Traders on high lipid platforms known by X’s pseudonym Qwatio have suffered a major loss after repeatedly shortening Bitcoin (BTC) and Ethereum (ETH) during recent market rises. Traders were liquidated five times over the weekend alone, bringing the total number of liquidations to 10 in just a few days.

According to the Crypto Market Activity Tracker LookonChain, Qwatio placed a highly leveraged bet on BTC and ETH, which led to a loss of around $3.7 million last week.

Coinglass data shows that a total of 387 BTC worth approximately $42.18 million and 2,990 ETH of $7.65 million have been settled from Qwatio’s accounts. Holding a balance of $16.28 million, the account balance was worth $610,000, recording a realised loss of $15.67 million.

High lipid traders will suffer losses after the first quarter bull run

Traders opened a leveraged short position at BTC and ETH, hours before President Donald Trump signed an executive order to establish the National Cryptocurrency in March.

The market saw the order as bullish and pushed the Crypto market to a high along with BTC, causing early losses for Qwatio. They are also known for establishing a major position in Melania Coin during its initial initial launch in 2025.

After losing thousands of dollars, Qwatio continued to short-circuit two biggest coins by market capitalization into the second quarter of the year. On July 4, after already liquidated 10 times, the traders opened another short position against Bitcoin, betting 21 BTC on $2.3 million, but the assets were trading at $109,135.

The coin has since fallen to $108,993, and Qwatio hopes to go further down to the analyst’s predictions that BTC claims to be in “weak positive” short-term market sentiment.

Short and long liquidation of the market is rapidly increasing

Qwatio’s losses came against the backdrop of several liquidations in the crypto derivatives market. For the 24-hour period ending July 7th, total liquidation of all major cryptocurrencies reached $184.16 million, according to Coinglas.

This number included $47.14 million in strengths and $137.01 million in short positions. This puts a strong pressure on bearish traders as the market is trading green.

Ethereum led the liquidation total, sweeping $64.14 million, $4,962 million from short positions and $1,452 million from long positions. Bitcoin continues, with $35.38 million settled and includes a short position of $31.25 million.

Many traders like Qwatio misdirected the market direction and were not decorated with the strength of the market’s growth.

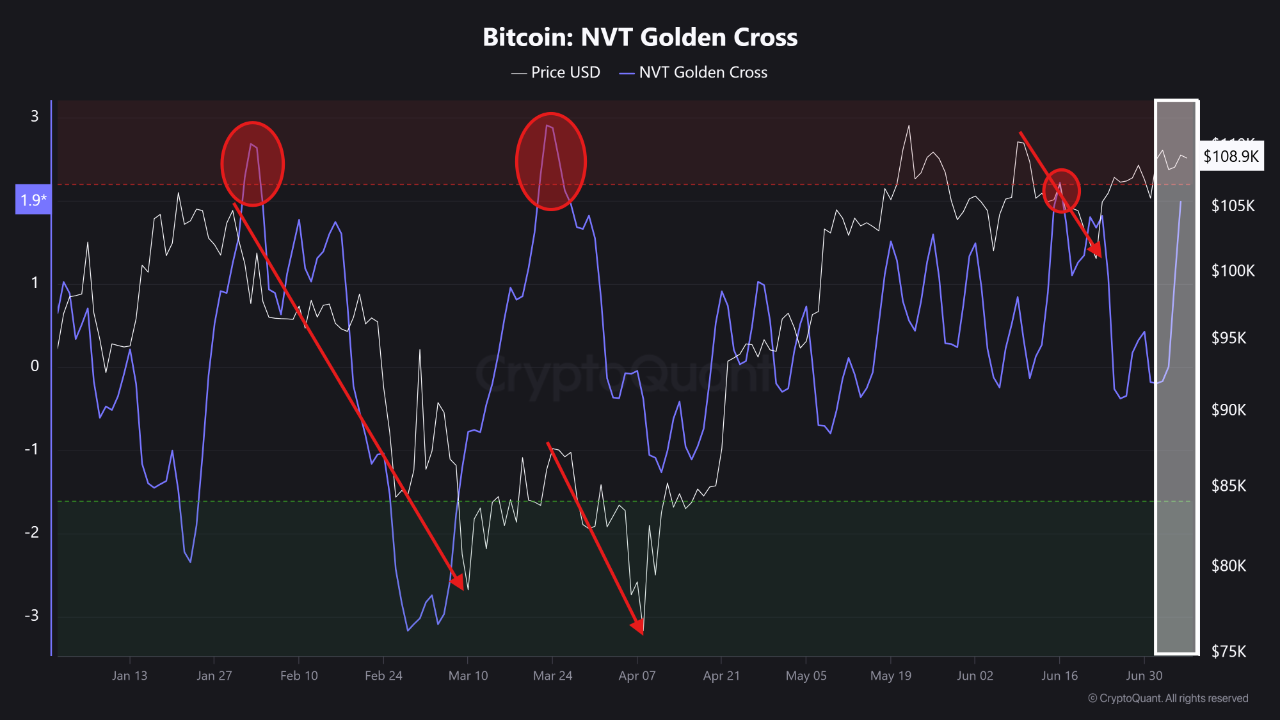

NVT Golden Cross on BTC Chart spells price toppings

According to Cryptoquant Take, NVT Golden Cross has made its three most recent tops in 2025: March 24, March 24, and June 16. On each occasion, the indicator peaks above the 2.2 threshold, with BTC price highs at $97,600, $87,500 and $106,800. Each peak was followed by corrections of -23.65%, -16.06%, and -9.87%.

Source: Cryptoquant

As of the latest reading, the NVT GC is standing at 1.98, but has not resumed its 2.2 signal line yet, but there is room for price momentum. Analysts believe there will be a price hike for a few days if the NVT exceeds 2.2.

Bitcoin’s price rise has sparked a chain reaction across derivatives platforms, particularly with benance, where short positions are rising.

Many traders seemed to interpret the gathering as a sales opportunity. Still, the continued rise in BTC prices has forced many of these short sellers to liquidate or margin calls.

Liquidation has encouraged a bullish feedback loop and accelerated the movement of rising prices. When bearish bets are squeezed out of the market, it builds a bullish momentum, a pattern seen in this week’s trading behavior.