Recent analysis reveals the significance of the current Bitcoin price level and how its next move will shape the ongoing bull market cycle.

Bitcoin (BTC) Investors who bought the asset at the beginning of the year are seeing less and less return. Premier assets have fallen from an all-time high of $126,200 in October, and year-to-date growth has slowed to 9.72%.

Yesterday, BTC experienced a correction in US stocks. Whale aiming for profit. Bitcoin hit an intraday low of $98,900 before rebounding back to $101,000.

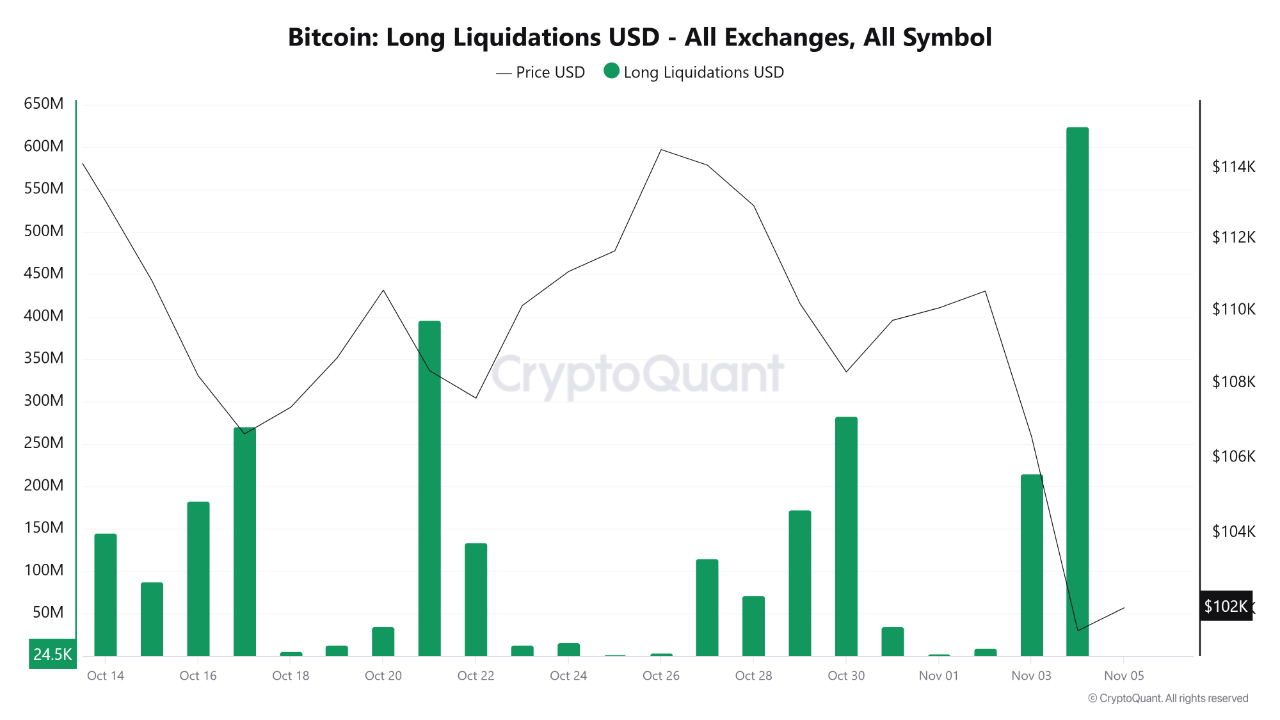

Bitcoin clearing data

However, Bitcoin has shown resilience, rallying to $101,000 yesterday and rising further to $102,730 at the time of writing. Meanwhile, Crypto Onchain has identified important details regarding the $101,000 support that will determine subsequent price action.

Bitcoin bulls’ last line of defense

Specifically, the analysis highlights that the bulls intervened at $98,000, pushing Bitcoin to the most critical level for the bulls. This level coincides with the lower support trend line of the ascending channel on the daily time frame.

bitcoin rising channel

The report notes that the $101,000 support line is more than a psychological line. This is the trend line that determined Bitcoin’s market structure from October 2023 onwards.

Meanwhile, Crypto Onchain noted that protecting the bottom of the channel will be decisive in Bitcoin’s short-term price trajectory. A pullback could occur if the $101,000 support is defended, and the current decline could become a buying opportunity.

