James Wynn, a high-risk crypto trader who made headlines for his aggressive leveraged trading strategy and the losses that come with it, made more than $500,000 today and made profits. This marked his biggest profit since May 25th.

This marks a dramatic shift for Wynn. Wynn shows that luck was dry after seeing all previous benefits being wiped out by the highly leveraged locations of high lipids.

James Wynn’s trading roller coaster ends with green

In June, Beincrypto reported a significant loss of $100 million in high lipids. Despite the blow, he continued his high stakes bet.

This month, blockchain analytics platform LookonChain highlighted that Wynn transferred 27,522 USDC to Hyperliquid and collected a referral bonus of $3,960.84 on July 10th.

Nevertheless, once again, betting on the market was not a good thing for Winn. Less than 12 hours later, Wynn’s high stakes shorts were fully liquidated, resulting in a new loss of $27,921.63. A day later, Wynn deactivated his X (formerly Twitter) account.

“James Wynn has disabled his X account! What happened? Did he explode completely? The balance between his wallet and high lipids combined makes everything $10,176,” Lookonchain posted.

However, the silence did not last long. On July 15th, Wynn reappeared, claiming a referral reward of 6,792.53 USDC. This time he went to Pepe for a long time with ten times leverage.

Lookonchain then observed that the trader added about 468,000 USDC to the high lipids. He took another bold step, opening up a long position 40x leveraged to Bitcoin. Despite facing partial liquidation, Winn was able to benefit from changing his strategy.

“He fell for a long short in BTC and hype. He reduced profits by $473.9K,” the company added.

HyperDash data also revealed that he made $105,948 and $345,456 on July 18th and 19th, respectively. Additionally, yesterday Wynn deposited an additional 536,573 USDC in high lipids. He then opened two new leveraged positions. It’s 25 times the length for Ethereum and 10 times the length for Pepe.

Today he concluded both deals, earning an incredible amount of $33,386 from ETH and $521,313.86 from Pepe. The latter represents his most profitable single trade since his $18 million victory on May 25th.

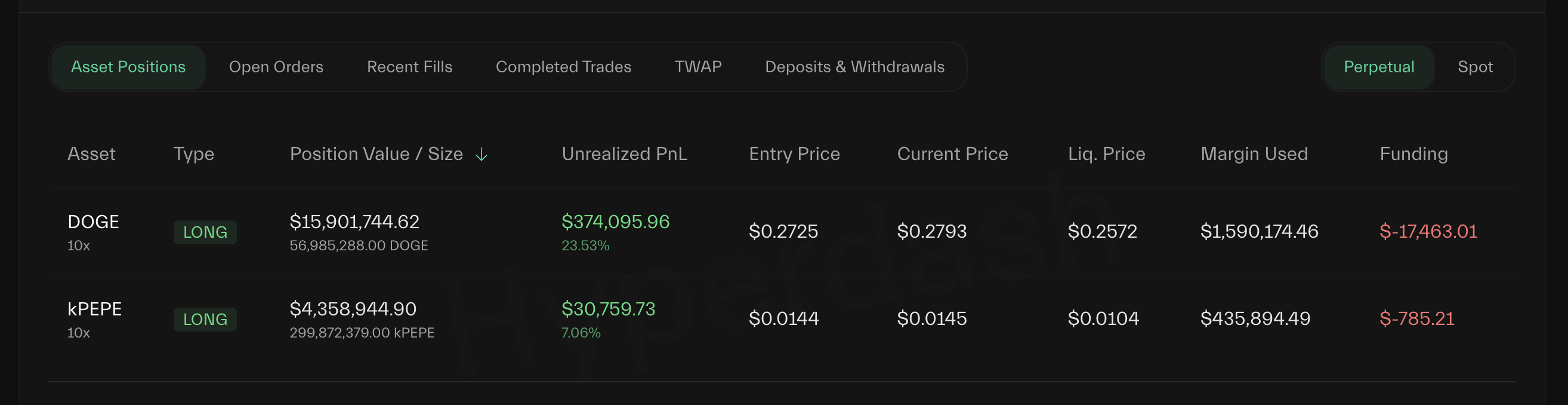

Wynn still has two open leverage positions. This includes 10 times the length of Doge and sits with an unrealized profit of $374,095. Another 10 times longer than Pepe now shows an unrealized profit of $30,759.

James Wynn Hyperliquid Open position. Source: HyperDash

Since returning to the market on July 15th, traders have achieved complex performances with seven profitable trades and eight net losses recorded. At the time of writing, he had a victory rate of 36.6%.

None of these profits are sufficient to reverse his losses, but they still offer traders a faint hope.

Meanwhile, Lookonchain highlighted another trader, not for a massive loss, but for a series of timing strategic bets that won nearly $30 million in just seven days.

He used four wallets for long ETH and SOL, “The White Whale,” a top high-fat trader who made just $30 million in the past week, with “Meet ‘The White Whale,” and he used four wallets for his long ETH and SOL.

Thus, the contrasting performance of James Wynn and “White Whale” highlights the high-risk, highly reward nature of leveraged transactions that can create or lose fate in a few hours.