In June, Bitcoin hashrate suddenly plunged to its lowest level for over a year. This decline came amid growing political tensions between the US and Iran, prompting speculation about potential geopolitical ties.

However, experts remain divided. What are the arguments on both sides of the argument? This is a deeper view.

Bitcoin hashrates after ATH – is Iran the culprit?

A key metric that measures the computing power to protect the Bitcoin network, hashrates the scale and health of mining activities.

A high hashrate means more miners will participate and networks will be safer. When the diagram falls, it usually suggests that many miners have paused their surgery for some reason.

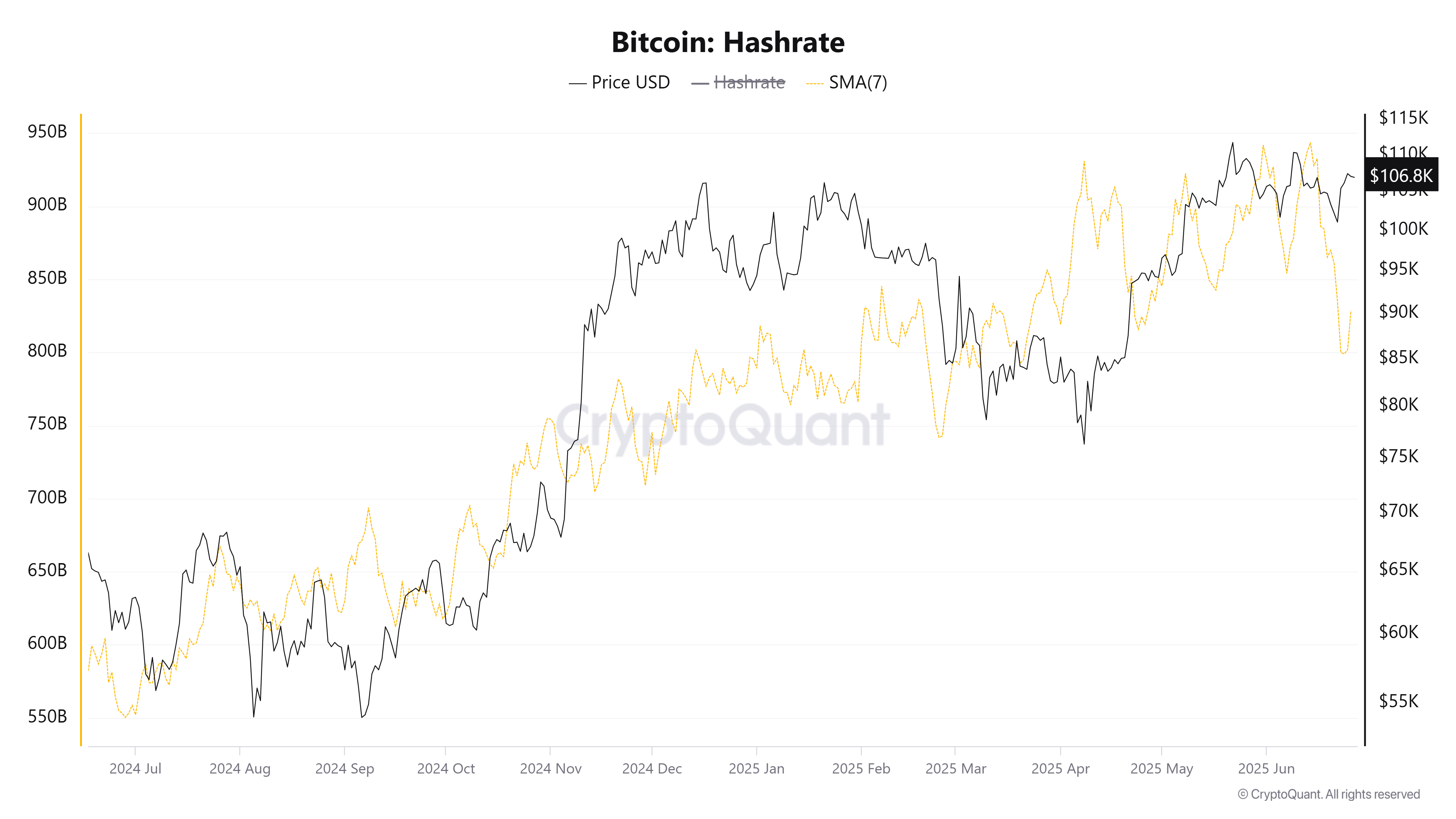

According to Cryptoquant, the average Bitcoin hashrate over the seven days fell to 800 EH/s. This is the lowest level since March 2025.

