Ethereum appears to be stabilizing after a sharp correction. Ethereum After falling about 15.6% from January’s highs, the stock traded around $2,950 before rebounding off key support. While Ethereum’s price performance still looks weak on the surface (down 11% in the week), some fundamental signals suggest that things may be changing.

A complete bearish momentum reset, aggressive whale accumulation, and sudden recovery in network usage are now lined up. Taken together, these signals raise an important question: Is Ethereum gearing up for a stronger rebound, or is this just a short-term pullback?

Bearish breakdown unfolds as volume diverges and whales intervene

Ethereum’s recent weakness did not come out of nowhere. From January 6th to January 14th, Ethereum The daily chart shows a bearish RSI (relative strength index) divergence. While prices continue to make new highs, the momentum indicator RSI is set to make lower highs, often indicating trend exhaustion.

That signal was reproduced cleanly. Ethereum corrected around 15.6% and slipped into the $2,860 support zone before stabilizing.

What matters is what has changed in support.

As prices trend downward (between January 20th and January 21st), on-balance volume (OBV) has formed higher lows, indicating that selling pressure is easing and large buyers are absorbing supply rather than exiting. OBV tracks volumetric flow, and this type of divergence often appears near the local bottom.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Structure of ETH”>

Structure of ETH”>

strong Ethereum Structure: TradingView

The whales appear to have responded to the change.

