Risk course traders who caused a big loss in one of Hyperliquid’s pools have come back again with another Ethereum (ETH) advantage. This time, the traders used 25x leverage, poses the risk of a replacement once more.

The whale trader, who caused more than $4 million in the lost liquidity of Hyperliquid’s pool, has returned again in another long position at Ethereum (ETH). This time, the traders quickly switched between the dangerous short and long positions of ETH, again exposing the exchange to potential liquidation. Following the news, the high-lipid hype native token went down further, slipping into $12.35.

The new batch in position is smaller as the whales deposited $2.3 million on high lipids. However, 25x leverage may have a distinctive effect in position. position The high lipid accounts of whales were still active as the crypto market entered another volatility.

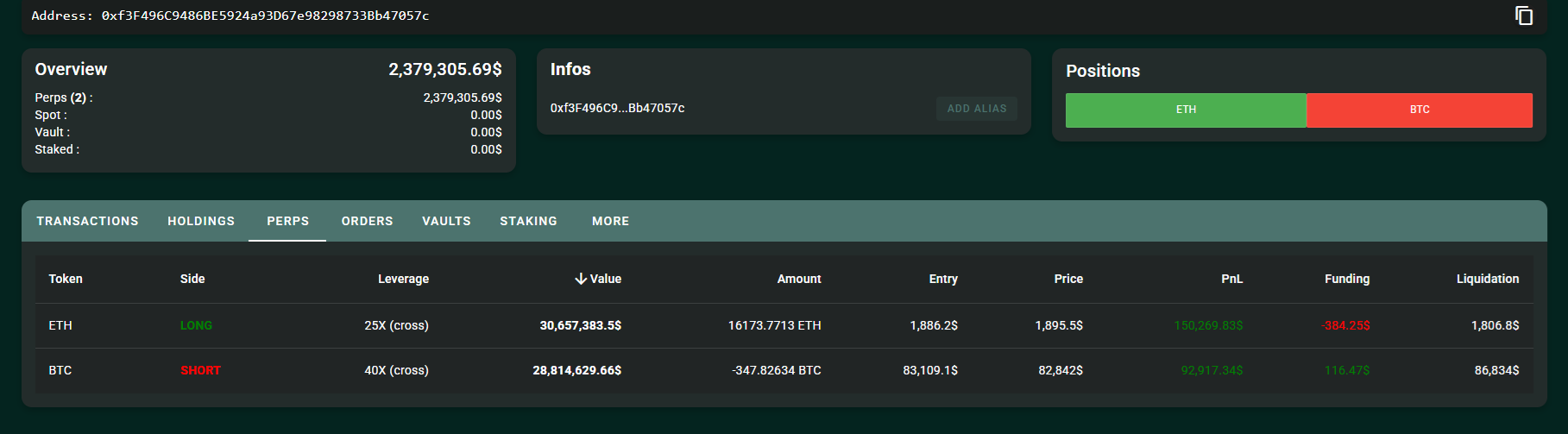

The trader’s position was on the green as he bets on ETH bounce and further slides in BTC. |Source: Hyperliquid

On-chain data caused the whales to travel through the GMX, resulting in a 4.08m USDC deposit. Initially, the whale shorted the ETH, but then closed its position and moved its assets for a long time. The whales secured a profit of $177,000 through their position before shifting to high lipids again.

