If history repeats itself, Ethereum could be ready for another powerful October. On average, ETH earned 4.77% that month, and by the end of October it would exceed $4,500 in coins.

With less on-chain data selling and increased network activity, the coin could potentially record profits in the coming weeks.

Ethereum investors move coins out of exchange and confidence in rising

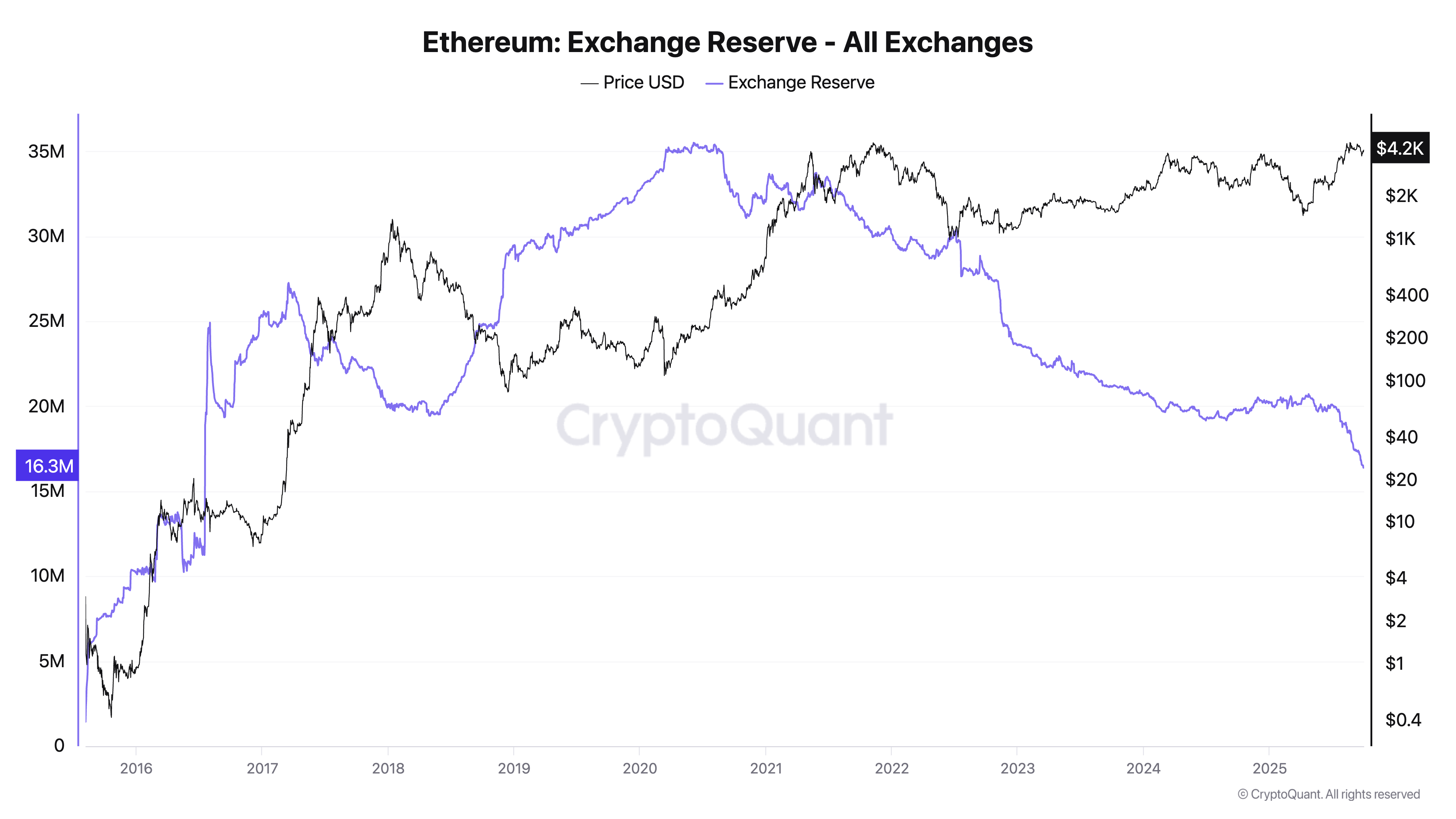

According to Cryptoquant, Eth’s Exchange Reserve has been declining consistently over the past few months. It sits at the nine-year low of 16.38 million ETH at press time, indicating that few coins are held on the centralized platform due to the potential for sales.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Ethereum Exchange Reserve. Source: Cryptoquant

ETH’s Exchange Reserve tracks the total amount of coins held in your wallet associated with central exchanges. When the numbers rise, they usually show that the owner is moving assets into exchange, potentially preparing to sell or trade them.

