Ethereum remains bound to range between the 100-200-day moving average, indicating the integration stage.

However, a decisive breakout in either direction is likely to define the next major trend, with market sentiment leaning towards a potential bullish breakout in the coming days.

By Shayan

Daily Charts

ETH is currently consolidating a 100-200-day moving average, and is in the crucial stage with price action.

Prices have been pulled back to retest this level after surpassing the extremely 200-day MA of around $2.5,000, an area that has served as a strong resistance in recent weeks. This pullback is very important. If bullish demand resurfaces and holds ETH above this moving average, it could target a 2.8k resistance zone and fire upwards on another leg.

At the moment, cryptocurrency appears to range between $2.5,000 and $2.8k, and a clear breakout from this zone could set the stage in the direction of the next important trend. Market participants are closely watching the bullish continuation that could solidify the inversion structure of ETH.

4-hour chart

In the lower time frame, ETH’s recent rally encountered resistance with a key bearish block between $2625 and $2670. This denial has brought prices back to the $2.5,000 support level, a historically important zone of ETH.

This area now serves as an important battlefield. If buyers can defend it, Ethereum will regain momentum and recombine the breakouts onto the supply overhead.

However, failing to hold $2.5k can cause an extended integration or even a retreat to low support.

By Shayan

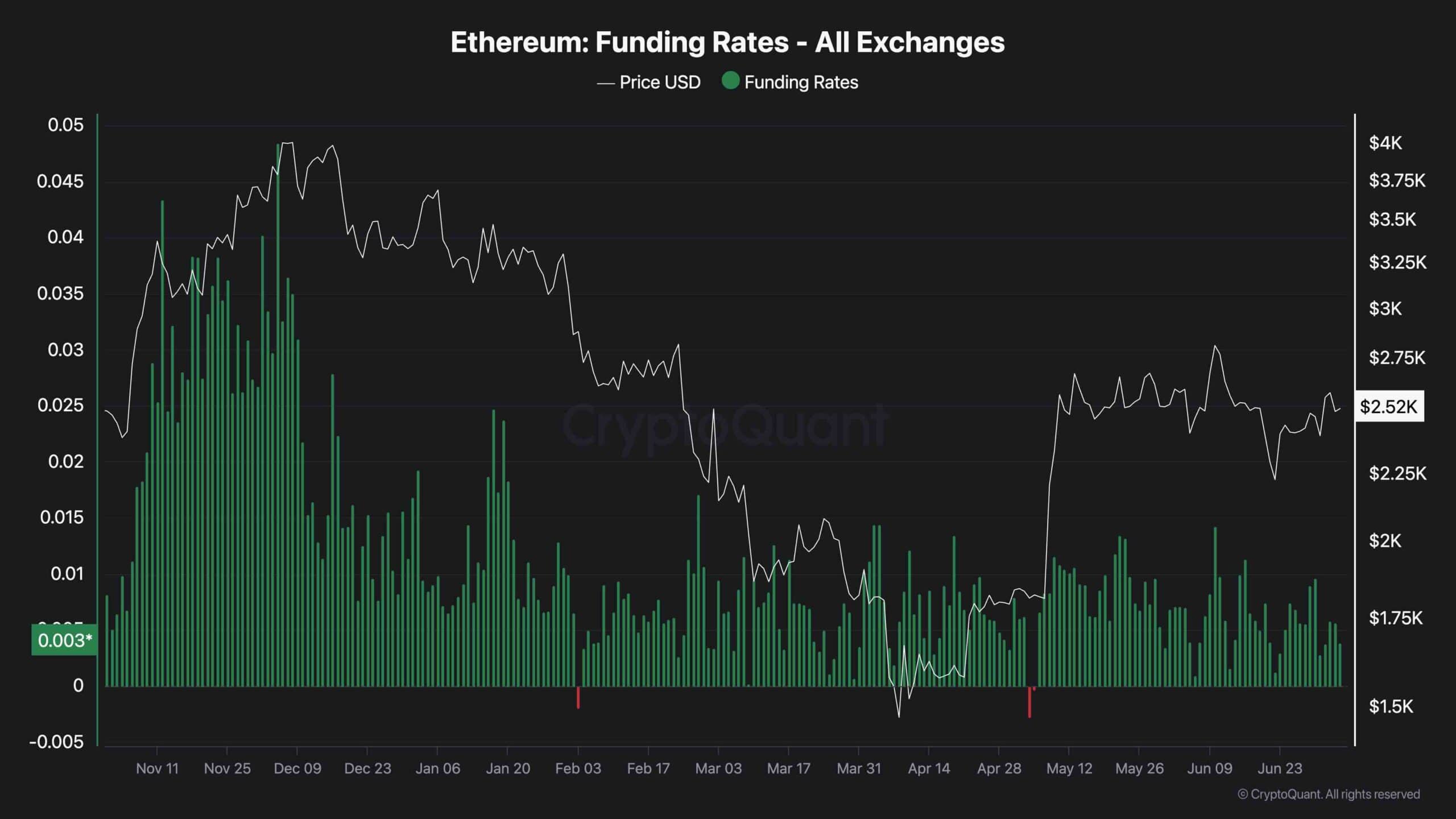

Funding rates remain an important indicator of market sentiment in Ethereum’s futures market. In healthy uptrends, this metric usually moves upwards, reflecting increased confidence and positioning from traders over the years in both spot and persistent markets.

However, ETH’s funding rates are currently declining amid price consolidation between the 100-200-day moving average. This suggests signs of reduced bullish convictions and buyer fatigue, increasing the possibility of short-term, lateral, continuous movement.

For Ethereum to surpass its 2.6k$2.6k and 28k resistance zones, stronger demand must flow into the derivatives market, bringing the funding rate to a more positive level. The integration phase could last until that shift is realized.