Ethereum’s (ETH) advantage has steadily declined over the past two years. This suggests that investor capital no longer prioritizes ETH. Instead, the fund may be shifting towards other altcoins such as Bitcoin and Solana and XRP.

However, analysts see a major opportunity in this situation. Many believe there is an unusual opportunity to accumulate ETH.

Will Ethereum’s five-year domination be an opportunity?

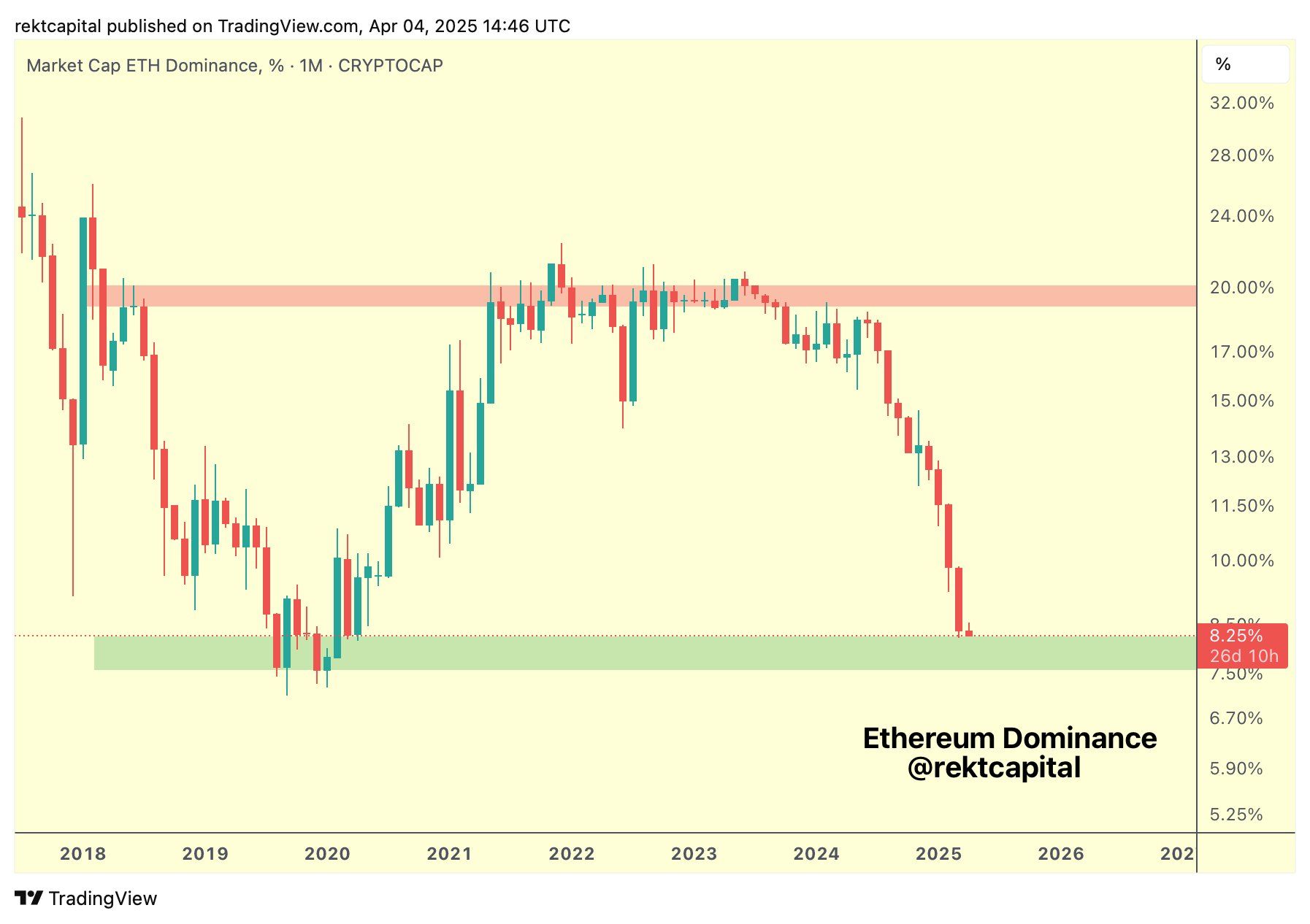

According to analyst Rekt Capital, Ethereum Dominance (ETH.D) fell from 20% in June 2023 to 8% in 2025. At the time of writing, it was even lower at around 7.3%.

Eth.D is expressed as the market capitalization as the percentage of the mayor of Ethereum’s market capitalization. The decline in ETH.D shows that investors’ interest in ETH has not only decreased compared to the past, but also compared to other assets in the market.

Rekt Capital shared a chart showing touching the green support zone. Historically, Ethereum has tended to turn back from the region and gain market strength.

Ethereum dominant performance. Source: Rekt Capital

Rekt Capital questioned whether Ethereum could repeat this historical pattern, calling it a powerful purchase signal.

