GCASH, the leading Philippine digital money app, has announced support for Circle’s USD coin (USDC). Domestic users can now hold and trade Stablecoin.

This is a major step in integrating domestic stubcoins with daily trading.

Circle USDC will enter the Philippine market

Local media have revealed the integration, noting that GCASH users in the Philippines can purchase, retain and send USDC via GCRYPTO, the app’s cryptocurrency platform. Arjun Varma, head of GCASH’s Wealth Management Group, says the integration presents a game-changer for the Philippines to include finance.

“By making digital dollars easy access, we will strengthen our stable and globally recognized financial assets by our users,” local media quoted Varma.

Unlike volatile cryptography such as Bitcoin (BTC) and Ethereum (ETH), USDC is stable and fixed to the US dollar. This makes it a more reliable digital asset for payments and savings.

The move is expected to help millions of Filipinos bypass traditional banking infrastructure.

“Payment in the Philippines is absolutely horrifying. Some of the worst rails and ramps in the world,” one user said.

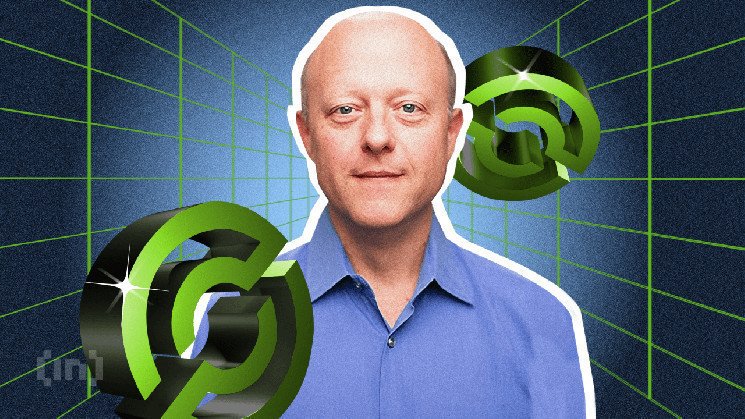

Regulated financial institutions have USDC reserves and are regularly certified by third parties to ensure transparency. Circle CEO Jeremy Allaire highlighted the scale of this expansion, citing opportunities for growth in the company’s Stablecoin network.

“GCASH, the largest and most widely used digital money app in the Philippines, has announced USDC support in its mobile wallet. Another 100 million users have been brought into Circle’s Stablecoin network,” he said.

Meanwhile, the move shows Circle’s outward expansion as competition in the Stablecoin market becomes more intense. Major traditional financial institutions, including the Bank of America (BOA), are currently focusing on adoption of Stablecoin.

This brings competition for Stablecoin issuers like Tether and Circle as established banks try to enter the space with the provision of Stablecoin. Once the financial giant comes in, fintech companies like GCASH are offering themselves as a potential means of expansion into Stablecoin issuers.

“GCASH’s USDC Move puts global digital dollars in the hands of 100 million Filipinos. Stubcoins may jump around banks in places like this,” another user added.

Despite optimism, transparency continues to bear great concern about the adoption of cheap recoin. Blockchain openness is perfect for security and trust, but it is not always ideal for everyday payments.

“Crypto payments failed for one small reason that requires correction. When sending USDC, I have the recipient see the transaction rather than the address. I don’t want to reveal my wallet for payments for 10USDC beer.”

GCASH’s USDC integration offers convenience, but requires stable transparency, such as revealing wallet addresses for USDC transactions, which could prevent adoption even for Philippine users.

Still, GCASH’s movement reflects the broader trends in digital wallets adopting blockchain-based finance.