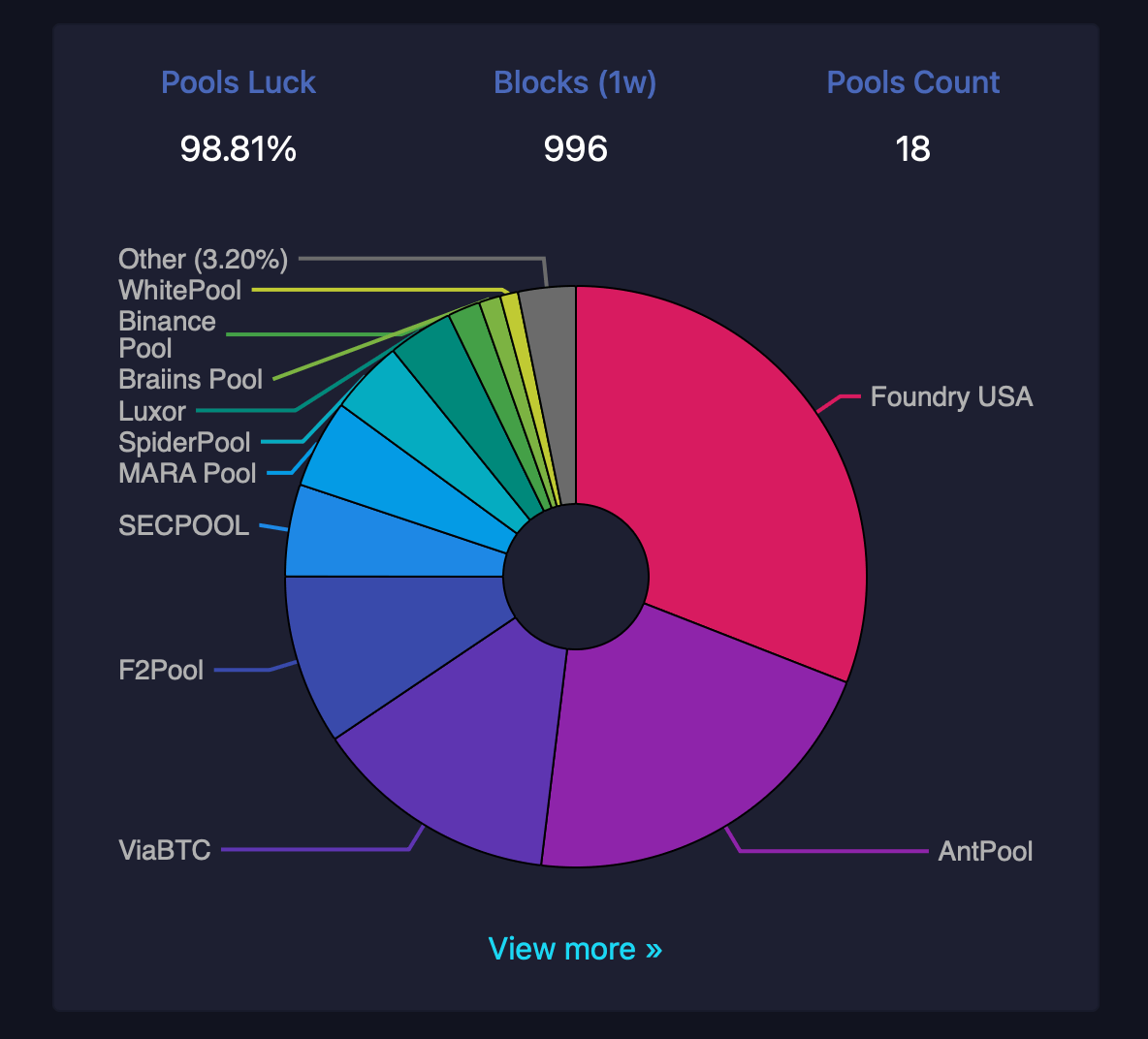

Bitcoin Mining Pool Foundry, Antpool and VIABTC collectively order more than 65% of the network’s global hashrate, amplifying dominance through scale, competitive pricing models, and tailored incentives for participants.

