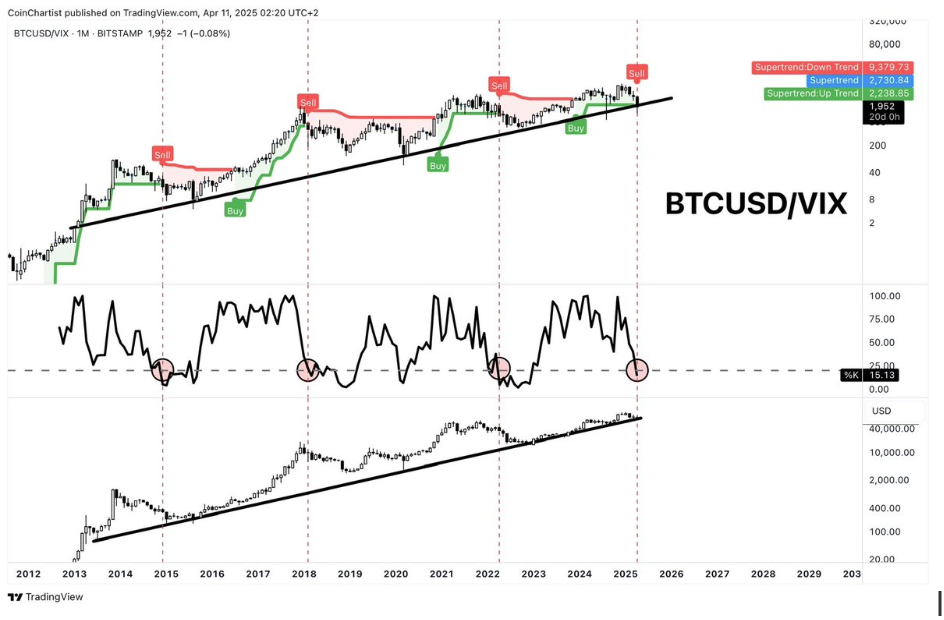

Technical experts Tony Severino Bitcoin/VIX warns that it is not as bullish as market participants believe. Instead, experts revealed that the current indicators point to the flagship code being in the bear market.

Bitcoin/VIX refers to the Bear Market: Analyst

in xPostSeveno warned that Bitcoin/VIX is not bullish as some crypto influencers may draw it. He said that technical analysis of it suggests that current signals tend to be seen by market participants. Bitcoin Bear Market. However, experts pointed out that the month wasn’t over yet. This suggests that these indicators could still be bullish.

Severino previously highlighted some reasons why he is no longer bullish about Bitcoin and other crypto assets. At the time, he hinted at the BTC charts. Elliott Wave Theory Other technical indicators also showed that flagship ciphers are probably at the top of this market cycle.

Severino previously highlighted some reasons why he is no longer bullish about Bitcoin and other crypto assets. At the time, he hinted at the BTC charts. Elliott Wave Theory Other technical indicators also showed that flagship ciphers are probably at the top of this market cycle.

In Seveno’s warning, crypto analysts like Said provided a more bullish outlook for Bitcoin. Saeed, this fix is simply a Healthy retracement And the broader trend in flagship cryptography is still bullish. Analysts highlighted $85,000 as the level of Bitcoin needs to be beaten on top to reach the new high.

The macro side seems bullish for Bitcoin at the moment. The latest CPI and PPI inflation data released were lower than expected, and quickly increased the hopes of the Federal Reserve’s fee reduction. According to a recent report, Boston Federal President Susan Collins also ensured that the US Central Bank is ready to stabilize the market as needed.

With the President of the United States Donald Trump’s tariffs Lasting, the US Federal Reserve may have to step in immediately. This is bullish for Bitcoin and other crypto assets.

BTC’s bullish technical analysis

In a recent X post, Crypto Analyst Titan of Crypto It has revealed that Bitcoin forms a reverse head and shoulder pattern, but for now it looks like a clean retest. He said if this pattern was unfolded, the flagship code could reach $125,000 this year, marking the new all-time high (ATH).

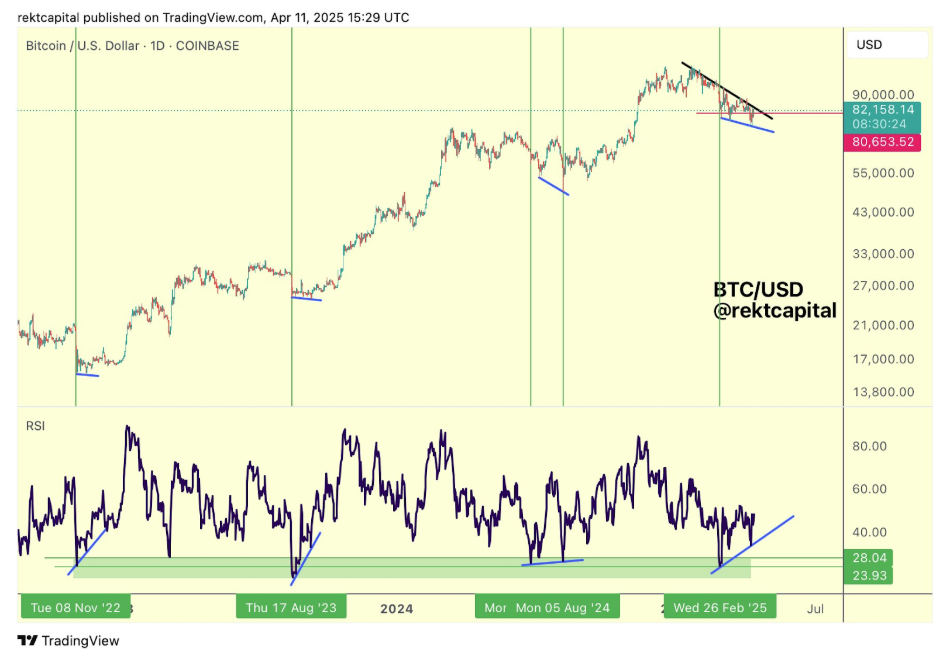

Meanwhile, Crypto analyst Rekt Capital revealed that Bitcoin is developing another higher, lower development of the relative strength index (RSI), while forming a lower price low. He noted that the BTC was formed throughout the cycle. A bold release This is a few times. This is positive for the flagship code. Each divergence always precedes an inverse reversal, indicating that BTC can again rise quickly.

At the time of writing, Bitcoin prices are trading at around $83,400, an increase of over 3% over the past 24 hours. data From CoinMarketCap.

Pexels featured images, TradingView charts