Nigeria has recently faced one of the most severe economic crises. Inflation surged towards the end of 2024 to hit highs. Despite some degree of easing, citizens still endure inflationary pressures.

Meanwhile, the Nigerian government is accelerating its efforts to regulate cryptocurrency trading. Prospects say that interventions could increase the country’s income.

Nigeria faces inflationary pressure

Nigeria, the most populous country and largest economy in Africa, has long been suffering from economic instability. Sources show that annual inflation rate surged to 24.48% in January 2025 before falling to 23.18% in February.

The 1.3% decline suggests that government financial tightening measures may be beginning to take effect. However, the country’s Naira currency is significantly undervalued. Over the past year, we have lost 230% of our value against the US dollar.

“The decline in inflation rates is primarily due to rebase of the Consumer Price Index (CPI), not a real decline in price levels or inflation pressures,” one citizen emphasized.

This is because the country’s import-dependent economy is so vulnerable to external shocks. Against this backdrop, President Bora Tinubu’s administration implemented bold economic reforms to stabilize the economy.

Among them is the removal of fuel subsidies over a decade and the unification of multiple exchange rates across the country. However, these measures have had unintended consequences, including a surge in fuel prices and a severe life crisis.

The impact of inflation is particularly devastating in conflict-filled areas where communities rely on food subsistence agriculture.

Cryptocurrency as a hedge with new regulations on the horizon

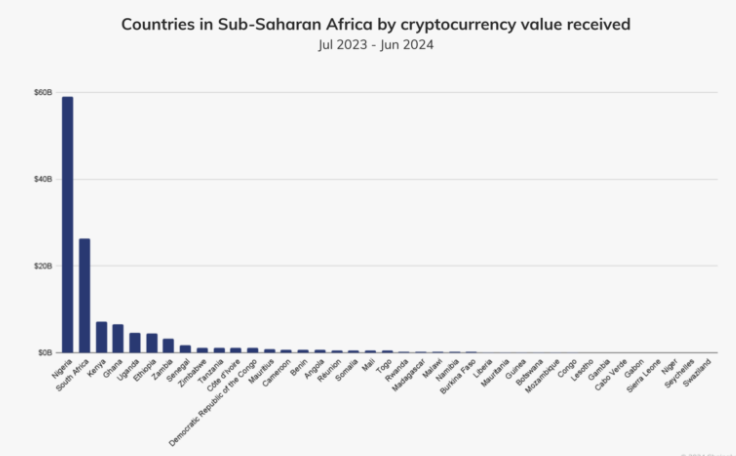

Amidst economic uncertainty, many Nigerians have turned to crypto as a hedge against inflation and currency depreciation. Blockchain analytics firm Chain Orisis revealed that between July 2023 and June 2024, Nigerians traded about $59 billion in crypto assets.

Nigeria will take the lead in crypto trading in sub-Saharan Africa. Source: Chain melting report

This surge in encryption reflects the growing distrust in the traditional financial system. It also suggests a desire for a more stable and accessible financial alternative.

Nigerian authorities have finalized new regulations in response to increased adoption of crypto. They want to integrate digital asset transactions into a formal economy.

The Nigerian SEC (Securities and Exchange Commission) has drafted a policy to ensure that all eligible transactions on regulated exchanges are incorporated into the country’s tax network.

The proposed bill, which outlines tax policies on crypto transactions and other digital assets, is under legislative review. A common sentiment is to pass within the first quarter of 2025 (Q1).

Meanwhile, the Central Bank of Nigeria (CBN) is stabilizing its currency and regaining trust from investors. Gov. Olaemi Cardoso announced that the bank has cleaned up its $2.5 billion foreign exchange backlog, with another $2.2 billion expected to be resolved soon.

Nigerian President Tinubu also ordered the release of food reserves and established a Commodity Committee to curb and stabilize prices.

While the economic crisis in Nigeria has left millions struggling, government intervention efforts, including signs that ease crypto taxes and inflation, suggest a potential shift. But it depends heavily on how authorities effectively implement their policies and whether the global economic situation is favorable.

At the same time, the adoption of a country’s cryptocurrency presents both opportunities and challenges. If properly regulated, digital assets could provide Nigerians with financial alternatives that will help them navigate economic instability.

Nevertheless, balancing innovation and regulation ensures that cryptography remains a viable solution rather than a source of new financial risk.

“Nigeria currently requires large investments in both formal and professional education. This is essential to boosting the skilled workforce and being capable of today’s global digital economy. Special attention must be paid to the blockchain, digital assets and Web3 shared by one user shared on X.