Leading asset manager Grayscale Investments took X to celebrate the Grayscale XRP Trust’s one year anniversary.

At XPost, Grayscale celebrates the first anniversary of XRP Trust, where certified investors can gain exposure to XRP without purchasing tokens directly.

This post highlights the strengths of XRP, and is a native token for the XRP ledger (XRPL), known for its speed and low cost payments.

Strong performance as NAV surges more than 400%

It’s been a year since the company resumed its investment vehicles. In particular, the Grayscale XRP Trust has recorded impressive performances since its renewal a year ago.

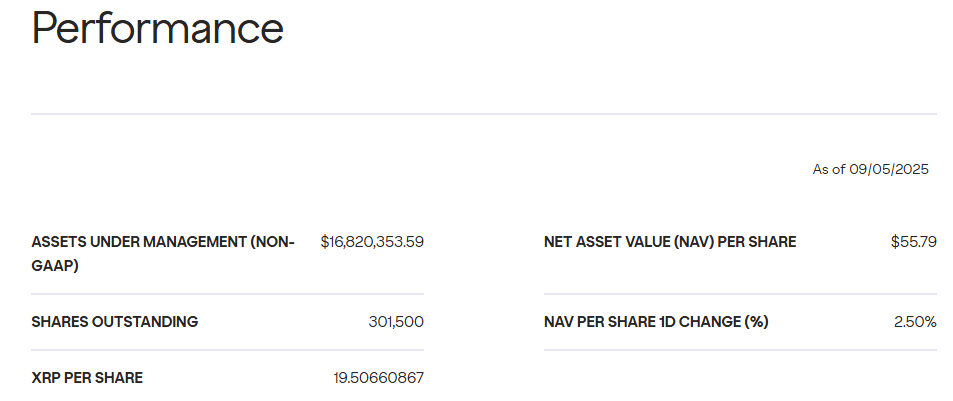

In just a year, the Trust’s Net Asset Value (NAV) per share has skyrocketed from the initial $10.85 to the current $55.79, showing an increase of 414%.

As of September 5th, the NAV was 2.50% spiked compared to the previous day’s value. Grayscale’s data shows that the company has issued approximately 301,500 shares to trust investors, each representing approximately 19.5 XRP. At the time of pressing, the trust had an AUM of $1,682 million.

Grayscale XRP Trust Performance

Spot ETF Move

Despite the incredible performance of XRP Trust, Grayscale is pushing its products to convert to spot-based Exchange-Traded Funds (ETFs). In January, I submitted an S-1 document to the SEC to facilitate this conversion.

This is a few months after Grayscale successfully converted Bitcoin and Ethereum trust into a spot ETF. Currently, the company is trying to do the same with XRP, with ETF’s shares expected to be released after it is approved by NASDAQ.

However, the SEC delayed its decision on potential approvals. Recently, Grayscale updated its application to allow approved participants to redeem and create ETF shares in XRP, cash or in physical form.

In the meantime, the SEC will have a final deadline of October 2025, which will decide whether to approve or disapprove Grayscale requests to convert XRP trusts to spot ETFs.