The recent price denial of Bitcoin may have been brought about by a massive transaction that occurred around June 1st.

For context, Bitcoin was rejected on June 3rd for $106,700 after attempting to touch the $107,000 mark.

Interestingly, recently chart From Santiment, Bitcoin trading volume rose sharply between May 6th and June 5th, 2025, coinciding with this price decline. On June 2nd, trading volume surged to $440.3 billion, reaching its highest level since December 2024.

This surge coincided with Bitcoin attempts above the $107,000 threshold. Despite the volume surge, prices were pulled back rapidly, suggesting that increased activity did not result in sustained upward movement.

The largest Bitcoin transactions during this period occurred on June 1st and June 2nd. On June 1st, 130,010 BTC transactions worth $141.1 billion were recorded. Two major deals emerged on June 2nd, 78,647 BTC ($94.1 billion) and 22,531 BTC ($2.36 billion). These transactions suggest the involvement of large institutional players.

Large May and June transactions

Beyond the peaks on June 1 and June 2, the data highlight some other notable ones Bitcoin transaction. On May 29, 18,921 BTC transactions were recorded, but their values were smaller compared to the June transfer.

Additionally, two important transactions took place on May 13th, 16,525 BTC and 16,500 BTC. Another notable deal took place on June 2nd, moving 14,000 BTC. These large transfers contribute to an overall surge in Bitcoin trading volume during this period.

This trend in key trading shows an increase in institutional players or whales’ involvement in the Bitcoin market. Santiment notes that such large-scale transfers often precede major changes in market trends.

Increase in address activity amid price drop

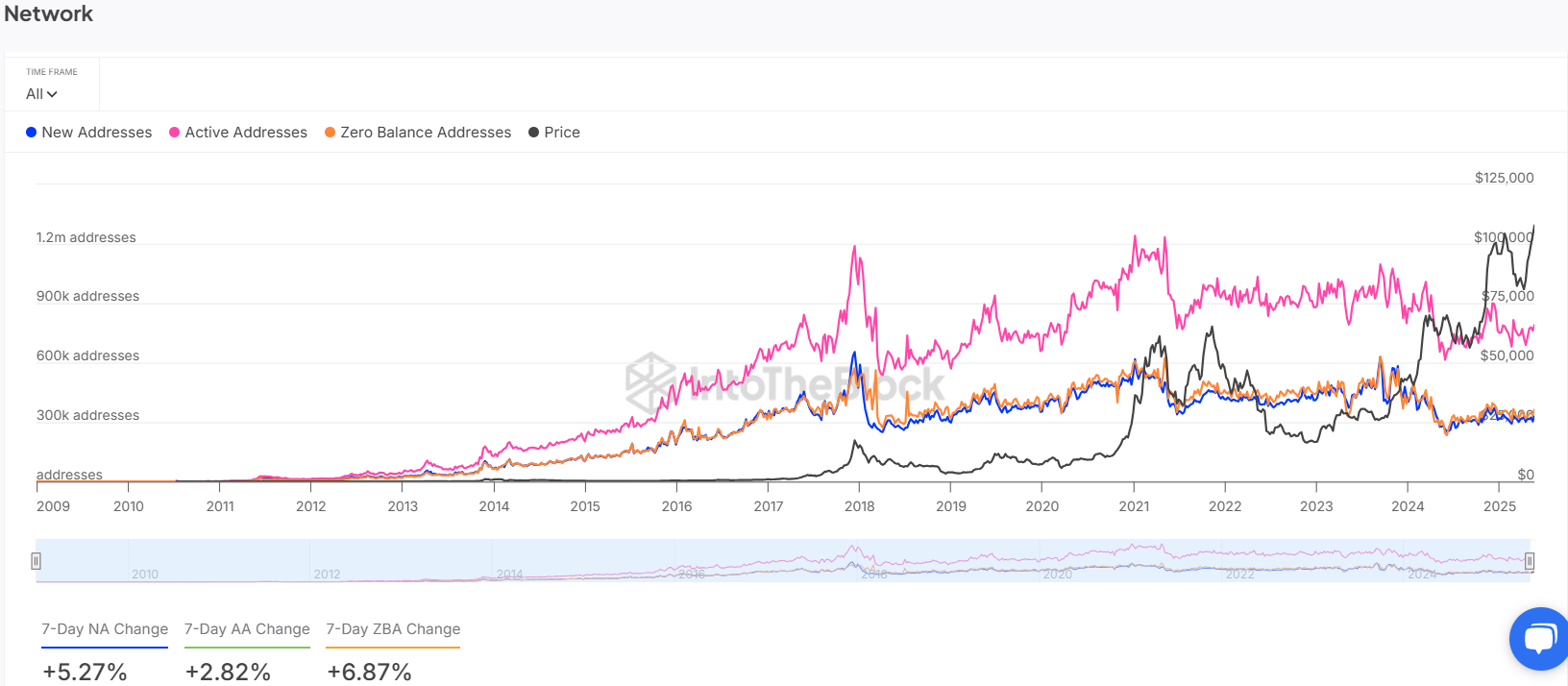

Data also shows address activity surged during the week when Bitcoin began to fall. Intotheblock data reveals new addresses have risen by 5.27%, active addresses have risen by 2.82%, and zero-balanced addresses have risen by 6.87%.

Bitcoin Daily Active Address

These numbers point to growing interest in Bitcoin, even as prices begin to fall.

What’s next for Bitcoin price?

Meanwhile, analysts are also paying attention to Bitcoin chart patterns. Famous analyst, Titan from Crypto, It was pointed out Classic signal of potential formation of head and shoulder patterns, reversal of price trends.

The left shoulder is formed in early May, with the head appearing in late May when Bitcoin reached its history high, and the right shoulder is now formed in June. If the price falls below the pattern neckline, it could indicate a transition from an uptrend to a downtrend, with a potential price target of as low as $96,000.

Bitcoin’s price is currently at $103,425, down 1.21% over the last 24 hours, reflecting a 1.81% decrease over the past seven days.