Bitcoin prices have recently fallen from their all-time high (ATH), indicating a potential change in the market situation. This reduction, although typical at first glance, could indicate fundamental concerns about future volatility.

Historical clues suggest that volatility explosions may be on the horizon, prompting key owners to turn into neutral.

Bitcoin faces calmly before the storm

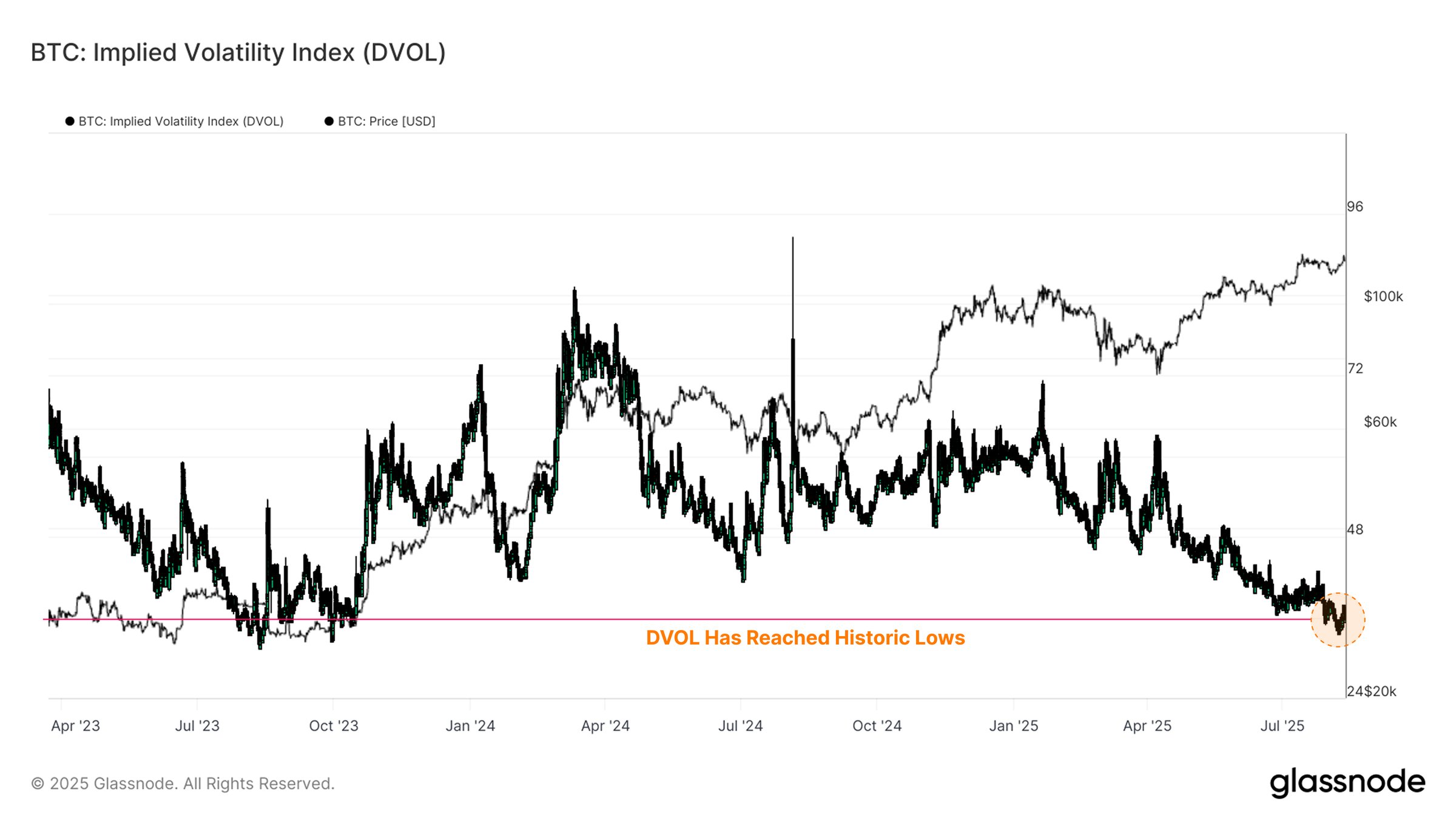

Bitcoin DVOL indexes tracking asset volatility are historically at a low level. It is only 2.6% of the less-valued days, indicating the extreme self-satisfaction of the market. This suggests that investors are not hedging against potential recessions.