Bitcoin hashrate. Source: Cryptoquant

This sharp decline occurred between June 14th and 24th, coinciding with rising military tensions involving Israel, the US and Iran.

Nic, founder of Coinbureau, proposed a provocative theory. He suggested that Iran could have bypassed sanctions by converting oil into bitcoin and funding state spending.

In a post on X, the NIC estimated that around 3.1% of the world’s Bitcoin hashrates could come from Iran.

He argued that the decline in hashrate following the US airstrikes may not be a coincidence. Bitcoin mining facilities run by Iran’s Islamic Revolutionary Guard (IRGC) may have been targeted.

This theory is supported by blockchain analytics company Elliptic. This reports that Iran uses Bitcoin mining as a financial tool to withstand international sanctions.

Another analyst, Mike Alfred, went further. He claimed that Iran is not only circumventing sanctions with Bitcoin, but also selling BTC obtained through cyberattacks to buy missiles and upgrading its uranium enriched infrastructure.

“We may have entered an era where countries are bombing each other’s Bitcoin mining facilities as part of the 2017 forecast global hash war,” Max Kiser told Beincrypto.

Is the United States a real cause?

Rob Warren, author of Bitcoin Miner’s Almanac, offered another view. He suggested that the decline may be rooted in US domestic conditions rather than geopolitical conflict.

Instead of condemning Iran’s airstrikes, Warren pointed to the extreme heat in the US as a more likely factor.

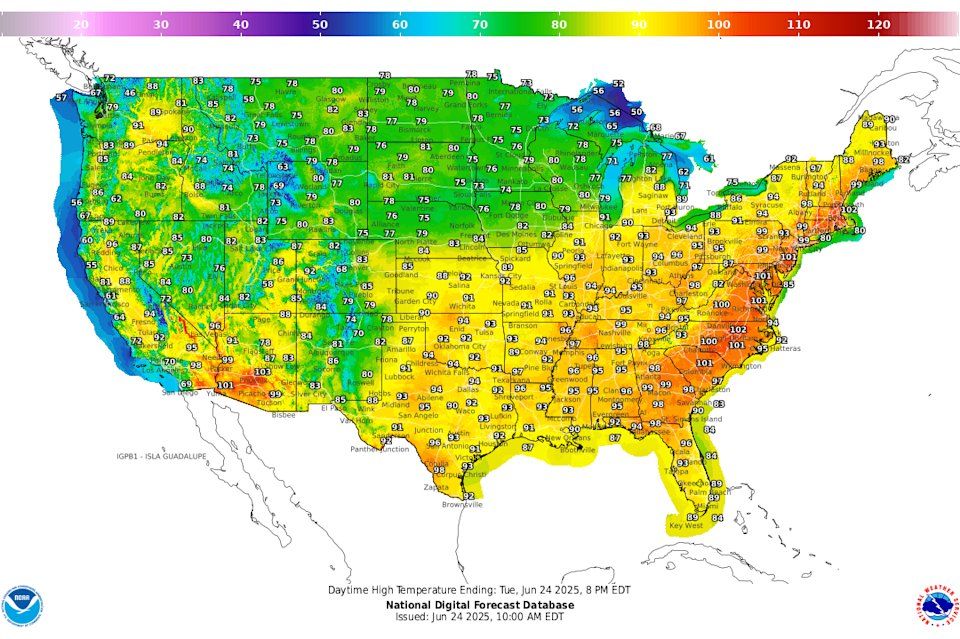

High temperatures in the daytime in the US. Source: National Digital ForeCast Database (NDFD)

“It’s always impossible to know the number of miners. Block times are the only proxy for the hashrate we exist in. My guess is reduced because it’s combined with the US heat dome and many other unknowns. I don’t think Iran is a single cause,” Warren said.

Tech investor Daniel Batten agreed to and applied Occam’s Razor. This is the idea that the simplest explanation is usually correct.

He said record high temperatures in Texas increased power demand on the ERCOT power grid, forcing miners to reduce operations to prevent overload.

U.S. Energy Information Administration (EIA) data shows a surge in electricity usage in Texas due to the growth of data centers and mining facilities. Natural gas-powered generation is projected to increase by 8% in 2025.

The crypto community is closely monitoring the definitive answers as geopolitical instability and climate-related disruptions increase. Regardless of the cause, this hashrate drop could have a long-term impact on Bitcoin’s price and mining strategy.