FTX has rejected a claim for users who were unable to start the Customer (KYC) process by March 3, 2025. This follows an order by the US Bankruptcy Court, which allows denied claims to be published and removed from the list of liability.

The exchange did not state the cost of the claim it denied, but Purple, a single X (formerly Twitter) user, estimated the claim was worth around $300 million.

He said:

“There are probably around 400,000 claims here! But looking at the estimated allowed claims <$50k <$50k, there was 457K, totaling $344 million on the petition date. So I think this would reduce liability by $300 million."

Interestingly, the exchange could deny more claims. FTX creditor champion Sunil Kavuri said on June 1, 2025 that FTX will be erasing claims that it will not be able to complete the KYC process by the deadline.

The court order memo is as follows:

“The claims listed in Schedule 1 are included in the order but not in the display. This may be the attached HERETO may still be subject to disallowance if you have not submitted all KYC information requested by the FTX Recovery Trust or its KYC vendor before June 1, 2025 at 4pm ET (‘kyc submission -deadline’) on June 1, 2025.

If all of these claims are denied, Kavuri estimates that creditors will save $655 million, below $50,000, and creditors will save $119 million, over $50,000.

Meanwhile, the FTX consumption claim report has attracted complaints and criticism from creditors who pointed out that KYC cannot be completed even after submitting all documents. Some users complain that the exchange did not give them feedback as to why their claims are being challenged.

Interestingly, the FTX administrator did not reveal how they would use their savings from rejected claims. However, the exchange is expected to begin the next phase of repayment by May 30th. Additionally, European creditors on the exchange could be repaid for Backpack, the company that acquired FTX Europe, shortly after its billing page begins on April 1.

Restricted countries’ FTX creditors are still waiting for renewal

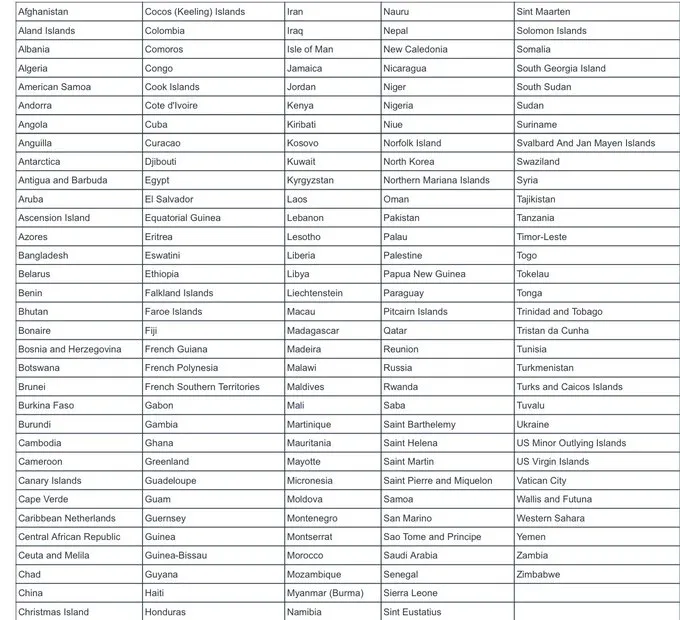

FTX creditors in the US and Europe have ultimately made some clear about their repayments, but a group of FTX creditors remains uncertain about their outlook. These creditors from over 160 countries have been excluded from the first phase of their recovery claims.

Kavuri revealed in February that the exchange had removed several countries from the first phase of recovery, including Nigeria, Egypt, Colombia, Russia, China, Ukraine and Saudi Arabia, and is working on solutions to those recovery. At the time, his post provided some degree of clarity to FTX creditors in these countries who were awaiting an opportunity to receive a refund.

Residents from almost 170 countries cannot request FTX repayments (Source: Sunil Kavuri of X)

However, users in these countries are still waiting for information about their repayment or their status and are looking for updates on when one creditor will be paid to Kavuri. As Kraken, Bitgo and FTX offer two distribution options for their claims, it appears unlikely that they will be paid in May as they are not available in most countries on the excluded list.