However, if Bitcoin is unable to sustain this level and the bearish momentum continues, it will go against its market structure and put the bull market at risk. This would mark a significant correction to new lows for the largest cryptocurrency by market capitalization.

Is it possible for Bitcoin to reach $92,000?

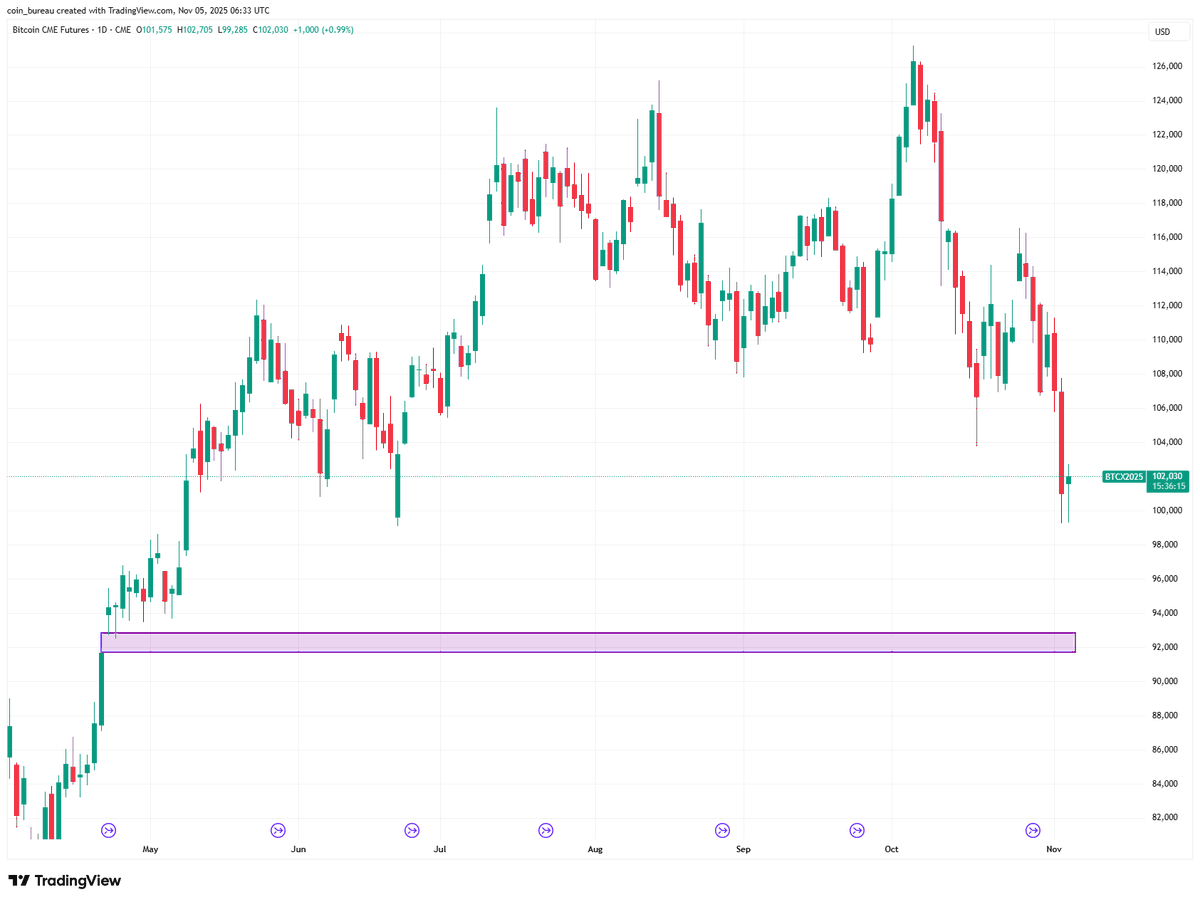

Nevertheless, another analysis shows that there is a CME gap nearby that Bitcoin could close. The futures market chart shows a gap between $92,000 and $93,000, which is 10% away from the current market price.

Bitcoin CME Gap is $92,000

Bitcoin has historically tended to close these CME gaps before the next rally, and market observers are not ruling out that possibility. However, strong support near current levels could thwart this move and push BTC northward.