Ethereum prices have struggled to recover, marking the $1,700 mark in the last few days about 1,700. Despite attempts to infiltrate high, ETH was unable to gain much momentum.

This lack of advances in price transfers has prompted a massive sale from the Ethereum whales, exacerbating bearish sentiment.

Ethereum whales move to sale

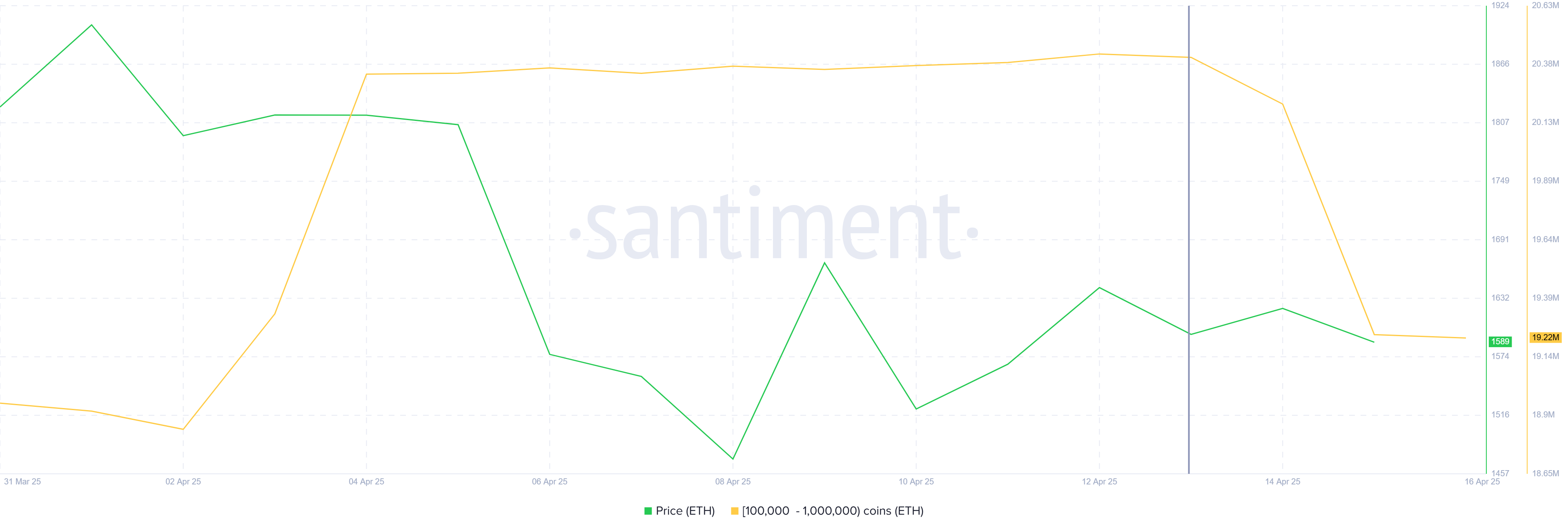

Over the past three days, addresses that hold ETHs of 100,000-1 million have actively sold around 1.19 million ETHs, worth more than about $1.8 billion. These whales’ decision to offload a substantial amount of Ethereum highlights a shift in market sentiment as they are likely aiming to offset potential losses from stagnant recovery.

As Ethereum fails to gain momentum above $1,700, these large holders seem to be taking advantage of current price levels, driving the market down. The sale of these whales at addresses indicates Ethereum’s lack of confidence in short-term price transfers.

Ethereum whale holding. Source: Santiment

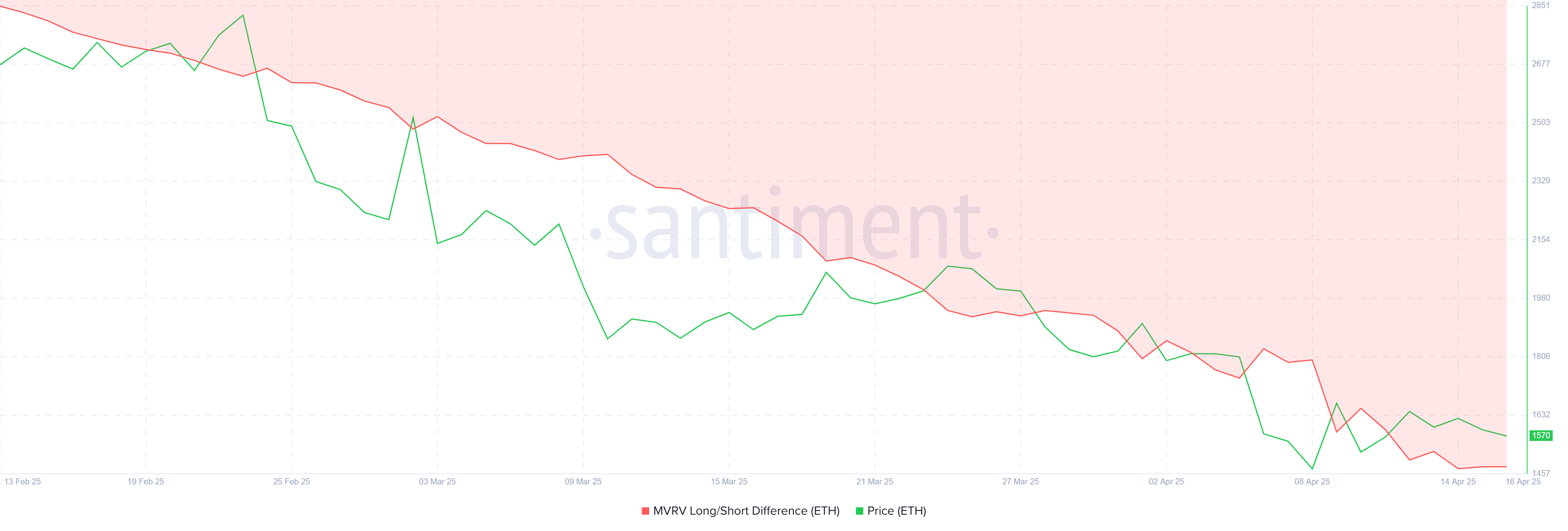

The overall macro momentum of Ethereum appears weak, as shown by the deep negative MVRV long/short difference of -29%. This indicator shows that long-term holders (LTHS) are struggling to maintain profitability. STHS are usually sold quickly after making a profit, increasing volatility and bearish pressure on Ethereum prices.

As STHS controls profits, Ethereum is susceptible to further declines. As more short-term investors sell their holdings, Ethereum could face downward pressure, especially if there is no critical catalyst that drives prices upwards.

Ethereum MVRV Long/Short difference. Source: Santiment

ETH prices are over $1,500

The price of the Ethereum is currently at $1,570, and it couldn’t break the $1,700 resistance. Altcoin is above the important $1,533 support level. However, given the broader market cues, further declines are possible if bearish sentiment continues.

Ethereum could face serious resistance in regaining its upward momentum. Without support from the broader market and positive news, below $1,533 could potentially extend the downward trend of ETH. If Ethereum cannot maintain this support it could drop to $1,429, marking an extension of ongoing losses.

Ethereum price analysis. Source: TradingView

However, collecting $1,625 in support indicates the possibility of another attempt to go above $1,700. If Ethereum succeeds at this level, it could push towards $1,745, disable the bearish outlook and sets a reversal stage.