The month-long drop in cryptocurrency prices has not only hurt major assets such as Bitcoin (BTC) and Ether (ETH), but also inflicted heavy losses on digital asset treasury companies that had built their business models around accumulating cryptocurrencies on their balance sheets.

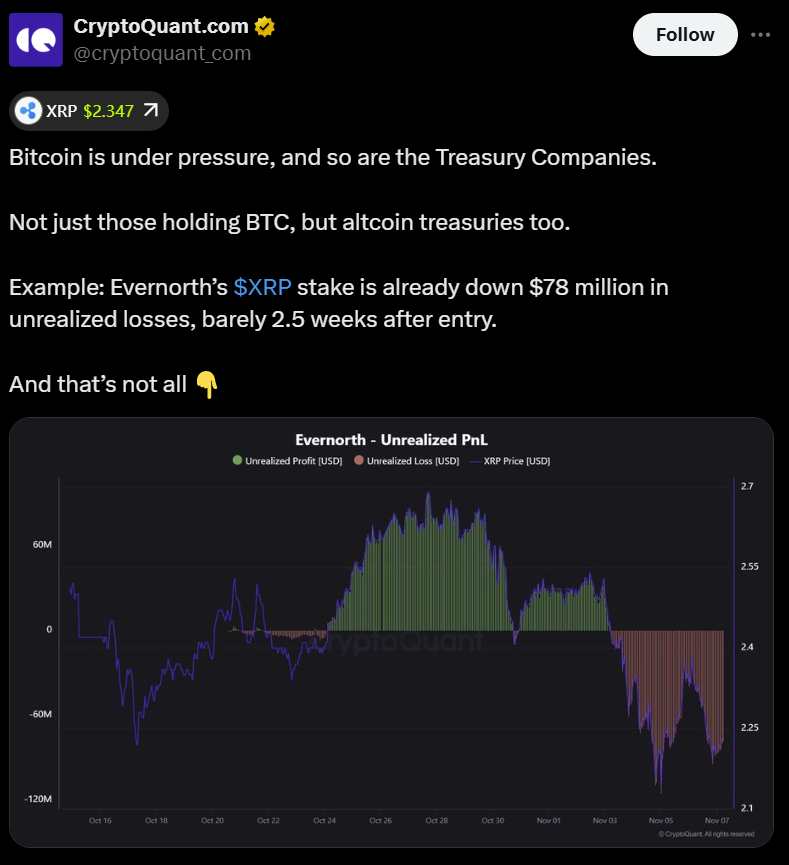

This is one of the key takeaways from a recent social media analysis by on-chain data firm CryptoQuant, which cited XRP-focused financial firm Evernorth as a prime example of the risks in this space.

Evernorth reportedly incurred approximately $78 million in unrealized losses on its XRP positions just weeks after acquiring the assets.

As a result of this decline, the stock price of Bitcoin’s original company, Strategy, Inc. (MSTR), also plummeted. The company’s stock has fallen more than 26% in the past month as Bitcoin prices have fallen, according to data from Google Finance. CryptoQuant noted that MSTR stock has fallen 53% from its all-time high.

However, Strategy still has significant unrealized gains on its Bitcoin reserves, at an average cost of around $74,000 per BTC, according to BitcoinTreasuries.NET.

sauce: cryptoquant

Meanwhile, Bitcoin, the largest ether holder, currently has approximately $2.1 billion in unrealized losses related to its ether reserves, according to CryptoQuant.

According to industry data, BitMine currently holds around 3.4 million ETH and has acquired more than 565,000 in the past month.

Digital asset treasury company: Echoes of the dot-com bubble

Digital Asset Treasury (DAT) has come under increasing valuation pressure in recent months, with analysts warning that the company’s market value is increasingly tied to the performance of its crypto holdings.

Some analysts, including venture capital firm Breed, argue that only the strongest players can withstand it, and note that Bitcoin-centered government bonds may be best placed to avoid a potential “death spiral.” They say this risk stems from the collapse of a company’s market net asset value (mNAV), a metric that compares a company’s value to the market value of its crypto investments.

Some liken the rise of digital asset treasury companies to the dot-com boom and bust of the early 2000s, an era ushered in by innovators with a long-term vision, not just opportunists looking for short-term profits.

Ray Youssef, founder of peer-to-peer lending platform NoOnes, predicted that most digital asset vaults will eventually disappear or collapse as market reality sets in.