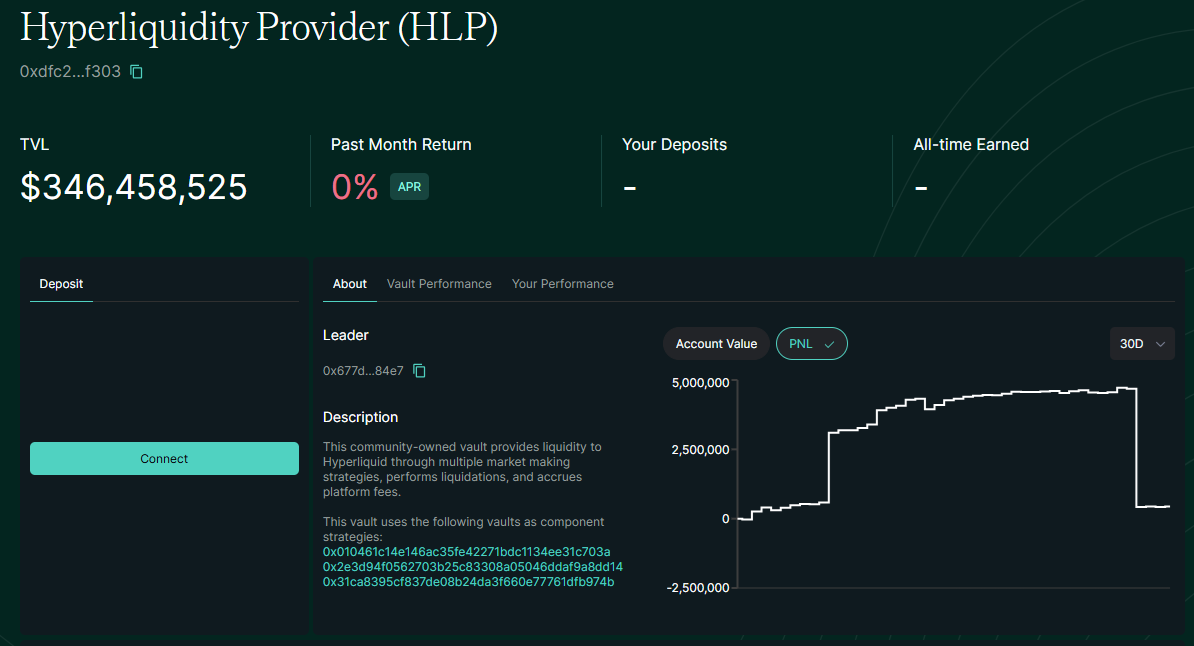

High lipid community safes still carry much lower liquidity after taking over the whale’s first ETH ever after liquidation.

The new position for Whale wanted ETH to be leveraged 25x and reduced Bitcoin (BTC) with 40x leverage. The new positions for traders are again using the maximum available leverage with high lipids, even after recent restrictions. Previously, whales took a risky position when trading at 50x leverage.

Trader whales are still green after BTC, ETH market moves

A few hours after setting up a leveraged position, the trader whale was still in the money. After ETH recovered, the position was profitable, but BTC slipped for under $83,000.

As of March 13, ETH was trading at $1,898.86 and BTC had returned to $82,952.12.

The whale’s location exceeded $100,000 with a relatively small profit. However, ETH’s funding rate has turned red due to long positions. The whales came in at $1,886.20 per ETH as prices floated just above the liquidation level.

Without a near-immediate whale gathering, the whales threatened to leave high lipids in another toxic, liquidated position.

ETH is currently trying to hold a support level of $1,887, where traders post the biggest accumulation of liquidity. ETH remains extremely dangerous when it comes to liquidation, with liquidation at $8.22 million.

In the last four hours, ETH has seen $4.8 million in long liquidation. $342 million With a short settlement. As ETH has faced long drawdowns over the past three months, the risk of long positions remains largely contested. A rebound was expected, but it was always behind by deeper price slides. Under these conditions, unexpected gatherings will benefit the leveraged whales most.

Bybit CEO doubts intentional strategy

Bybit CEO Ben Zhou believes the whales are intentional to liquidate large-scale leveraged positions. He views highly leveraged trading as a potential problem for both DEX and centralized market operators.

Zhou believes that the whales chose an easy way through liquidation.

“What happened essentially was that the whales left the high lipid liquidation engine that was used. Imagine opening a 300m long position to the ETH and opening at a margin of about $15 million with 50x leverage. I commented X’s Zhou.

Zhou proposed a solution that would be used in other exchanges. In this solution, large positions automatically reduced leverage. This prevents whales from exploiting available liquidity and saddle exchanges along with toxic debt. Zhou also believes that lowering leverage thresholds for high lipids are still open to manipulation. Another potential vector is creating multiple accounts. This is intended to prevent the exchange from screening.

High lipid community safes still have much lower levels of fluidity. |Source: Hyperliquid

Zhou argues that due to its massive leverage, high lipids are still competitive and lowering restrictions can be harmful to the company. Because of this, Dex is extremely vulnerable to assault.

Nevertheless, recent liquidation has hurt the high-lipid community that used safes for passive income. The involvement of risky traders was Vault’s Black Swan event, previously gaining liquidity of over $4.8 million.