BNB Chain meme coins have plummeted by up to 90% in the past day, wiping out millions of dollars of investor funds as China’s meme bubble bursts.

The rapid losses have traders questioning whether these meme coins offer sustainable upside or are simply speculative traps.

“BNB Meme Coin” collapses, BNB Meme Coin plummets

In October, many BNB-based meme coins experienced explosive gains. For example, PALU gained 1,693% after gaining attention from Binance founder CZ and securing a listing on Binance Alpha.

Moreover, the market value of Binance Life coin peaked at $500 million yesterday. Another coin, “4,” also rose more than 600 times in what the community calls “BNB meme szn.”

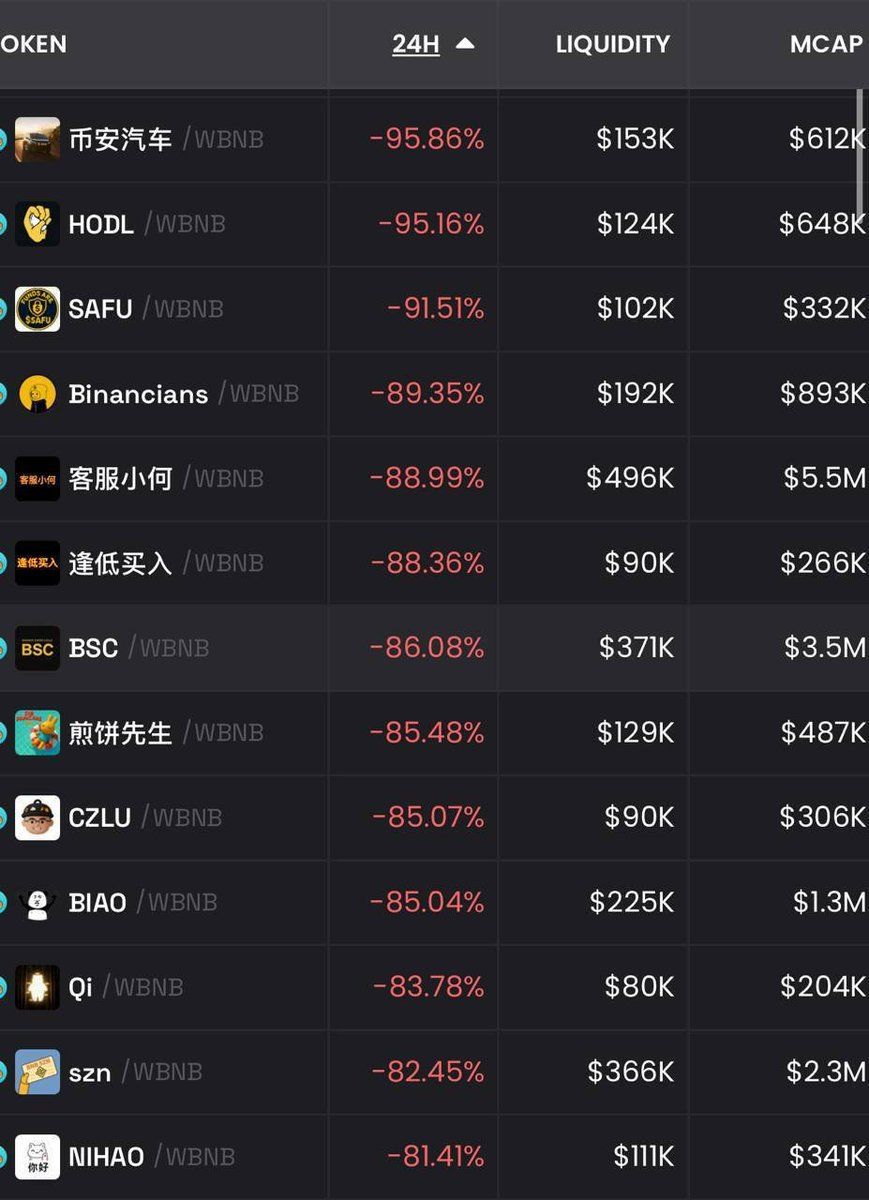

However, the momentum now appears to be reversing. The BNB meme coin market endured a dramatic collapse, with most tokens dropping around 90% in just 24 hours. The sudden collapse sparked widespread criticism from the community.

“Not only are we at the top of the cryptocurrencies, so are the stock prices, and the BNB meme is using up its last bit of liquidity. Please tell me why the fire sale?” the analyst wrote.

BNB Meme Coin is down 81%-96%. Source: X/Whale_Guru

Moreover, while the rapid rally netted many traders millions of dollars in profits, the sharp decline resulted in equally large losses. According to Lookonchain’s on-chain analysis, one trader (0x2fcf) withdrew 5,090 BNB, worth about $6.6 million, from Binance to chase the meme rally.

“He spent 3,475 BNB ($4.54 million) on the acquisition of Binance Life, customer service Xiaohe, PUP and Hakimi, all of which are now in the red,” the post reads.

Here’s a breakdown of Whale’s trade:

- Binance Life: Whale bought 8.97 million tokens for 2,555 BNB ($3.3 million) and is now sitting at a loss of $439,000.

- Customer Service Xiao He: It acquired 16.31 million tokens for 760 BNB ($993,000), which is now down about $700,000.

- puppy: I bought 5.19 million tokens for 105 BNB ($137,000) and lost about $47,000.

- Hakimi: I invested 55 BNB ($67,000) in 4.84 million tokens, which is now about $5,000 less.

In total, the wallet has approximately $1.2 million in unrealized losses.

Ragpull, FOMO, Meme Lessons for Coin Traders

Meanwhile, one analyst claimed that many of these coins suffered a “lag pull” as the price of HODL, the main token of the recent BNB meme coin rally, crashed along with other peer coins.

“I don’t need to convey the irony of a particular chart being rough on a particular ticker, but the lesson here for all of us is that if we don’t get 95% of Anonyme coins early, there is a very good chance they will be set on EL (exit liquidity),” the analyst said.

He added that investors who chase hype risk falling into an unsustainable cycle, and urged participants to focus instead on established “good” memes. Darden said early positioning remains the most important factor for success in meme trading. He summarized the principle as follows:

“When in doubt, remember BEOBEL: Be Early Or Be Exit Liquidity.”

The collapse of the China-themed BNB meme token highlights the fragility of hype-driven markets and the risks inherent in short-lived meme coin bubbles. This sudden change has raised questions about whether the BNB meme wave has truly come to an end, or whether it is just a temporary hiatus before the next speculative surge.

The post BNB Meme Coin Tank 90%: Has the “BNB Meme Coin” bubble finally burst? The post appeared first on BeInCrypto.