This is a segment of the Supply Shock Newsletter. Subscribe to read the full edition.

Bitcoin has multiple personalities, equal money, freedom, resistance and hope.

Micro Strategy Chairman Michael Saylor sits under all of them as Bitcoin id – Its most raw instinct, personification.

Thursday marked the 25th anniversary of Saylor’s loss of $6 billion in a day ($11 billion adjusted to inflation) as a dot-com bubble burst. The event was one of the biggest daily personal losses in human history to that point.

This is his comeback story.

Premium Domain

Saylor wasn’t always the pinnacle Bitcoin Bull. However, he realized digital rarity long before the first block was mined: Domain name.

After founding MicroStrategy in 1989 and building it as a data mining and business intelligence operation, in the 90s, Saylor had the clear idea of purchasing a “premium” domain name.

Angel.com. alarm.com. Wisdom.com. emma.com. Speaker.com. alert.com. Voice.com. hope.com. Only one person could own each at a time, and microstrategy spent a comprehensive acquisition of these types of premium domains, on an average of around $100,000 each, along with a low-value secondary domain of thousands of dollars.

“I thought, ‘Is it great to own a portion of English?’ and so I bought all these domains.” My first million Podcast. He personally owns Michael.com, one of which owns the nickname Mike.com.

“In other words, you own “hope,” or you own “voice,” or you ultimately have Google voice. Or, some telecommunications companies will want to start services.

Alarm.com and Angel.com were then commercialized in real companies, which were then spin-up by Saylor and MicroStrategy’s research and development departments, respectively.

MicroStrategy eventually sold Alarm.com and its related businesses in 2009 for $27.7 million, and sold it to Venture Capital Firm ABS Capital Partners. In 2013, Software Company Genesys acquired Angel.com for its business for $110 million in cash and quickly rebranded it under its own company umbrella.

Meanwhile, Saylor has asserted that Voice.com is worth $1 billion for the right buyers.

It was around this time that Saylor first made public comments about Bitcoin.

He posted again a week later after Bitcoin dropped by up to two-thirds of its record high from $1,242.

Sinking costs

Saylor did not return to Bitcoin until mid-2020, at least publicly. In the event timeline, premium domain sales to Crypto’s startups may have been his light bulb moment with capital.

It was first announced in May 2019 when MicroStrategy first showed its intention to buy Bitcoin. BlockChainEOS.

Block.One was previously calculated to raise $4.1 billion in ETH during the offering of the first year of initial coins that began in mid-2017 and ended before the voice was revealed.

“They (block.one) contacted us, one of their domain brokers, and asked, “Do you want to sell it? I’ll give you $150,000.” I hadn’t thought about it.

“They come back and say, ‘They doubled it to $300,000.” I said, “No to them.” A few days later, they (a colleague at Saylor) said, “The broker really went to $600,000.” I said no. I said, “Don’t say they have no interest in anything.”

