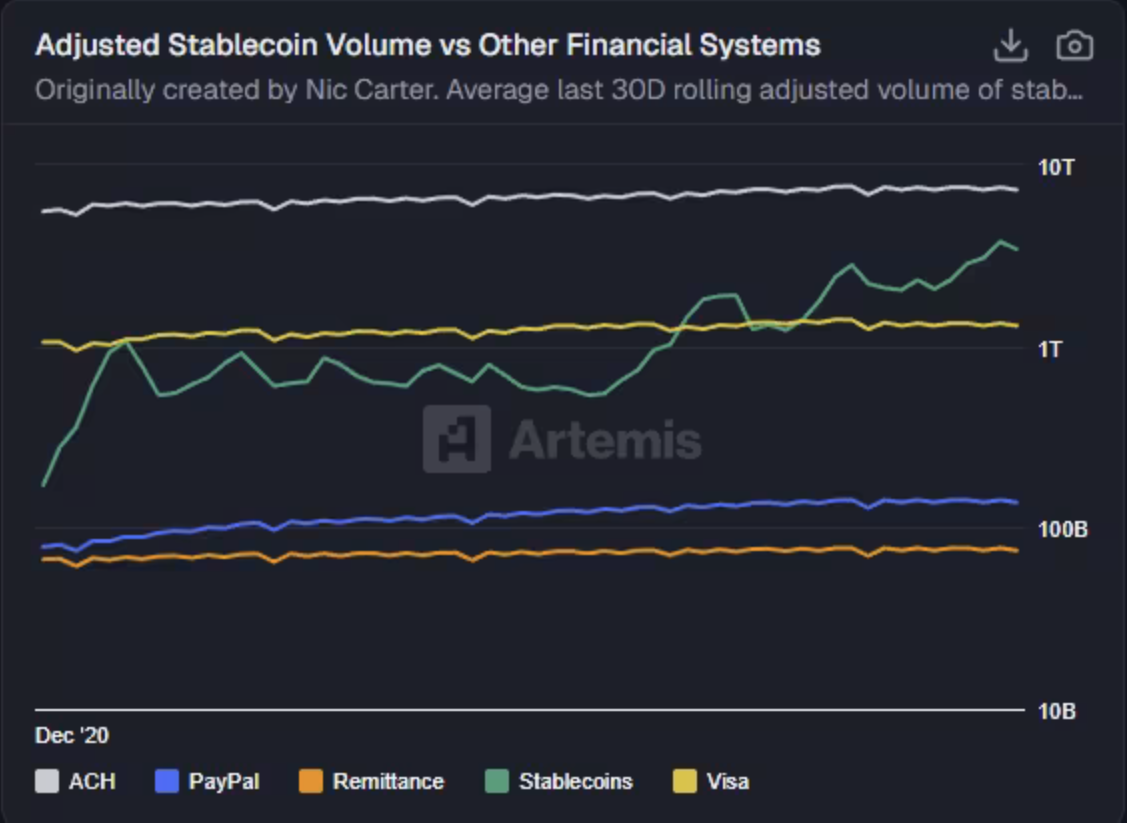

With regulatory clarity and increased adoption, stablecoins could handle more transaction volumes than the U.S. automated clearinghouse system in 2026, according to a new forecast.

Galaxy Research, the research arm of digital asset firm Galaxy Digital, points to existing transaction data and regulatory trends that support its predictions.

Vice President of Research Thad Pinakiwicz said stablecoin supply continues to increase at a compound annual growth rate of 30% to 40%, and trading volumes are increasing as well as issuance. Galaxy also cited the anticipated implementation of the definition under the GENIUS Act in early 2026 as a factor supporting further growth in stablecoin usage.

Comparison of stablecoin volumes and other financial systems. sauce: galaxy digital

The paper also provides predictions for the price of Bitcoin (BTC), stating that it could reach $250,000 by the end of 2027. 2026 is “too chaotic and unpredictable, but it’s still possible that Bitcoin will hit a new all-time high in 2026,” said Alex Thorne, director of corporate research at Galaxy Research.

