The 2022 transition from Ethereum’s Proof of Work (POW) to Proof of Stake (POS) was marked as a major technological change. We have reduced the network’s energy consumption by more than 99%.

However, Meltem Demirors, a general partner at Crucible Capital and former Coinshares executive, argues that the transition is a costly mistake.

Ethereum missed a trillion dollar opportunityy

According to Demirors, Ethereum’s move to POS devalued the network by allowing for the growth of Layer 2 (L2) solutions. She believes that the L2 scaling solution is diluting the core Ethereum ecosystem. In her opinion, if Ethereum had stayed at POW, it could have been a trillion dollar protocol and could have leveraged a powerful energy computing ecosystem similar to Bitcoin.

In contrast, if Ethereum had held its POW model, it could have driven innovation in GPU computing. She likened this to how Bitcoin Miners have driven advances in hardware technology.

“Proof of interest was a mistake. Ethereum could have been a trillion dollar protocol with its own robust energy for calculating the ecosystem. Instead, MEV extracts billions of dollars from users and apps,” she explained.

Her argument suggests that under the POW, Ethereum could have maintained a stronger, more centralized Layer-1 (L1) network without the fragmentation introduced by the Layer 2 scaling solution.

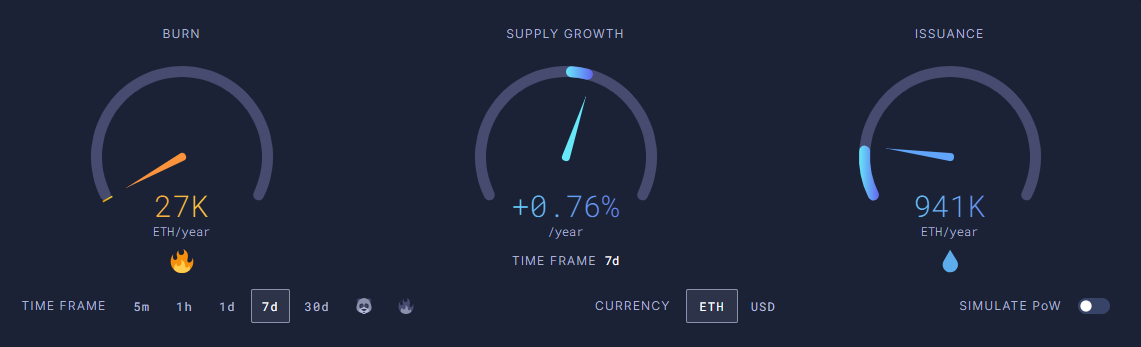

In 2022, Ethereum achieved “Zero Net Issuance” 55 days after the merge, creating a headline as ultrasound money. Following the London Hard Fork in 2021, we introduced the EIP-1559, burning some of the transaction fees and reducing our total ETH supply over a long period of time.

However, recent data suggests that Ethereum has been experiencing its longest period of inflation since its transition to POS. According to ultrasound gold, Ethereum’s annual inflation rate reached 0.76%. At the time of writing, the network is only burning 27,000 ETH per year, while publishing 943,000 ETH per year.

Ethereum supply and burn rate. Source: ultrasound.money

This contradicts the previous deflationary narrative that positioned ETH as a more valuable repository than Bitcoin.

“At the current rate of network activity, Ethereum will not be deflationary again. The ‘ultrasound’ story will likely have died or require much higher network activity to come back to life,” Cryptocant analysts recently emphasized.

Has Ethereum been meant to be money?

Recently, Peter Szilagyi, the lead of a major Ethereum team, said ETH was never meant to be money. This statement challenges the fundamental narrative of Ethereum’s transition to POS.

“ETH was never meant to be money. ETH was meant to support a decentralized world. It involves value ETH. It said that ETH didn’t want ETH to make it money. It produced tar and feathers.”

If ETH was not intended to be money, what would its ultimate purpose be? Critics argue that this lack of clear vision undermines Ethereum’s long-term value proposition. Despite these changes, Ethereum Network has witnessed important scaling activities.

Vince Yang, CEO of Zklink, said the EIP-4844 upgrade will remain beneficial for Ethereum, especially for layer 2 networks.

“Scaling activity at Ethereum exploded from 140 to 285 TP compared to earlier this month due to a significant reduction in gas costs to perform Layer-2 transactions,” Yang told Beincrypto.

This scaling activity is important for developing new blockchain applications and strategically deploying Layer 2 and Layer 3 solutions.

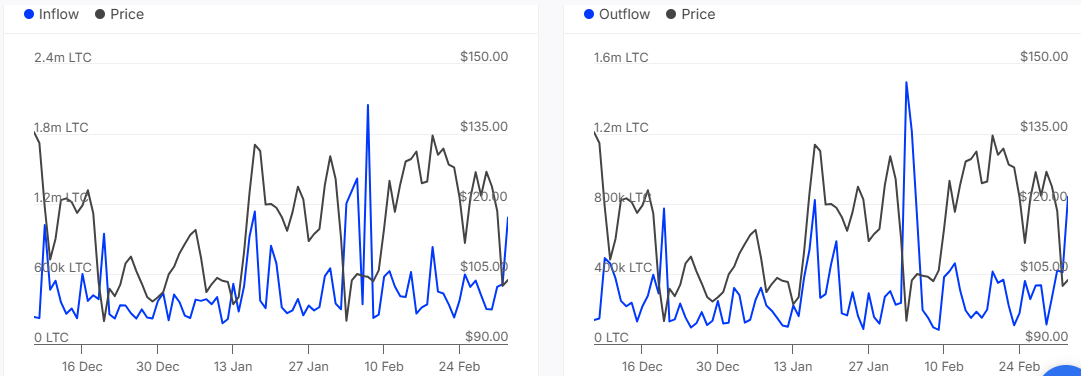

ETH price performance. Source: Beincrypto

Beincrypto data shows that ETH has traded at $1,971 at the time of this writing, down more than 2% over the last 24 hours.