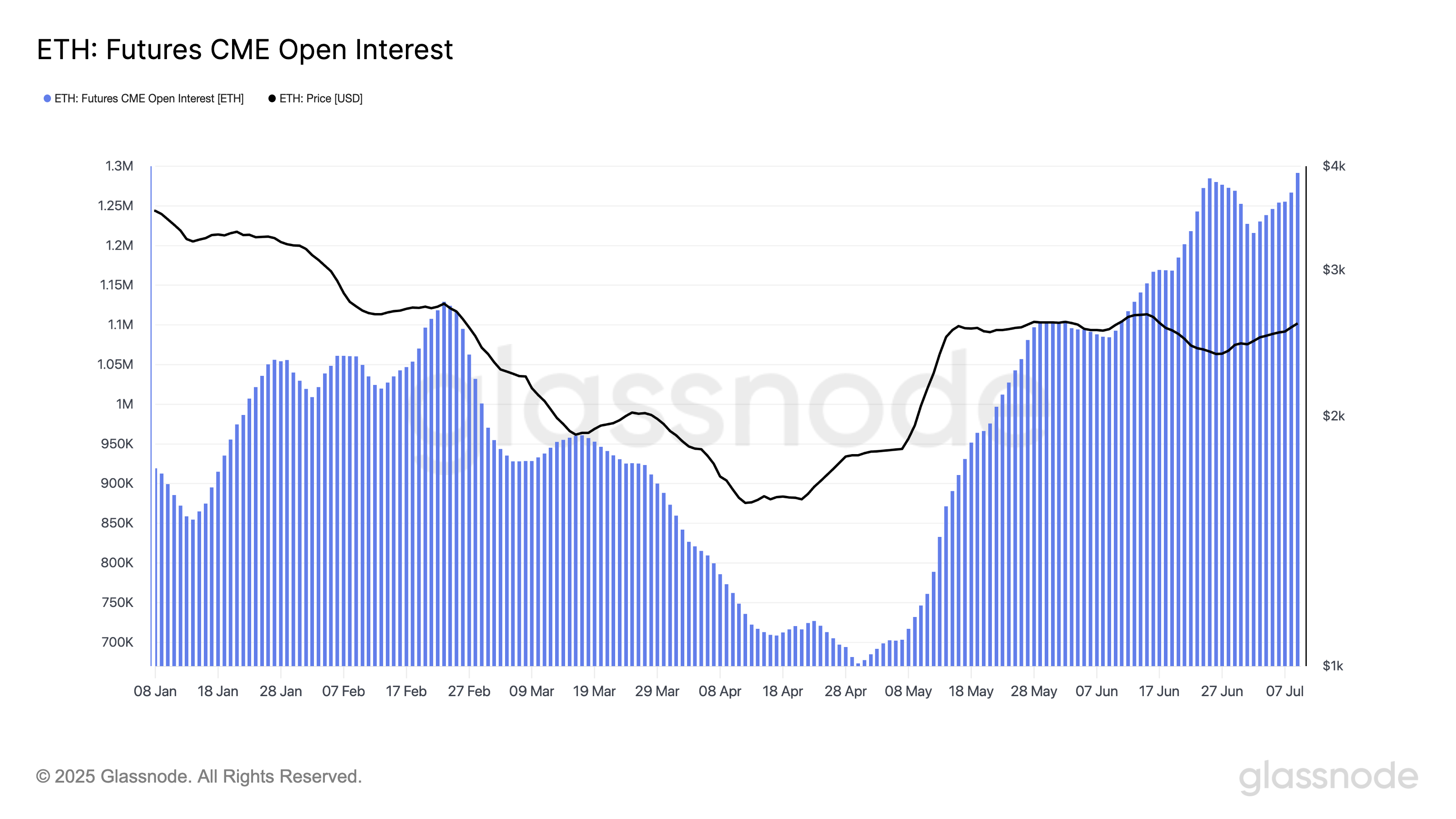

Open interest in ETH futures from Chicago Mercantile Exchange (CME) measured on a simple seven-day moving average has skyrocketed to a record $3.34 billion, according to GlassNode’s on-chain data.

ETH: Futures CME open interest. Source: GlassNode

This reflects the growing institutional position as players in key markets move even further upside down to accumulate ETH.

Open profit refers to the total number of unresolved futures contracts that have not been resolved. Such a surge indicates an increase in trading activity and an increase in capital to the market.

