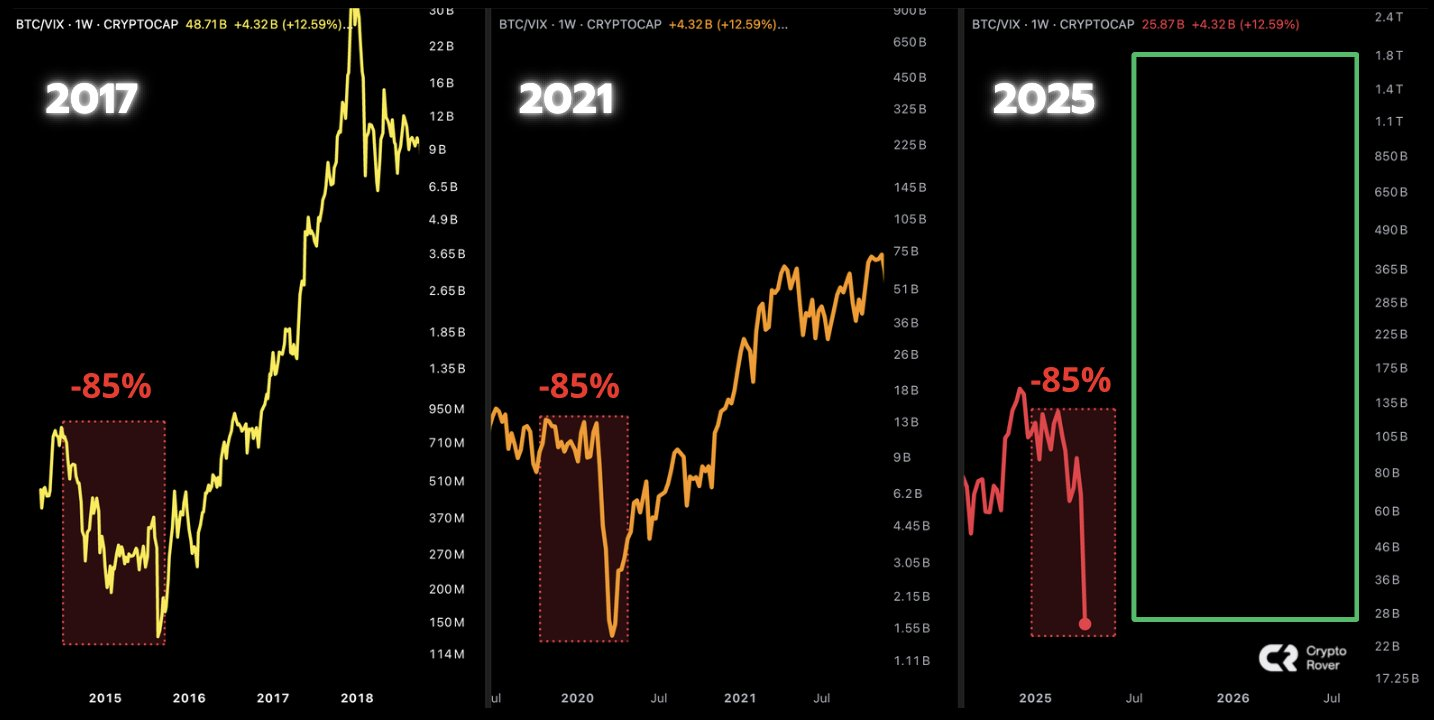

The current cycle of Bitcoin shows strong similarities with the structural reset seen in both 2017 and 2021.

Key market metrics such as the relationship between Bitcoin and market volatility (BTC/VIX ratio) and the total crypto market capitalization on the weekly chart show similar alignments to those seen in the vicinity of previous significant market shifts. These major price adjustments in the past served as more than just a recession. They effectively reset the market before the major upward trend that followed began.

Bitcoin Script: How Past Crash Sets Historically New Highs

Looking at the big picture, Bitcoin’s price history reveals its recurring multi-year structure. Strong upward feet, driven by widespread excitement, ultimately end with a sudden price drop (historically it can also exceed 80%-85% from the peak).

Historical Bitcoin Market Cycle Comparison (2017, 2021, and 2025)

Following these massive drops, a quiet period of historically beginning when dedicated, long-term investors steadily began buying again, laying the foundation for the next important climb. Examples include lows that reached around $200 since 2013, nearly $3,000 since 2017, and around $16,000 after peaking 2021.

The structure for 2025 shows a familiar rhythm. After exceeding $100,000, Bitcoin fell below $80,000, driven by macroeconomic stress and increased geopolitical risks. Importantly, this pullback brought prices to zones where significant purchases have occurred in past cycles and could prepare the ground for the next upward trend.

Bitcoin Price Check: Can BTC break key resistance to check the pattern?

BTC/USD chart (March 2025 – April 2025)

Bitcoin is currently trading nearly $85,050, recovering $74,436 from its recent low. It has returned to around $74,436 from its recent low. On the four-hour chart, prices were pushed beyond the descending trendline. It is currently concentrated between $84,200 and $85,700.

The relative strength index (RSI) is located at about 59.58, suggesting that moderate purchasing energy exists without excessively overheating the market. Fibonacci’s retracement levels provide clear goals: $85,700 (0.786), $88,700 (1.0), and $97,600 (1.618) are potential $111,900 (2.618) if trends are confirmed.

A daily closure exceeding $88,000 is staying as a critical threshold for bull verification. On the downside, the main support level is $82,000, followed by $79,900 and $77,800.

For historical guides, can Bitcoin already be built towards $150,000?

The market structure, coupled with on-chain indicators and historical cycle patterns, suggests that Bitcoin may be in the pressure accumulation phase prior to another expansion.

However, confirmation will depend on volume, breakout strength above $88,000, and sustained return of facility purchases. As history repeats itself, the path to Bitcoin’s $150,000 may already be ongoing.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.