The famous Ethereum whales are betting on their recent ETH price recovery. On-chain analyst @ai_9684xtpa reported via X that the whale borrowed 4,000 ETH (worth around $7.25 million) from the credit lending platform Aave. Analysts pointed out that the whales borrowed this ETH specifically to open up new short positions, giving them a cautious or bearish outlook.

“The $ETH band has made a profit of USD 1.029 million since 04.13” is also very strong. I’m not going to get close to ETH again! Can you get everything that belongs to him this time?

After borrowing 04.22-04.25 coins to a short ETH, he lost $382,000, 11 hours ago, $382,000.

Wallet address https://t.co/copoovctzc

This article is by #gateio |…https://t.co/5u3cpk5fja pic.twitter.com/hyalcixu1l

— Ai U (@ai_9684xtpa) April 26, 2025

Whale rocky recent deals: losses following profit

This is not the first major move for whales these days. They have been actively swinging trading ETH since mid-April. Previous transactions reportedly resulted in more than $1 million in profits. However, their luck seemed to have changed between April 22nd and 25th.

Meanwhile, the whales shorted the ETH, but were kicked out when prices rose and forced to buy back higher. This has resulted in a total loss of around $382,000 in recent shorts. Now despite those losses, they’re making another big short bet

Data show that the average short price for the whales was $1,731 and its closing price reached $1,778.70, culminating with a realised loss of $14.23 million from the previous 8,000 ETH position.

Related: What does the Ethereum whales know that we don’t do that?

How did ETH prices respond to this time?

Despite these activities, Ethereum traded higher during the latest sessions, trading for around $1,806 after registering a gain of 1.85% each day. CoinMarketCap data increased the market capitalization increase of Ethereum to $21.805 billion, with daily trading volume increasing by 5.05% to $15.8 billion. The network’s circulating supply remained stable at ETH of 172 million, in line with the total supply figures.

Source: CoinMarketCap

The market-to-market cap ratio of 6.95% was referring to active trading terms. During the session, ETH immersed $1,773 before purchasing pressure pushed the price up to nearly $1,820, indicating a volatile but strengthened market environment.

Which exchange flow tells you about ETH supply

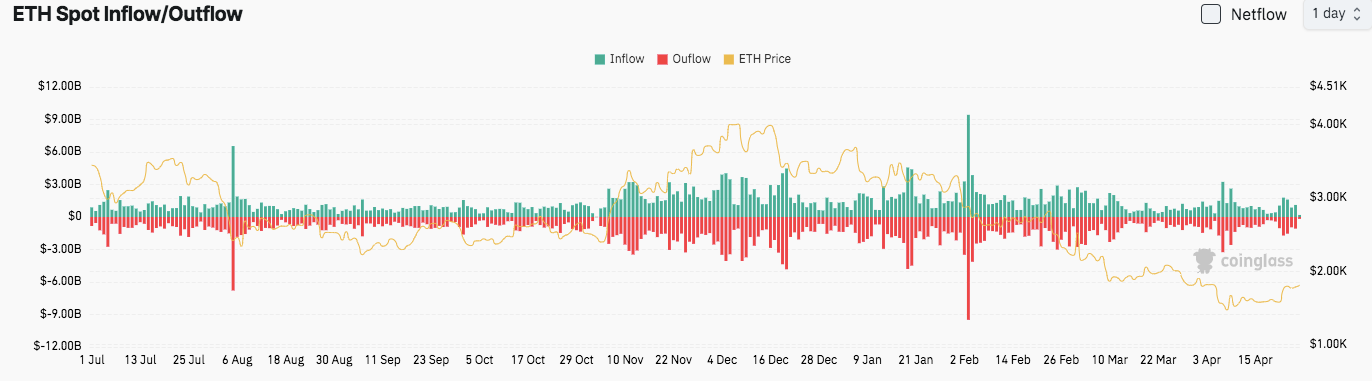

Looking at the wider on-chain data provides more context. Recent Coinglass figures show that Ethereum that has flowed into the exchange has been almost balanced recently. This is not the case in late 2023/early 2024, when more ETHs were consistently leaving the exchange (often considered bullish and implies a low supply available for sale).

Source: Coinglass

Currently, flows are balanced near the $1,800 price level, which raises doubts about whether sales pressure from exchanges will rise again if prices try to rise much.

Related: Whales buy $588,000 worth of Ethereum amid market panic: a great opportunity?

Are more users involved in Ethereum Network?

Meanwhile, it appears that user activity on Ethereum is picking up. The encrypted data showed the revival of the active address in Ethereum.

After a period of fluctuating activity between mid-2022 and early 2024, the number of active addresses will again climb. However, historical data showed that the surge in user engagement remains unchanged to a sustained price rise, leaving the impact of this trend uncertainly.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.