“Since June 2023, Ethereum’s advantage has dropped from 20% to 8%. Historically, Ethereum’s dominance has reversed from this green territory and puts more priority on the market. Can Ethereum repeat history?”

Another analyst, Cryptoanup, also thought that the drop was not an opportunity for mistakes. He pointed out that when Eth.D hits record low records, it often marks a good time to accumulate ETH before a new growth cycle begins.

“ETH’s control seems to have found the floor. Soon again!” predicted Cryptoanup.

However, a recent analysis from Beincrypto reveals that ETH whale addresses are still actively selling. This week, addresses with 100,000-1 million ETHs sold 1.19 million ETHs worth more than $1.8 billion. These sales exacerbate the decline in ETH prices and control.

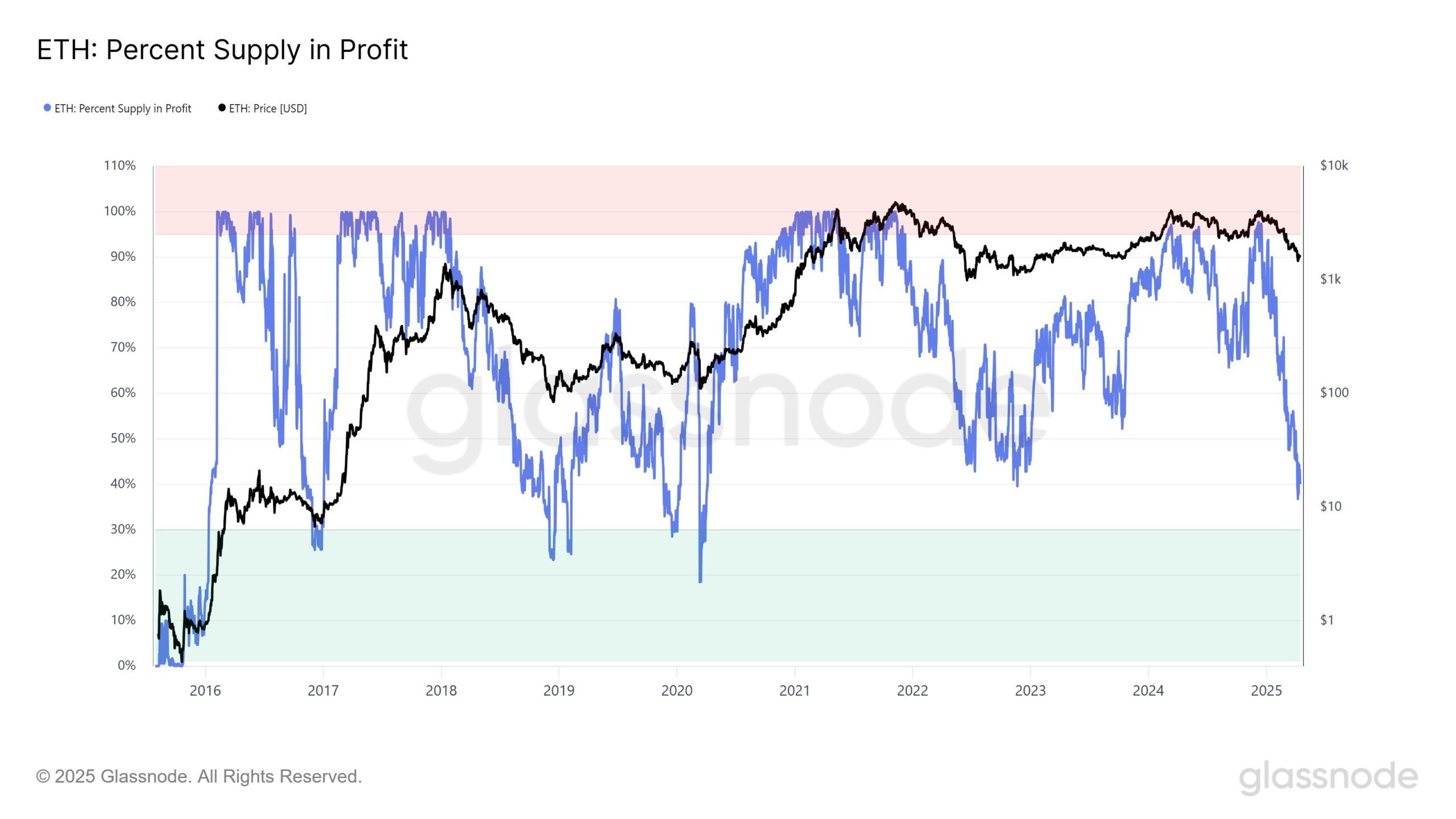

Profit supply drops to the lowest level over four years

Beyond the decline in advantage, GlassNode data shows that the proportion of ETH supply in profits has also fallen to its lowest level in four years.

Supply of ETH percent in profit. Source: GlassNode

Currently, only 40% of ETH supply is profitable, down significantly from 97.5% in early December 2024. The analyst venture founder says that if the metric falls below 30%, it indicates a rare purchase opportunity that has only been shown a few times in the past decade.