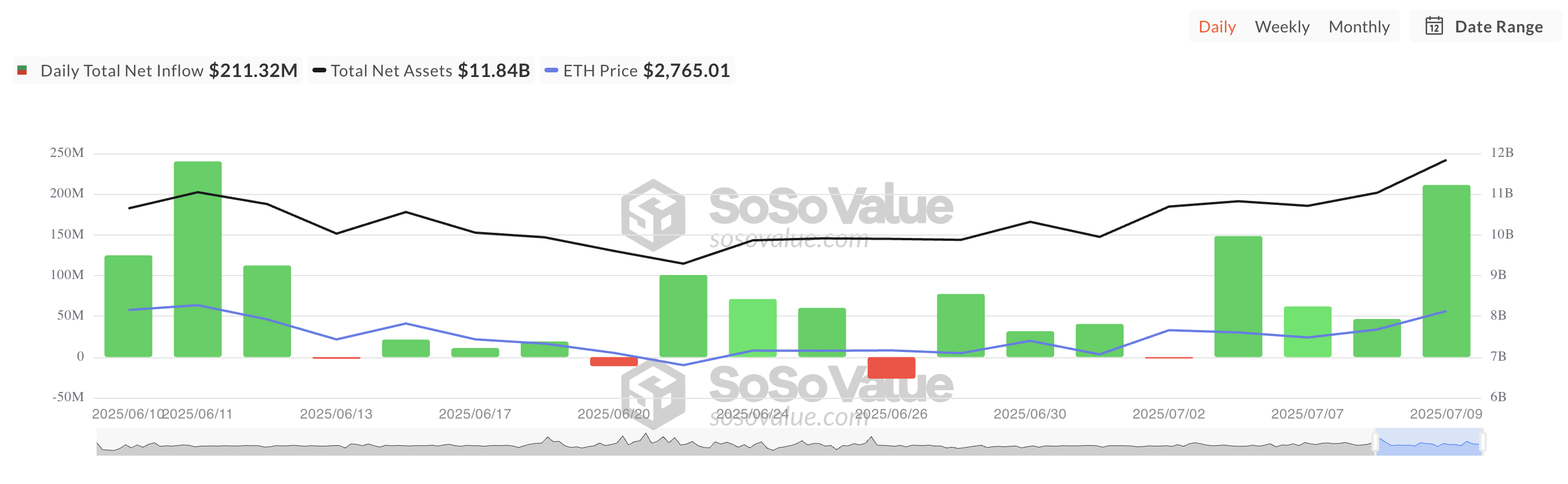

Furthermore, the consistent weekly influx into Spot ETH ETFs highlights the strengthened trust in Altcoin among these key investors.

According to SosoValue, ETH-backed funds have recorded uninterrupted weekly inflows since May 9th. Over the last week alone, more than $219 million in capital flowed into the ETH Spot ETF, despite the majority of Coin’s side-facing price action.

All Ethereum spot ETF net flow. Source: SosoValue

This sustained investment confirms increased confidence in ETH’s long-term value as sophisticated investors place ahead of the expected breakout of over $3,000.

However, there is a catch.

When retail traders tapped out, Eth Bulls was under $3,000

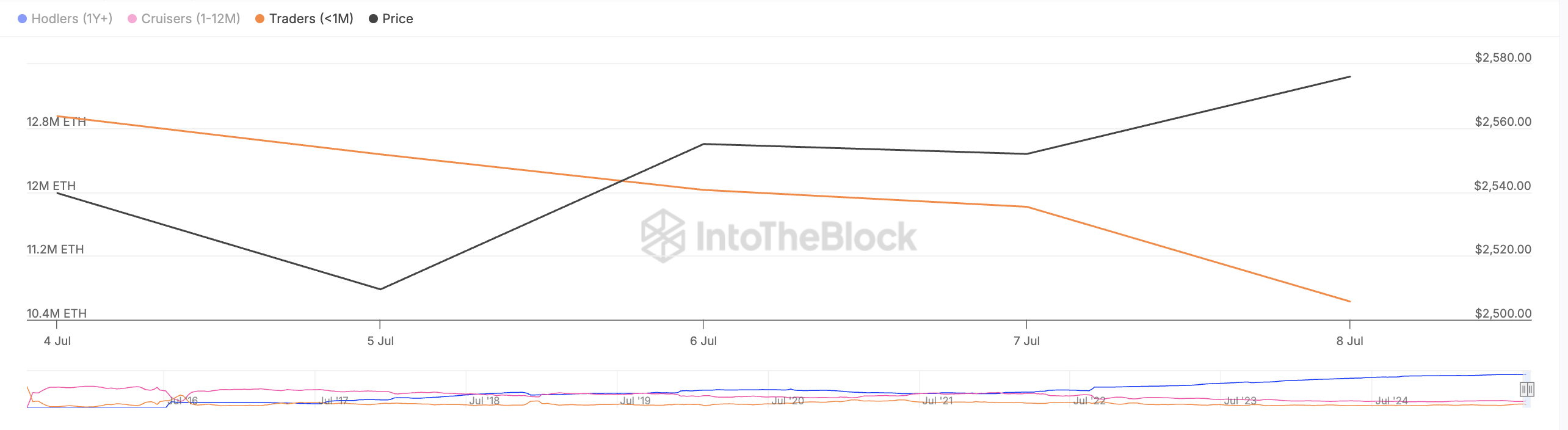

As key owners chase over $3,000 rallies, ETH’s short-term price measures continue to be oppressed by “paper hand.” These retailers have kept their coins under 30 days and are selling their recent strength.

Data from IntotheBlock shows that the balance for this group has dropped by 16% since July 4th, slowing the growth in coin prices amid strong institutional support.

Ethereum balance held at each hour. Source: IntotheBlock

Retailers drive short-term price performance of their assets through frequent and emotional sales and sales. Unlike institutional investors who tend to maintain volatility, retail participants are more responsive to news, sentiment and short-term price movements.

Once they start selling, the downward pressure will increase, stalling the rally or triggering corrections.

While institutional interest in ETH is a good sign of long-term trust, retailers are needed to catalyze gatherings that exceed $3,000 in the short term. If they fall while remaining lonely, the coin could lose some of its recent profits and fall below $2,745.

ETH price analysis. Source: TradingView

However, due to a revival of new demand, ETH prices could exceed $2,851 and reach $3,067.