The main owners of Ethereum are back in the market. During the market consolidation last week, key players seized the opportunity to actively accumulate ETH.

On-chain data reveals an increase in whale holdings, while ETH-based exchange trade funds (ETFs) recorded their first weekly net inflows in eight weeks, indicating a significant change in emotions.

ETH whales accumulation and ETF inflows provide hints for imminent price surges

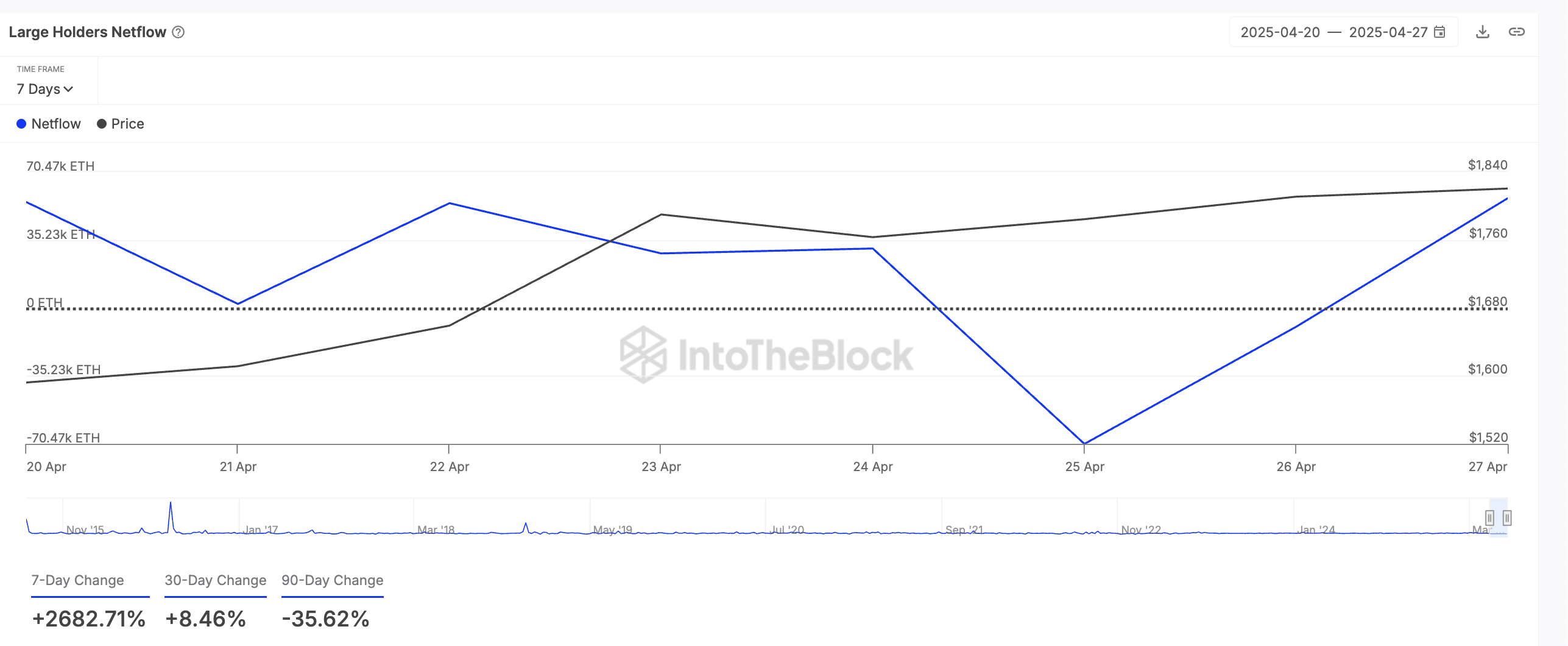

Major Altcoin ETH has been focusing on a massive spike in Netflow last week, according to on-chain data. This has lost 2682% in the last seven days, according to on-chain data providers.