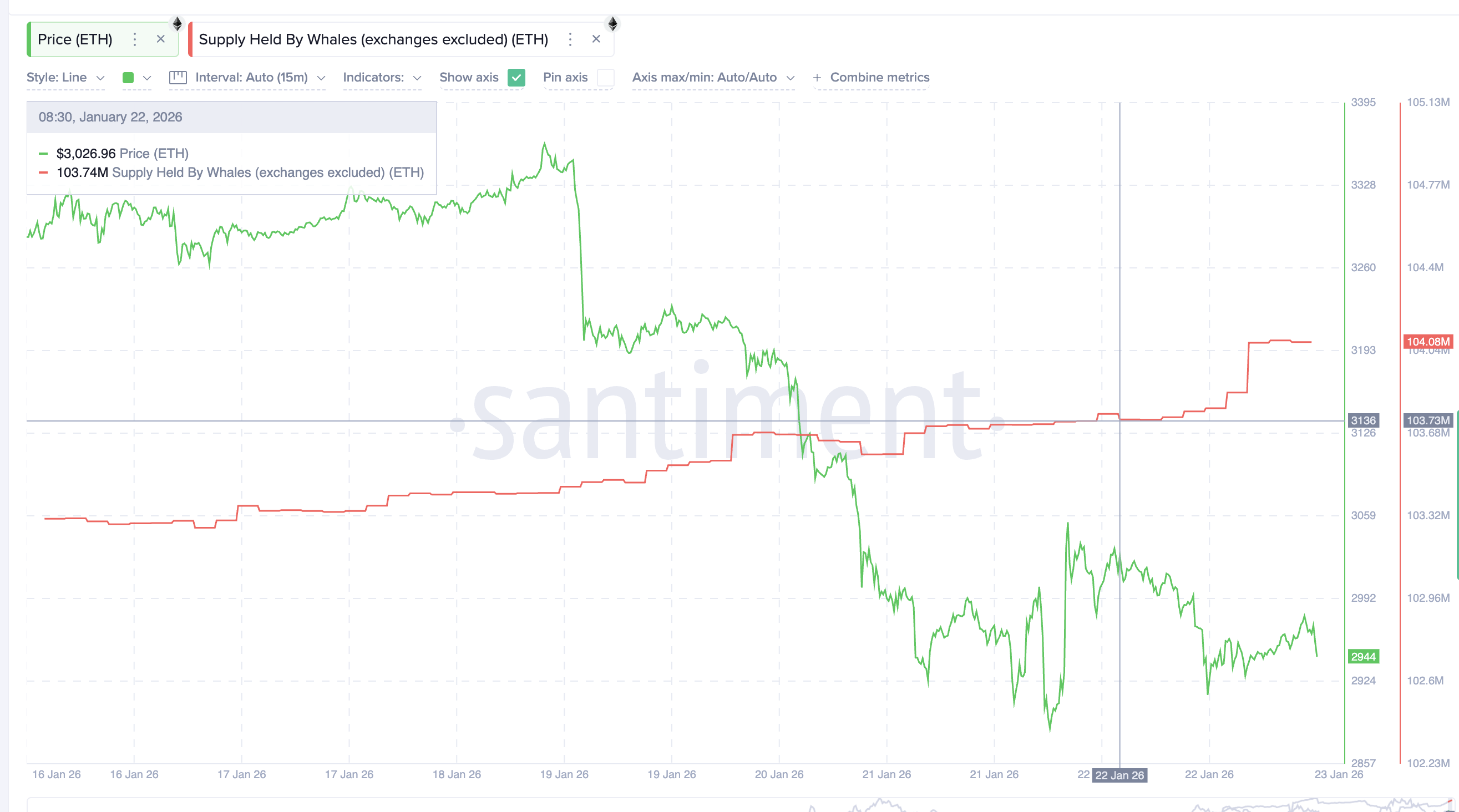

In the past 24 hours, the supply of Ethereum held by whales (excluding exchanges) increased from 103.73 million Ethereum Up to 104.08 million people Ethereum. Approximately 350,000 additional dollars will be added. Ethereum In just one day.

ETH whale”>

ETH whale”>

Ethereum Whale: Santiment

At the moment Ethereum If you calculate the price, that accumulation is worth just over $1.03 billion.

This suggests that whales are not buying the top. They intervened after momentum reset and price tested major support, treating the correction as an entry rather than an exit. But that may not be the only reason.

Ethereum regains second place in daily unique addresses and takes first place Get used to it

It’s not just the technical setup that has improved.