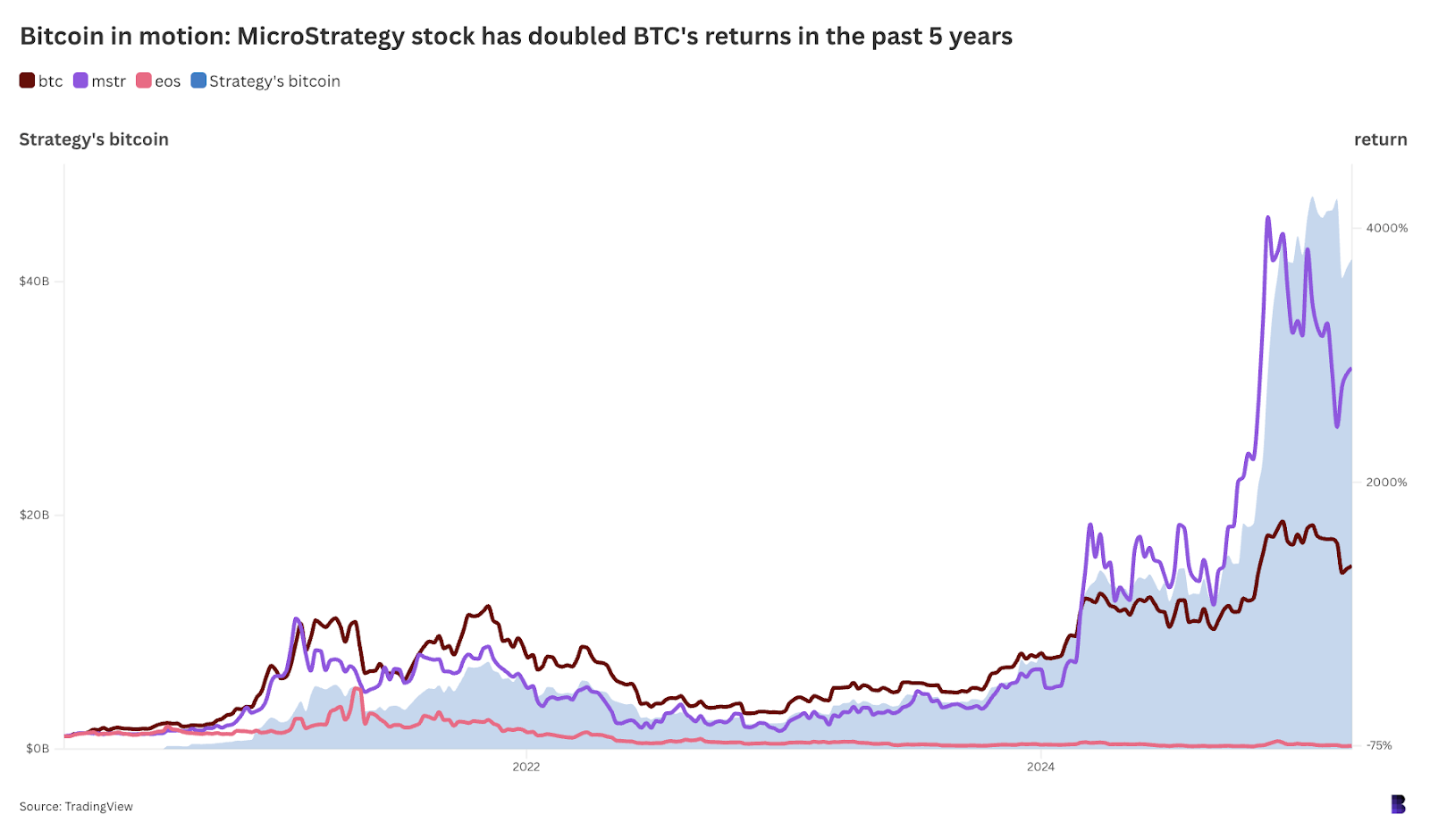

MSTR returned to its record high in November last year, more than 20 years later. Thanks to that Bitcoin plan. EOS has declined by 75% over the past five years. Source: TradingView.

Block.One offered $1.2 million, but Saylor refused. Then it was $2.5 million. Then it was $5 million. Then it was about $10 million.

“When I reached $12 million, I said I would answer the phone for 30 minutes, and it started out as I said, ‘Well, what about $22 million?’ And I said, “Let me explain, this is like my daughter. I want to marry her, but only to someone who values more than I value her.”

MicroStrategy closed in June 2019 at $30 million. I surpassed one first offer by 200 times. It is the largest pure domain name sales in history, almost double the previous record Qihoo paid 360.com in 2015 at $17 million.

Block.One has sunk another $150 million into Voice.com development over the next two years before closing in late 2023. Voice said “the ongoing uncertainty in the Crypto and NFT markets will continue for more time than we do.”

Conversely, Saylor and MicroStrategy have started buying Bitcoin and placed themselves in a very exploitative way to fuel the imminent Bitcoin rally, which was fueled in the hopes of ETFs such as BlackRock, Fidelity and others.

How did it begin?

A year after domain sales ended in July 2020, Saylor said in a quarterly revenue call that MicroStrategy could begin purchasing Bitcoin next year as part of its new capital allocation strategy.

The plan was to invest $250 million in alternative assets over the next 12 months. “It may include digital assets such as stocks, bonds, gold, and Bitcoin, or other asset types.”

It took less than a year. MicroStrategy purchased 21,454 BTC for $250 million in less than two weeks, and in August 2020 Bitcoin declared its major Treasury reserve assets.

Bitcoin was then traded for under $12,000, but within four months it broke its $20,000 price record.

Corners the market

By December 2020, MicroStrategy had started its first debt sales since it chose Bitcoin. This earned $400 million in interest on 0.75% interest. Then the second increase was up two months later, and the third increase after four months.

So, in September 2023, MicroStrategy sat at $4.2 billion in BTC in the very early stages of the Monster Bull Run.

Since then, MicroStrategy has spent nearly $27.8 billion to acquire an additional 340,860 BTC ($28.7 billion). Bitcoin has more than tripled its price at that time, but MicroStrategy has removed “micro” from its name and is only using its recent strategy.

The strategy currently holds a total of 499,096 BTC (2.5% of distribution supply), which is well worth it to be included in the benchmark NASDAQ 100 Stock Market Index. Saylor has been a squeal of his lentitude the whole time, picking up from where former evangelists like Roger Vere dropped out.

Of course, the strategy raised billions of dollars across nine completed debt sales to help fund Bitcoin acquisition plans.

How is that going?

Currently, the company has acquired a $9.3 billion conversion debt against BTC’s $41.8 billion, and this year it is responsible for 30% of the US convertible market.

The strategy totals $33.2 billion on Bitcoin, and Napkin Math effectively preempts the $700 million strategy at the time of writing. Saylor’s personal net worth is estimated at $6.6 billion, and in January the company promised to raise it openly $42 billion I’ll buy more over the next three years.

Whether Voice.com is truly worth $1 billion or if you’re certain that Bitcoin will “surge forever,” Saylor’s career is marked by the same basic instincts to corner the market, especially with long-term digital assets of digital assets that serve as the basis of the Internet economy.

Saylor simply expanded from one high liquid digital asset class in domain names (the niche space where he is considered legendary) to one deep liquid digital asset in Bitcoin.

Surprisingly, what follows the Voice.com deal also serves as an almost perfect all-talk for crypto investments. block.1 sunk nine numbers into a token project pivoted by the NFT, but before it started it went to zero and lost to the bear market.