“The ETH percentage supply for ETH (40%) is lower than the last bare market cycle bottom (42%) when ETH was trading at $800. Looking at the on-chain, this is a signal that is already rolling out,” VentureFounder said.

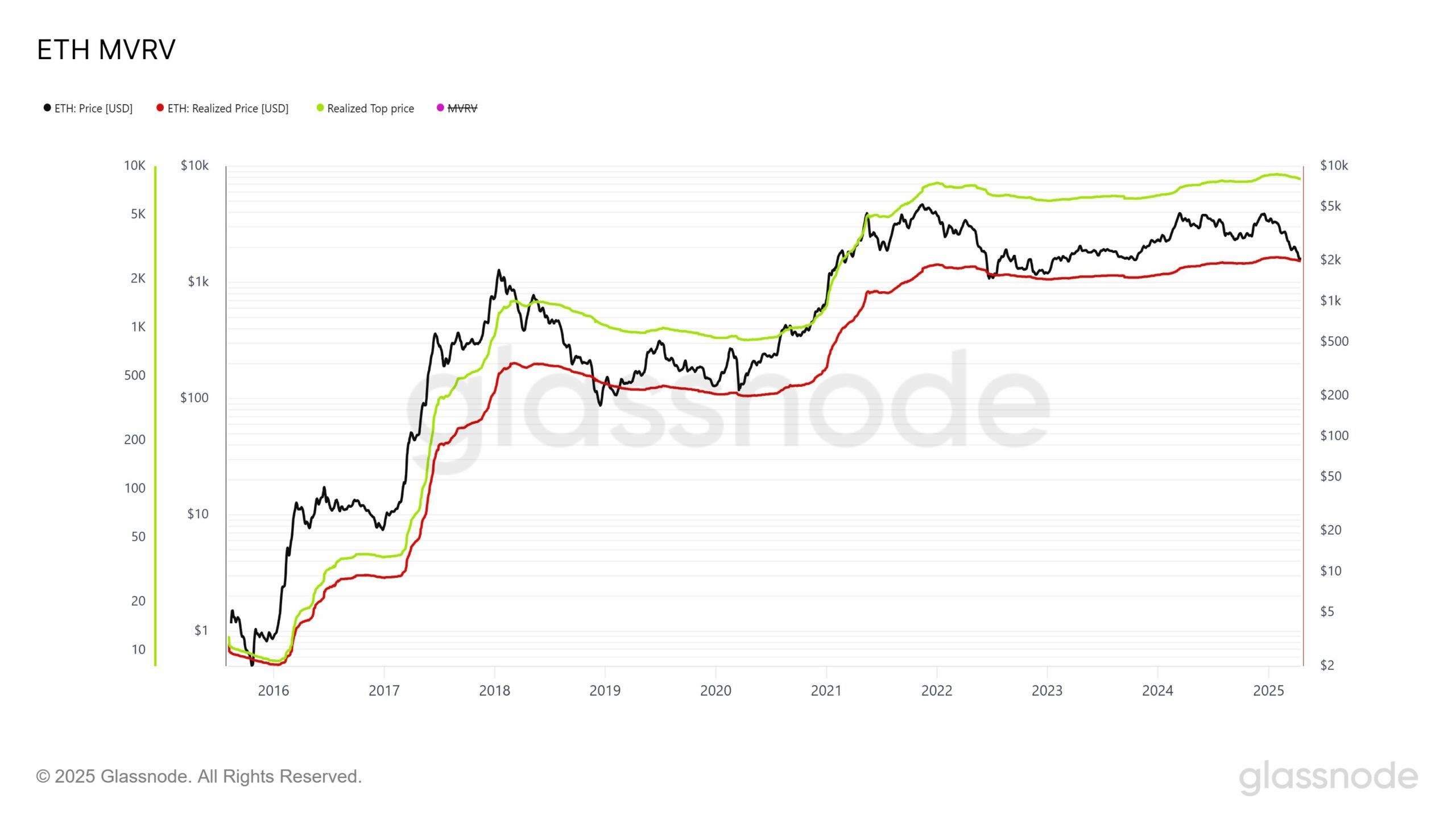

VentureFounder highlighted another important metric. Ethereum’s current market value has declined to match its on-chain realised value. The realized value reflects the average price that all ETK tokens moved last. When market prices drop to this level, they often show rare purchase windows. Historically, such moments tend to precede a strong price rise.

Ethereum MVRV. Source: GlassNode

“Look at this long-term chart for ETH. Do you want to buy Ethereum or sell Ethereum? Be honest,” commented the venture founder.

Despite ETH falling 60% from its late 2024 high, a recent report from Beincrypto confirms that Ethereum remains the top DAPP platform. DAPP fee revenue exceeded $1 billion in the first quarter of 2025.

Additionally, future upgrades for Pektra and Fusaka will be released on Mainnet in May 2025 and later in 2025, respectively. These upgrades can greatly improve network performance and boost investor sentiment.