What is a mining pool?

Collaborative mining pools aggregate computational resources from individual miners to enhance block discovery odds and distribute rewards based on the hash power they contribute. As of March 20, 2025, the total network hashrate for Bitcoin is 809.65 EH/s. Leading this sector is Foundry USA (246 Eh/s), Antpool (173 Eh/s), and Viabtc (111 Eh/s) (111 Eh/s), according to statistics from Mempool.space.

Their vast infrastructure attracts miners who prioritize stable returns, expanding the dominant pool and perpetuating a critical feedback loop while smaller competitors face pressure.

Foundry USA

Foundry USA currently holds the top position and pilots almost 30% of Bitcoin’s total hashrate. The appeal of the pool is reportedly attributed to strict security protocols, including KYC/AML adherence, address whitelisting, and SOC 2 certification. That “donation” initiative further distinguishes it, allowing miners to allocate a portion of their revenue to Bitcoin development, with the goal of growing goodwill within their ecosystems.

Foundry’s US-based business claims to provide regulatory predictability. This is a key draw for miners who are wary of geopolitical volatility. Probably a crypto mining mine with publicly available miners Bit Farm, Hat8 and dedicated pools for foundry. Of the last 998 blocks, Foundry discovered 310.

Antpool

Antpool ranks second in 173 EH/s and leverages its partnership with Bitmain Technologies (founded in 2013) to provide reliability and trust. The pool employs pay per last N share (PPLN) model with no fees to optimize the profitability of the miners. Merged mining features allow simultaneous participation in multiple blockchains, increasing the potential for income at no additional cost.

Antpool’s geographically distributed network of nodes (through the US, Germany and China) minimizes downtime, and low payment thresholds and strong reputation cements its popularity. Bitfufu and Bitedeer are said to dedicate hashrates towards Antpool’s collective computing power. With the last 998 Bitcoin block, Antpool’s hashrate was able to win 209 blocks.

VIABTC

The third VIABTC at 111 EH/s is designed to prioritize revenues and increase minor returns via its proprietary PPS+ payout system. The platform enhances its appeal through integrated financial tools such as crypto-assisted loans and hedging strategies, along with real-time telegram notifications for hashrate shifts. VIABTC’s adaptable payment options make them a compelling option for miners. The pool offers PPS+, PPLN, and solo payment methods to cater to a variety of mining preferences.

In particular, PPS+ is a VIABTC exclusive system and is designed to maximize profitability. This is an advantage highlighted by the super-large reviews. VIABTC, which supports merge mining between Litecoin (LTC) and Bitcoin Cash (BCH), is said to provide several opportunities for diversification. Miners reportedly gather in this particular pool for their intuitive interfaces, mobile apps and global user base. Of the 998 blocks mined, the VIABTC pool was able to capture 136.

Why Miners Choose a Larger Pool

Miners increasingly prefer large pools such as Foundry, Antpool, and VIABTC because of their reliability and stable reward distribution. These entities mitigate operational risks through sophisticated infrastructure, dedicated support, and cost-effective pricing structures.

However, the resulting centralization blows the debate about the fundamental spirit of Bitcoin, as concentrated hash power can theoretically expose networks to coordinated vulnerabilities. These debates have often resurfaced, but to this day none truly restrains centralization. As of March 2025, the trio’s 65% hashrate share reflects its ongoing trajectory towards increasing centralization, unless the situation changes.

Miners benefit from stability and efficiency, but this integration challenges the decentralized ideals of Bitcoin. For example, people speculate that in the future, if centralization continues unabated, certain entities and transfers may be blocked. Economic pragmatism continues to promote this trend, suggesting that centralization does not change in miner priorities or technological breakthroughs. The ongoing tension between operational practicality and philosophical principles remains a critical dynamic for the evolution of Bitcoin.