Ethereum (ETH) has registered some small profits over the past week, up 2.80%. Nevertheless, the well-known Altcoin remains far from growing from the bottom, dating back to December. In this bearish market situation, renowned market analyst Ali Martinez highlights the price level that is important in determining whether the ETH revision is finished and whether it is suitable for entering the market.

Ethereum: Opportunities for purchasing and the downsides of the future?

In an in-depth analysis post for X, Martinez explains that Ethereum crashed 57% from its $4,100 local peak in December. This decline is attributed to widespread distribution by large Ethereum holders, particularly whales. Over the past four months, wallets holding 10,000 ETH have dropped by 80. Meanwhile, the ETH whales offloaded 130,000 ETH during this period, their wallets holding more than 100,000 ETH.

Amid the decline in ETH, the Ethereum Spot ETF also received massive withdrawals, as indicated by a net spill of just $760 million last month. Additionally, investors transferred 100,000 ETH to investors with the intention of selling for fear of a loss in price.

Looking forward to it, Martinez is further suggesting several technical indicators that further suggest the downsides of Ethereum amid this intense sales pressure. For example, a breakdown from the rising triangle on the three-day chart suggests that ETH may be heading towards a price target of around $1,000.

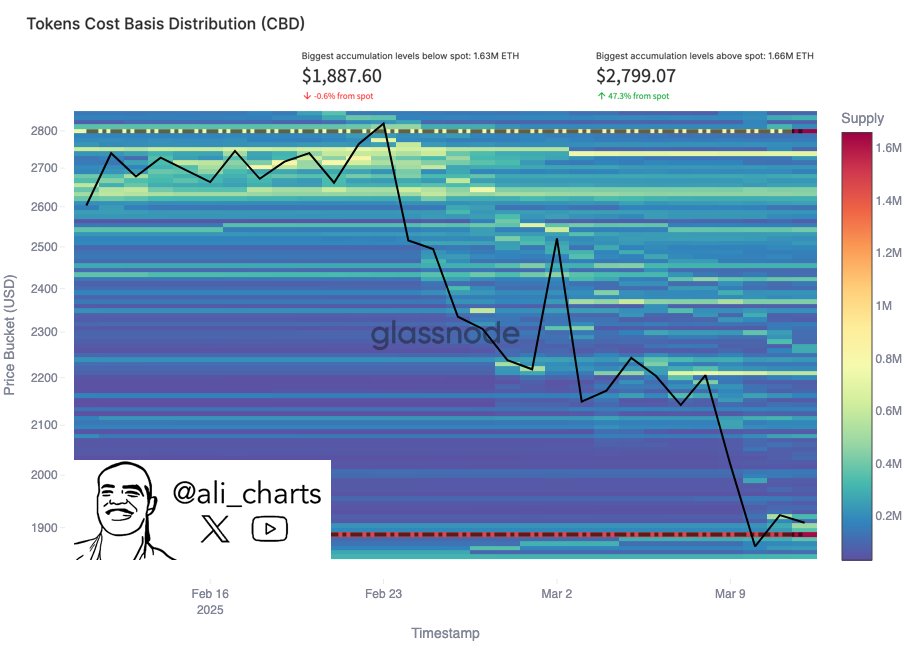

Meanwhile, the ETH price range highlights $1,440 as another downside target, indicating a potential decline of 27.4% from current market prices. Interestingly, Ethereum currently outweighs its main support of $1,887, so data from the cost-based distribution correlates with both bearish predictions. However, if prices fall below this level, targets like $1,440, $1,250, or $1,000 will likely fall.

That said, Martinez points out that there is a possibility of a recovery in the ETH market. By analyzing the amount of ETH acquired at each price level, analysts point out that the ETH Bulls face serious resistance between $2,250 and $2,610. If ETH Bulls could pass this resistance, it would negate the current bear market outlook.

Ethereum price overview

At the time of writing, Ethereum was trading at $1,985, reflecting profits of 1.10% over the past day and 2.10% over the past seven days. However, AltCoin fell 27.32% last month. Ethereum, the largest Altcoin in the market, boasts a market capitalization of $239 billion, accounting for 8.7% of the Crypto market.

Ledger Insights featured images, TradingView charts

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.