DVOL measures expected price fluctuations over the coming months, with current low levels showing a relaxed outlook from traders. However, this calmness can be fleeting, as volatility shocks often follow periods of self-satisfaction. In the event of an unexpected market event, Bitcoin can see rapid price fluctuations and could break the investors by surprise.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Bitcoin DVOL Index. Source: GlassNode

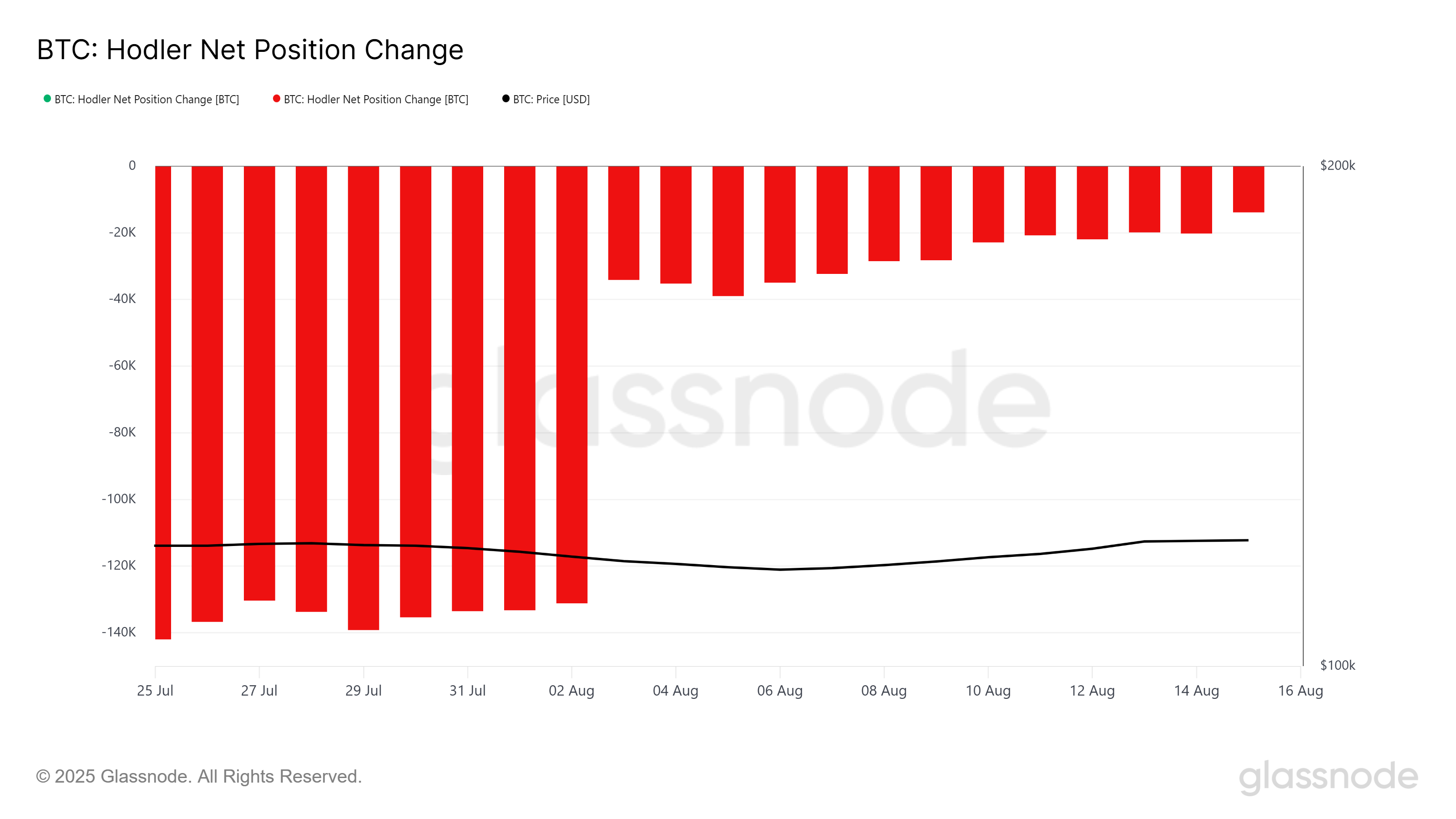

Bitcoin’s overall macro momentum shows a significant change in investor behavior. Changes to Hodler’s net position have been slower and signaled a decrease in activity from long-term holders (LTHS). LTHS was beginning to accumulate at the beginning of the month, but this buying trend was paused due to uncertainty that is likely common in the market.

The lack of sales despite the lack of new purchasing activities suggests some optimism among these holders. They seem to be waiting for a clearer market direction before making the next move. This suggests that LTHS is cautious, but we expect volatility spikes will ultimately lead to price increases and will be able to keep the position in place for now.

Changes to Bitcoin Hodler Net position. Source: GlassNode

BTC Prices can keep support

Bitcoin prices have been on an upward trend throughout the month, but this momentum has waned over the past 24 hours, with BTC dropping to $117,305. This decline occurs when prices slip under established uptrend lines, indicating a change in market sentiment.

If investors are maintaining their position during the expected volatility surge, Bitcoin can stabilize over $117,000. This opens the door for a potential push to $120,000, turning it into support, allowing for even more upward movement.

Bitcoin price analysis. Source: TradingView

However, if investors’ sentiment becomes bearish and sales increase in response to volatility, Bitcoin could drop significantly. In this case, the price could fall at a support level of $115,000, potentially reaching as low as $112,526. This wipes out profits seen in August and negates the bullish outlook.

The historic Bitcoin indicator in the post shows huge volatility spikes – where is the BTC price? It first appeared in Beincrypto.