Cryptoquant, a leading cryptocurrency analytics company, has released its latest market analysis, revealing major changes among experienced Bitcoin investors.

According to the company, these experienced investors are moving into the accumulation stage. This is a trend that precedes a historically significant price rise.

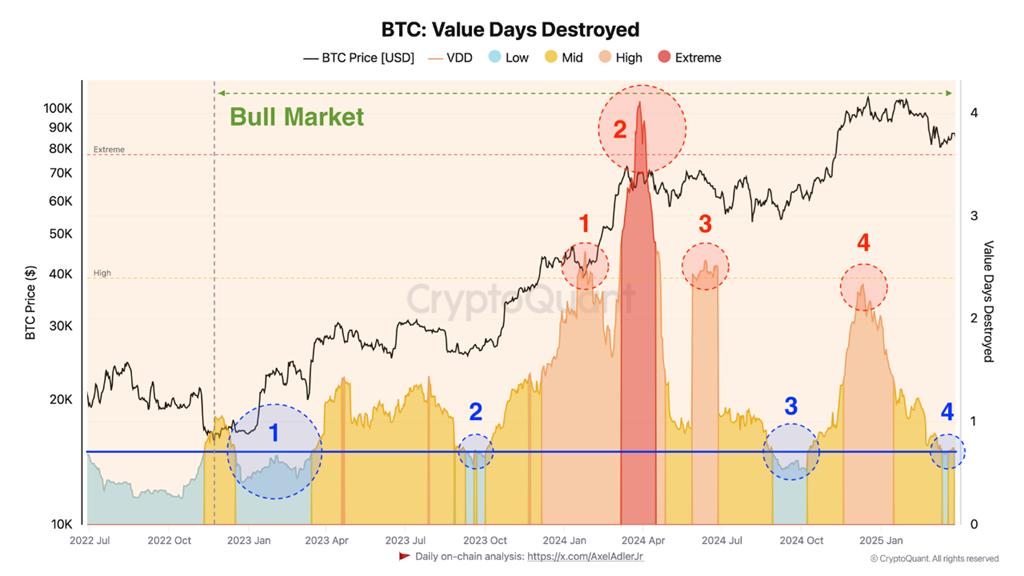

Cryptoquant identifies four major periods of coin accumulation by experienced market participants, currently in October 2023, October 2024 and March 2025. These phases are marked with blue circles in the company’s analysis table. In contrast, four important sales peaks occurred in January, April and July 2024, with the final peak in March 2025 marking a red circle.

According to the analyst company, the current accumulation stage is characterized by several important factors.

- Sell to Hold – Investors who previously sold at Market Peaks have adopted a holding strategy. This is evident from the Destructed Value (VDD) indicator, as it was the lowest in March 2025.

- Significant lack of sales – The lack of significant sales suggests that experienced participants are not attractive to profit from current Bitcoin price levels.

- Historical Priorities of Price Rising – Historic Market Cycle shows that the period of low VDD, characterized by the accumulation stage, precedes the upward price movement.

Cryptoquant’s findings suggest that the current accumulation stage may indicate a further assessment of Bitcoin prices in the medium term.

VDD vs BTC price chart shared by Cryptoquant.

*This is not investment advice.