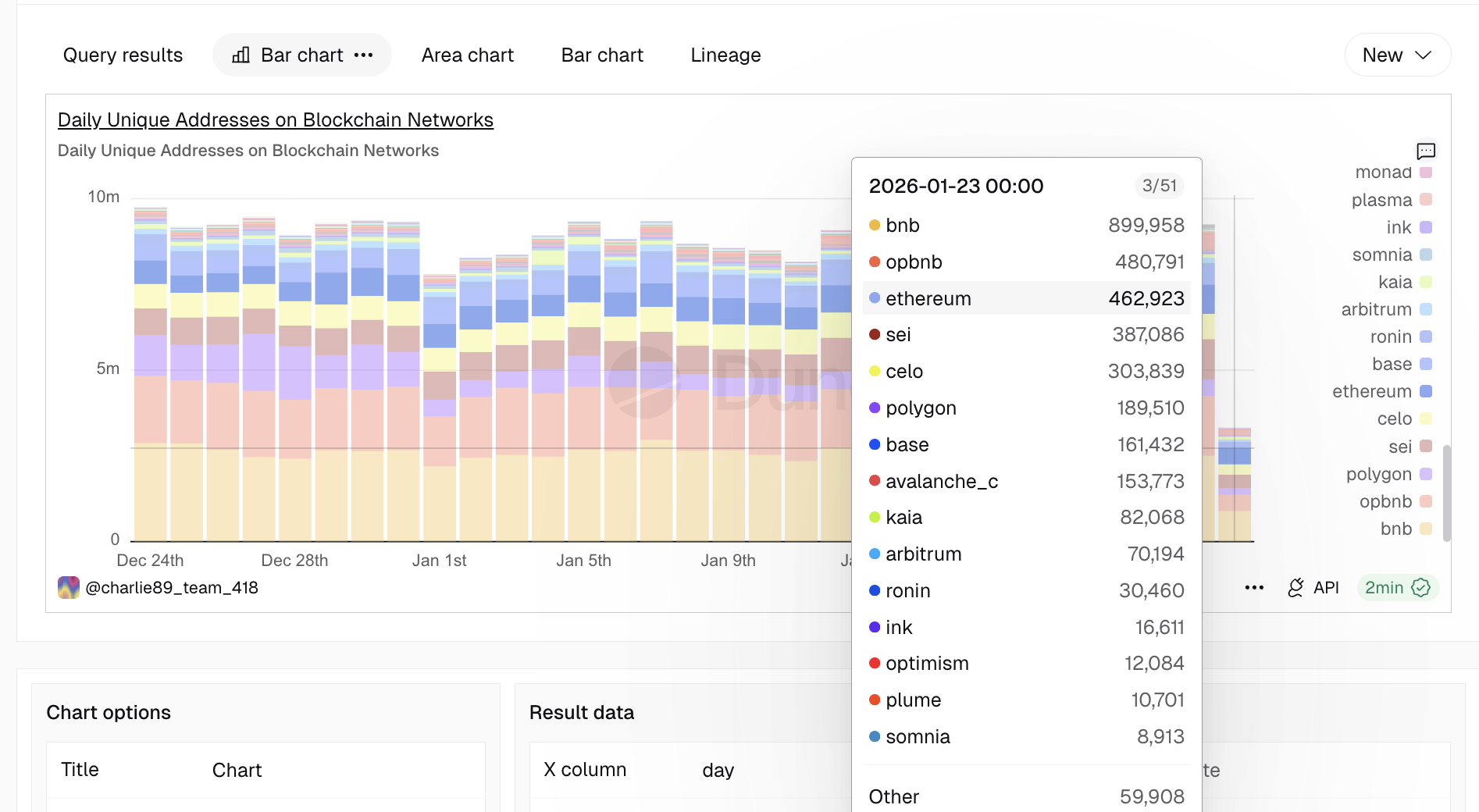

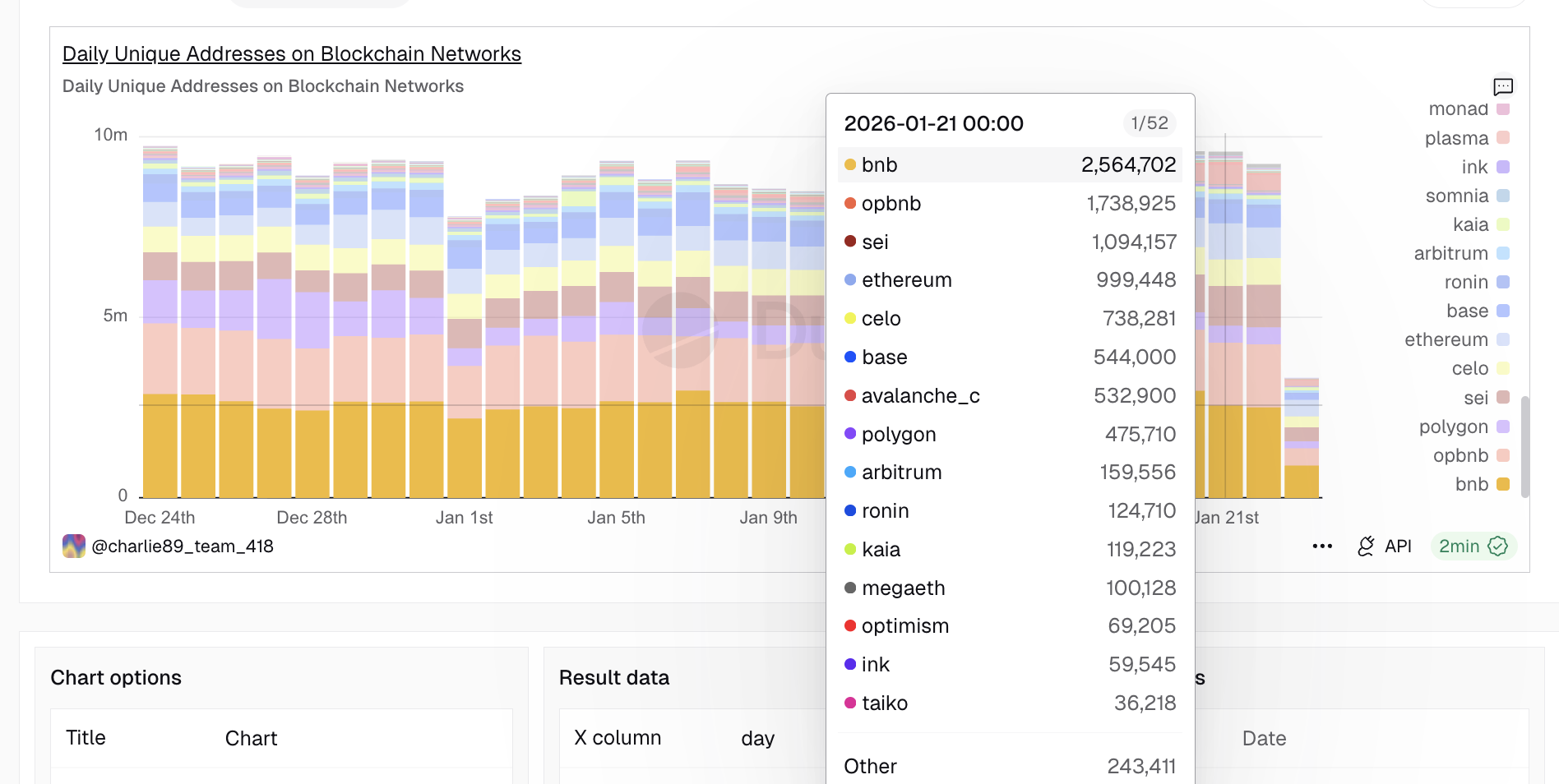

As of writing on January 23rd, Ethereum has regained second place in Layer 1 DUA (Daily Unique Address). BNBidentified only by BeInCrypto analysts. I just passed Get used to it (another Layer 1) has seen increased activity recently due to gaming-related growth. opBNB (Layer 2 BNB) is also a frequent competitor, but remains at a high standard.

ETH regains number 2 position”>

ETH regains number 2 position”>

Ethereum Retaking the number 2 spot: Dune

This is important because daily unique addresses reflect actual network usage rather than price speculation. Ethereum regaining this position shows that on-chain activity as a layer 1 is recovering, even though the price remains below recent highs. Get used to it It has been Ethereum’s nemesis for quite some time.

Sei previously defeated Ethereum: Dune

Additionally, Ethereum still outperforms all major layer 2 ecosystems in terms of address growth.

The recovery is already beginning to spill over into social conversation.

Ethereum’s social dominance jumped from about 0.37% to 4.43% since yesterday, peaking at nearly 5.8% before cooling off. Historically, local peaks in social advantage have preceded short-term price increases. Ethereum. This is the same period in which Whale earned over $1 billion. Ethereum.

Social Volume Surge: Santiment

for example:

- On January 17, the region’s social advantage spiked, increasing by 2.1%. Ethereum We’ll go even further in the next session.

- On January 21st, there was another spike before rising 3.4% within 24 hours.

While this does not guarantee an increase, it does indicate that new network relevance previously led to short-term price tracking. L1’s return to second place in daily unique addresses (at the time of writing) is the underlying reason for the increased attention.

Ethereum price level is key

From here, the structure of Ethereum is clear.

On the downside, $2,860 remains an important support. This level marks the end of the 15.6% correction and is where the whales actively intervened. A complete loss of this zone would weaken the bullish case and open the price to downside support.

On the positive side, Ethereum To confirm short-term strength, the stock needs to clear $3,010, just 2.6% above the current price. If the rally continues, the focus will be on the resistance zone at $3,350, which has been the upper limit of the price since mid-January.

If this level is broken, Ethereum price could target higher extensions around $3,490 and $3,870. However, if the price cannot sustain $2,860, the focus will return to $2,770 and the rebound theory will be invalidated.

The post Ethereum Whale Adds $1 Billion with 15% Correction — What Will the Next Price Be? The post appeared first on BeInCrypto.