Conversely, the reserve drop suggests that investors are transferring coins to refrigerated or long-term custody.

In the case of ETH, a steady decline in exchanges indicates an increase in investor trust and long-term holding behavior.

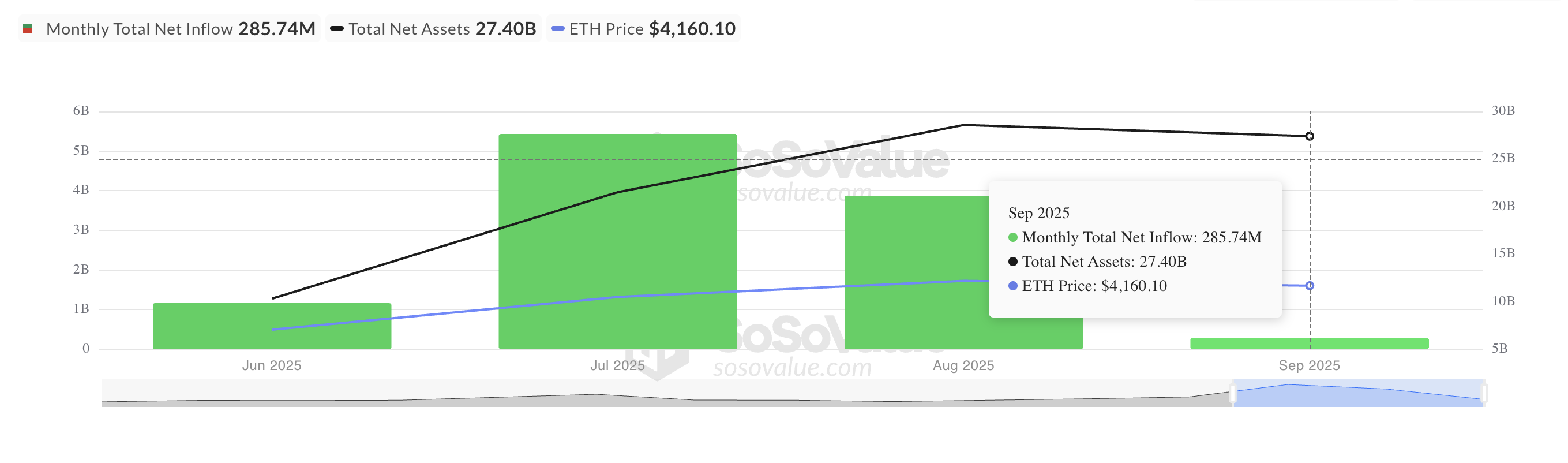

Most of this trend is attributed to swelling and institutional accumulation. According to SoSovalue data, the monthly net inflow to Spot ETH Exchange Trade Funds (ETFs) totaled $286 million in September.

All Ethereum spot ETF net flow. Source: SosoValue

If this continues, it will strengthen ETH supply and reduce immediate selling pressure.