ETH Adult Netflow. Source: IntotheBlock

Large-scale holders of assets refer to the address of whales that hold more than 0.1% of their circular supply. Large owners’ Netflow metrics track the difference between the coins these investors buy and the coins sold over a specific period.

As the large-scale holders of assets Netflow Surges surge, whale investors are increasing their accumulation of coins. This accumulation trend suggests belief in the future benefits of ETH, as key holders tend to act when they see value at current price levels.

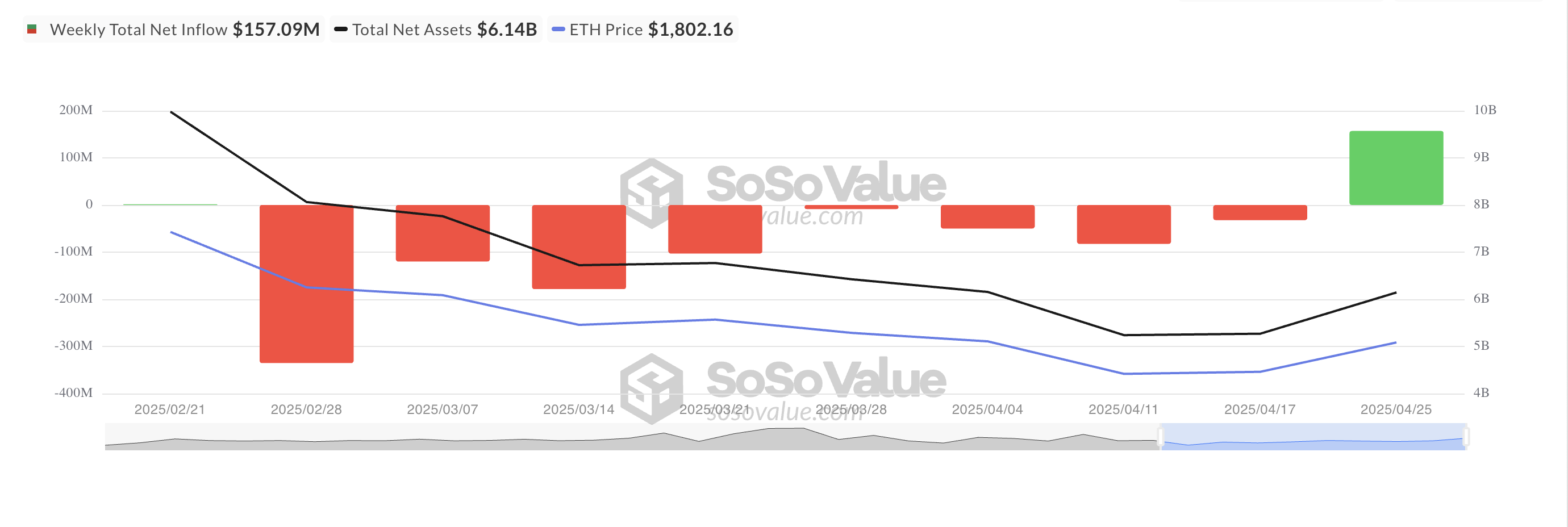

In addition to the bullish story, ETF, backed by ETH, recorded its first weekly net influx in eight weeks. According to SoSovalue, net inflows into ETFs supported by ETH reached $157.09 million between April 21 and April 25, overturning eight consecutive weeks of outflows totaling over $700 million.

All Ethereum spot ETF net flow. Source: SosoValue

ETH could be even more upside down in the short term as key players are re-entered in the market.

Ethereum is seeing bullish momentum

On the technical side, ETH’s positive balance of power (BOP) highlights a revival of demand for major Altcoin. This is currently 0.31.

This indicator measures the buying and selling pressure of an asset. If the value is positive, the pressure will exceed sales pressure. This indicates the strength of ETH price transfer and even more potential upward momentum. If this occurs, ETH can exchange hands for over $2,000 and for $2,027.

ETH price analysis. Source: TradingView

However, if market sentiment gets worse, ETH could reduce recent profits and plummet to $1,385.