Related: Coinbase is ‘cautiously optimistic’ about 2026 as crypto approaches institutional inflection point

Dollar-pegged stablecoin market expands

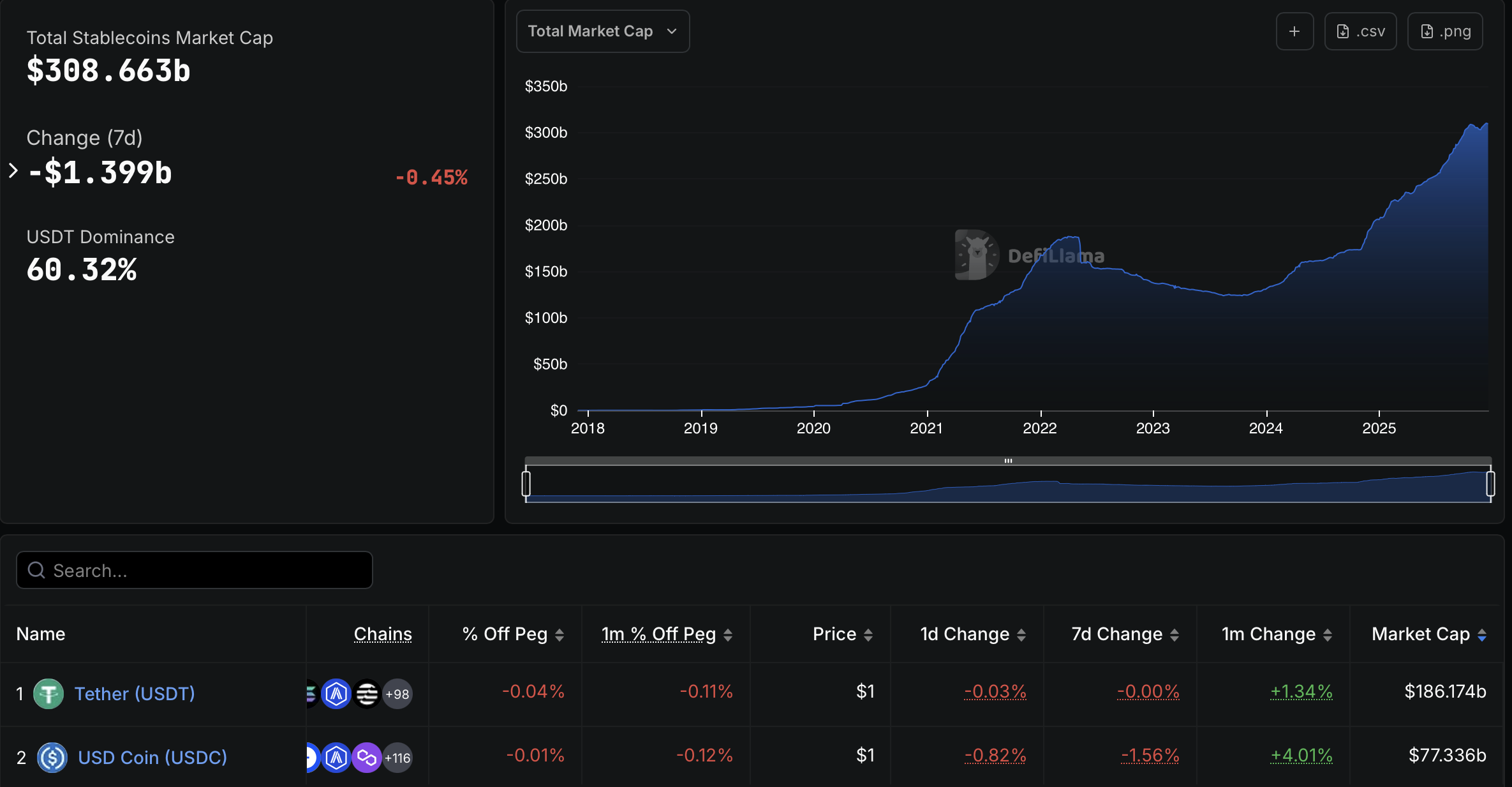

According to data from DefiLlama, the market capitalization of stablecoins is currently around $309 billion. While Tether Inc.’s USDt (USDT) and Circle Inc.’s USDC (USDC) remain dominant, more and more financial institutions and payment companies have entered the stablecoin race in recent months.

Stablecoin market capitalization. sauce: Defilama

In October, Western Union announced plans to launch its own USD-pegged stablecoin, the USD Payment Token. The token is built on the Solana blockchain and issued by Anchorage Digital Bank as part of the broader digital asset payments network.

Sony Bank is reportedly preparing a stablecoin pegged to the US dollar for use across Sony’s US ecosystem, including PlayStation games, subscriptions, and anime content. The stablecoin is scheduled to be issued in 2026.

On Thursday, SoFi Technologies launched SoFiUSD, a fully reserved USD stablecoin issued by its banking subsidiary SoFi Bank. The company said the token debuted on Ethereum and is designed to support low-cost payments for banks, fintechs, and enterprise platforms.

Janine Wu, an associate at Galaxy Research, said she expects stablecoins affiliated with TradFi to consolidate in 2026, as users and merchants are unlikely to adopt a long list of digital dollars, preferring instead the one or two that are “most widely accepted.”

magazine: Quantum Bitcoin attacks are a waste of time: Kevin O’Leary