Ethereum Daily Transactions is surged

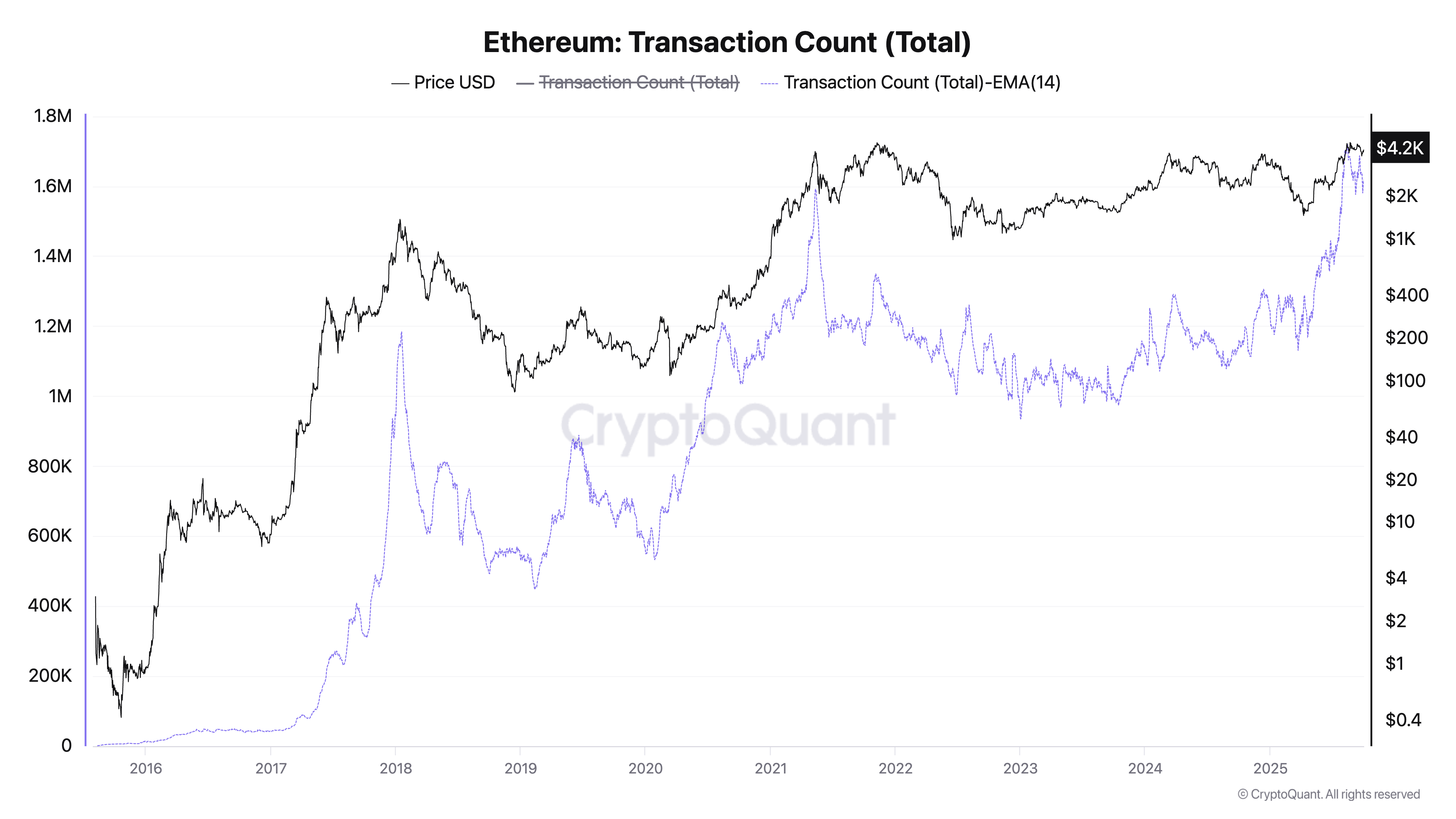

Ethereum also began to see an increase in network activity. This could support ETH rallies over the coming weeks.

In a new report, Pseudonymous Crypto-Analyst DarkFost argued that the current expansion in Decentralized Financial (DEFI) activities is driving an increase in Ethereum chain activity.

According to the report, daily transactions on the Layer-1 (L1) network are divided from a four-year range, reaching an unprecedented 1.6-1.7 million people. This marks “the highest level recorded at Ethereum,” added DarkFost.

Ethereum transaction count. Source: Cryptoquant

Such a higher amount of transactions in Ethereum often results in greater demand for ETH, a native coin. This is used to resolve transactions in L-1. If this growth continues, demand for ETH will rise and it will also boost prices.

Ethereum’s eyes are $4,500 in October, but the risk is close to $3,875

At press time, ETH trades for $4,308. A historical trend raised by current bullish momentum could result in a coin’s average gain of 4.77%, which could close around $4,500 in October.

This is below the all-time high of $4,957, but it will continue to mark welcome growth given the weak momentum across the wider market.

ETH price analysis. Source: TradingView

However, if bullish trends reverse and sell-offs are strengthened, the ETH price could slip to $4,211, extending the loss to $3,875.

Post Ethereum’s October records say $4,500 is visible. It first appeared in Beincrypto.