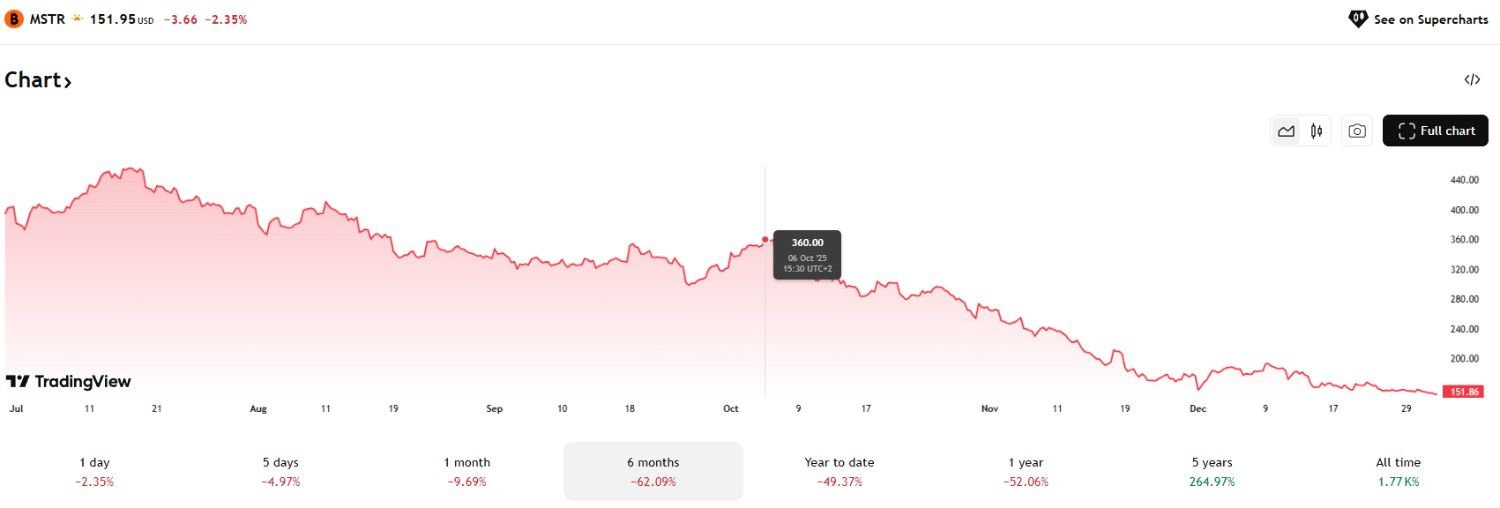

Strategy (NASDAQ:MSTR) (formerly MicroStrategy) had a tough 2025, but the company’s stock began a serious decline in October, just as Bitcoin (BTC) started to stall after hitting all-time highs.

So, since October 6, 2025, MSTR stock has fallen from $360 to $151.86 as of this writing on January 2, 2026, a nearly 58% decline in less than three months. Over the same period, Bitcoin fell more than 29% from its all-time high of $126,198 to about $89,370. Overall, MSTR stock experienced nearly twice as much loss as BTC.

This economic downturn will result in a loss of approximately $53 billion from Strategy’s market capitalization, which currently stands at $47.2 billion, according to its official website. At the same time, the mobile software leader still holds $60 billion worth of “digital gold.” In other words, Strategy is trading approximately 21% below the value of its Bitcoin holdings.

While the flagship cryptocurrency is not the only factor driving Strategy’s stock price higher, the timing of the joint decline is nonetheless notable as it illustrates the relationship between Bitcoin and the company’s market performance, especially given that Executive Chairman Michael J. Saylor has long supported aggressive Bitcoin moves as a core of the company’s strategy.

Furthermore, this shows how volatile the interaction between Bitcoin and premium valuations is in the broader market. In short, this trend could cause similar ventures to rethink how they approach digital assets and balance sheets.

MSTR is one of the worst performing stocks in 2025

At current prices, Strategy stock is trading at a 52-week low. Reviewing last year’s performance, economist Peter Schiff said that if Strategies were included in the S&P 500, it would be the sixth-worst performing stock in the index.

Mr. Schiff also criticized Mr. Saylor’s strategy, claiming that the focus on Bitcoin destroyed shareholder value.

“Mr. Thaler argues that the best thing a company can do is buy Bitcoin. Well, that’s basically all MSTR has done, and that strategy has destroyed shareholder value.” Schiff wrote.

Strategies is not included in the S&P 500 index, but if it were, it would be down 47.5% in 2025, making it the sixth worst-performing stock in the index. @Saylor argues that the best thing a company can do is buy Bitcoin. Well, that’s basically all $MSTR did, this strategy destroyed shareholder value.

— Peter Schiff (@PeterSchiff) December 31, 2025

Further pressure is mounting due to rule changes to the MSCI index that will reclassify companies with more than 50% of their total assets in cryptocurrencies as investment funds rather than operations.

A potential silver lining could be that even if BTC prices fall to $75,000, MicroStrategy’s Bitcoin portfolio would still be worth about $50 billion without collateralized Bitcoin debt.

Featured image via Shutterstock